Can Ajinomoto’s (TSE:2802) Buyback and Biotech Deal Reveal a Strategic Shift in Value Creation?

Reviewed by Sasha Jovanovic

- Ajinomoto Co., Inc. recently announced a share repurchase program of up to 30,000,000 shares for ¥80,000 million and entered a licensing agreement with Astellas Pharma Inc. for its proprietary AJICAP antibody-drug conjugate technology.

- This collaboration extends Ajinomoto's reach in the growing biopharmaceutical sector and highlights its strategic focus on health-related technology and shareholder returns.

- We’ll now examine how the new share buyback plan could influence Ajinomoto’s investment case and future growth trajectory.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 26 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

Ajinomoto Investment Narrative Recap

To be a shareholder in Ajinomoto today, one has to believe in its ability to grow both its traditional food and emerging healthcare businesses while navigating input cost pressures and demand volatility. The announced ¥80,000 million share repurchase program seeks to support the most important short-term catalyst, confidence in capital efficiency and shareholder returns, but does not fundamentally address the biggest risk: persistent margin pressure from raw material cost inflation and price-sensitive consumers.

Among recent announcements, the reduction in the Q2 2025 dividend (JPY 24.00 per share, down from JPY 40.00) is the most relevant, signaling a more cautious stance on near-term cash flow and earnings. This move, alongside the ambitious buyback, brings the focus back to Ajinomoto’s challenge of balancing generous shareholder rewards with ongoing investment in growth sectors amid variable profit margins.

However, investors should be aware that ongoing risks tied to input cost inflation and consumer price sensitivity remain a key concern that could …

Read the full narrative on Ajinomoto (it's free!)

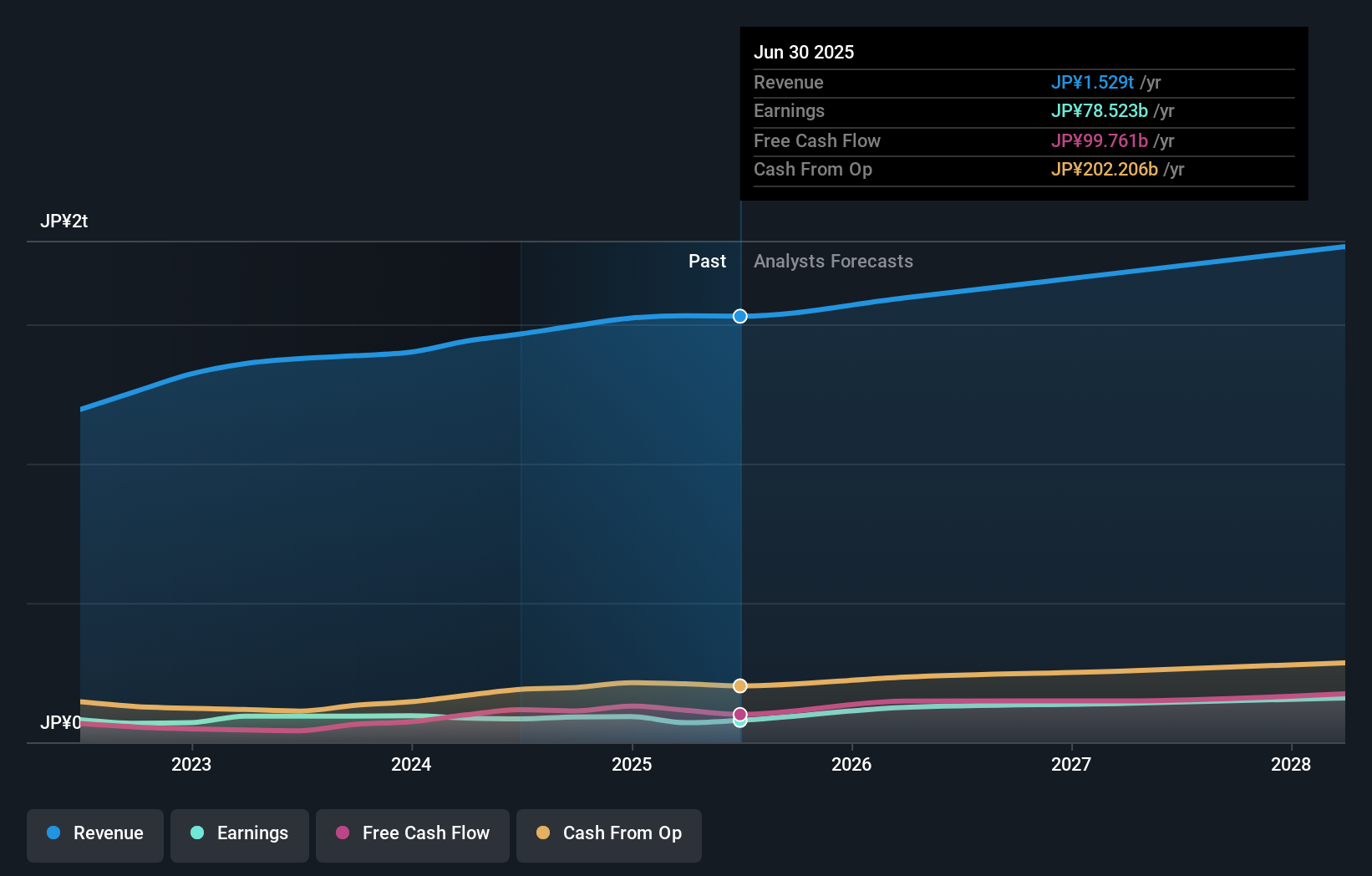

Ajinomoto's outlook points to ¥1,783.4 billion in revenue and ¥156.5 billion in earnings by 2028. This projection is based on a 5.3% annual revenue growth rate and a roughly ¥78.0 billion increase in earnings from the current ¥78.5 billion, effectively doubling profits over the period.

Uncover how Ajinomoto's forecasts yield a ¥4450 fair value, a 18% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community estimates suggest Ajinomoto’s fair value spans from ¥3,858 to ¥4,450, drawing on two unique analyses. While optimistic growth in healthcare and ingredient technologies could support future performance, persistent input cost inflation and uneven volume recovery raise questions about sustained profit momentum.

Explore 2 other fair value estimates on Ajinomoto - why the stock might be worth just ¥3858!

Build Your Own Ajinomoto Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Ajinomoto research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Ajinomoto research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Ajinomoto's overall financial health at a glance.

Contemplating Other Strategies?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- Find companies with promising cash flow potential yet trading below their fair value.

- We've found 14 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:2802

Ajinomoto

Engages in the seasonings and foods, frozen foods, and healthcare and other businesses in Japan and internationally.

Reasonable growth potential with adequate balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives