Kikkoman (TSE:2801) Valuation in Focus After Upgraded Profit Guidance and Currency Boost

Reviewed by Simply Wall St

Kikkoman (TSE:2801) has just raised its profit guidance for the fiscal year ending March 2026, adjusting its outlook following stronger first half results and favorable currency exchange rates. Revenue expectations were slightly decreased, but profit metrics saw an increase.

See our latest analysis for Kikkoman.

Despite Kikkoman’s updated guidance and encouraging profit outlook, the stock has lost momentum in 2024, with an 18.7% year-to-date share price decline and a 1-year total shareholder return of -19.1%. While recent weeks brought some relief, the performance shift suggests investors are reassessing growth prospects and risk following several years of modest returns.

If you’re searching for the next promising opportunity, now is the perfect time to broaden your search and discover fast growing stocks with high insider ownership

With shares down sharply from last year, while the company continues to post resilient profits and trades at a modest discount to analyst price targets, investors may be wondering if Kikkoman is now undervalued or if future growth is already reflected in the price.

Price-to-Earnings of 21.9x: Is it justified?

Kikkoman’s shares are trading at a price-to-earnings ratio of 21.9x, significantly higher than both its industry peers and its own fair value estimate. This elevated valuation sets expectations for stronger performance ahead.

The price-to-earnings (P/E) ratio measures how much investors are willing to pay for each yen of the company’s earnings. For Kikkoman, a P/E of 21.9x means the market is pricing in either superior profit growth or a premium for quality and stability compared to other companies in the food sector.

However, the current P/E ratio is well above the JP Food industry average of 16.5x and is also higher than the estimated fair P/E of 20.4x. This sharp premium suggests investors are optimistic about future prospects, but it raises questions on whether those expectations are sufficiently supported by current fundamentals. The market may be poised to adjust toward the fair P/E level as earnings evolve.

Explore the SWS fair ratio for Kikkoman

Result: Price-to-Earnings of 21.9x (OVERVALUED)

However, slower revenue and net income growth, or fading optimism over premium pricing, could challenge the case for a higher valuation moving forward.

Find out about the key risks to this Kikkoman narrative.

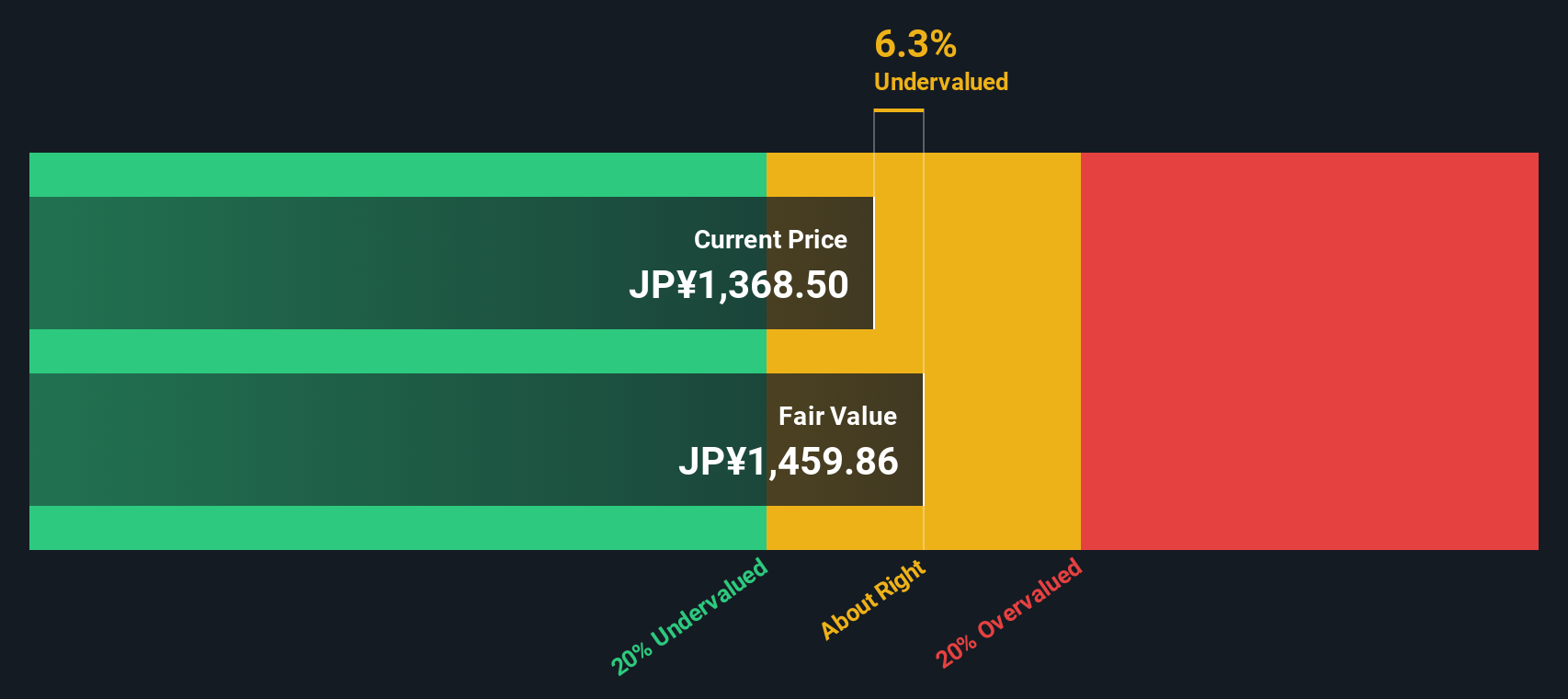

Another View: Discounted Cash Flow Puts Price Below Fair Value

While Kikkoman looks expensive when judged by its price-to-earnings ratio, our DCF model reaches a different conclusion and suggests the shares are currently trading around 6% below intrinsic fair value. This presents a very different story. Could the real opportunity be hiding beneath headline multiples?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Kikkoman for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 879 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Kikkoman Narrative

If you’d like to weigh the facts independently or explore different angles, you can quickly build your own take on Kikkoman’s outlook in just a few minutes. Do it your way

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Kikkoman.

Looking for more investment ideas?

The best investors always keep an eye on fresh opportunities. Don’t let great stocks pass you by. Let the right tools point you toward your next big win.

- Earn steady potential by uncovering companies with strong yields through these 16 dividend stocks with yields > 3% for reliable long-term income.

- Boost your growth portfolio by targeting firms leveraging artificial intelligence with these 25 AI penny stocks, where innovation meets performance.

- Supercharge your watchlist by tapping into value with these 879 undervalued stocks based on cash flows, highlighting businesses trading below their cash flow potential.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kikkoman might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:2801

Kikkoman

Through its subsidiaries, engages in the manufacture and sale of food products in Japan and internationally.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives