Fuji Oil (TSE:2607) Valuation in Focus After Updated Earnings and Dividend Guidance

Reviewed by Simply Wall St

Fuji Oil (TSE:2607) just released updated earnings guidance for the year ending March 2026, detailing sales and profit expectations. The company also reaffirmed its dividend payout at last year’s levels. These updates help investors gauge future performance.

See our latest analysis for Fuji Oil.

After the guidance announcement, Fuji Oil’s shares have shown resilience, with the last close at ¥3,402. While the 1-year total shareholder return dipped slightly by 0.5 percent, the three-year total return stands out at nearly 70 percent, highlighting meaningful long-term value creation even as short-term momentum has eased.

If earnings visibility and steady dividends have you curious, now is a smart moment to explore other fast growers with strong insider backing. Discover fast growing stocks with high insider ownership

With robust long-term returns and new guidance in hand, does Fuji Oil’s current share price reflect an undervalued opportunity? Or have investors already priced in the company’s projected growth?

Price-to-Earnings of 30x: Is it justified?

Fuji Oil’s shares currently trade at a price-to-earnings multiple of 30x, making them appear expensive compared to industry averages, even with recent profit improvements reflected in the share price.

The price-to-earnings (P/E) ratio tells investors how much they are paying for each yen of current earnings. A higher P/E often signals that the market expects stronger growth ahead or perceives the company as having superior quality and prospects. For Fuji Oil, this suggests investors are anticipating robust future performance or rewarding the recent turnaround in profitability.

Compared to the Japanese Food industry average P/E of 16.3x, Fuji Oil stands out as considerably more expensive. However, the SWS model indicates that a fair P/E for Fuji Oil would be 33.7x, so the market could still re-rate the stock higher if the company delivers on growth expectations.

Explore the SWS fair ratio for Fuji Oil

Result: Price-to-Earnings of 30x (OVERVALUED)

However, slower revenue growth or missed profit expectations could quickly dampen investor sentiment and lead to a reassessment of Fuji Oil’s valuation.

Find out about the key risks to this Fuji Oil narrative.

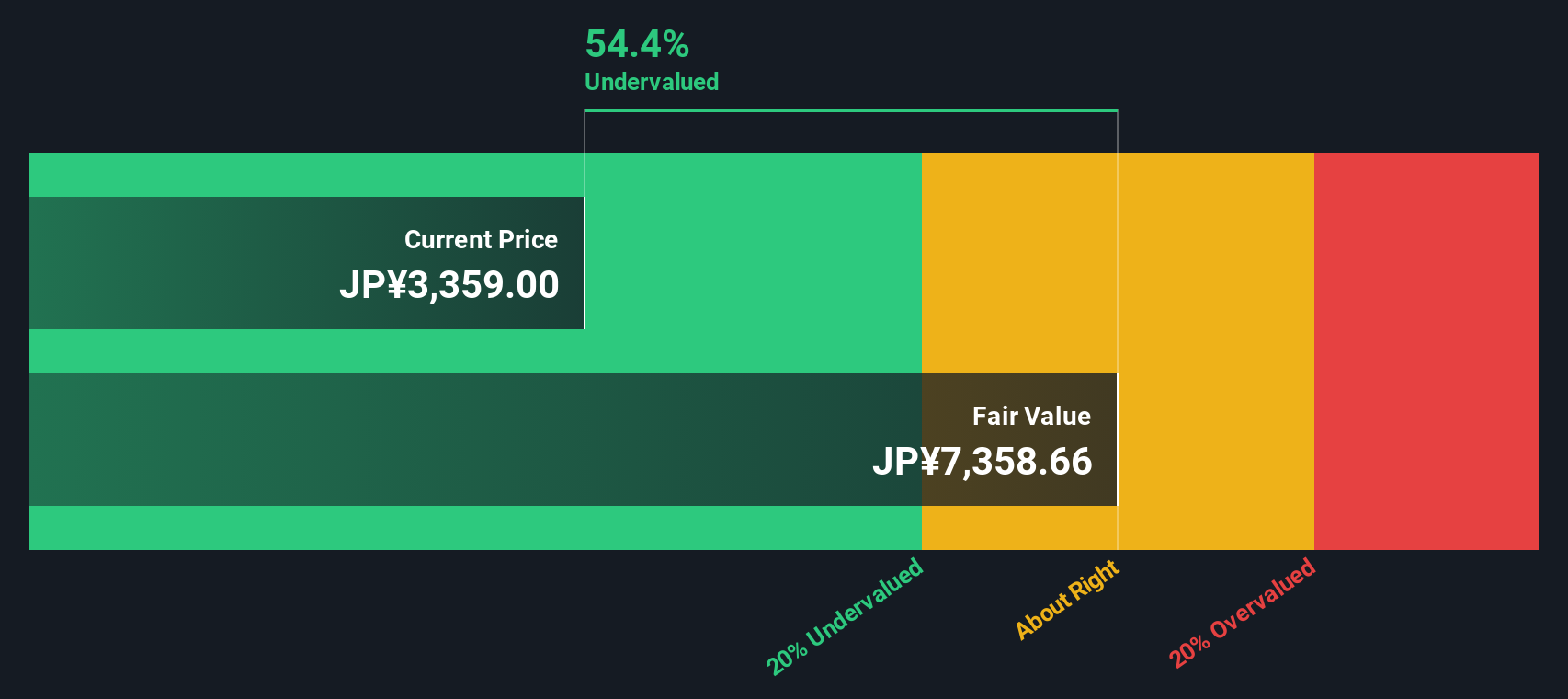

Another View: Discounted Cash Flow Puts Fuji Oil Deeply Undervalued

For a different perspective, our DCF model values Fuji Oil at ¥7,336 per share. This is more than double its current market price of ¥3,402. This method considers projected future cash flows and suggests the market may be overlooking significant long-term value.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Fuji Oil for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 898 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Fuji Oil Narrative

If you prefer drawing your own conclusions or want to analyze the numbers directly, it's easy to assemble your own perspective in just a few minutes. Do it your way

A great starting point for your Fuji Oil research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Smart investors never stop at just one opportunity. Expand your horizons by reviewing unique stock lists tailored to today's market themes. Staying ahead is everything.

- Capture the upside of companies delivering strong cash flows and attractive prices by checking out these 898 undervalued stocks based on cash flows, designed for value-focused investors.

- Tap into breakthrough potential by reviewing these 27 AI penny stocks, where innovation in artificial intelligence is creating new market leaders.

- Strengthen your portfolio’s income with these 15 dividend stocks with yields > 3%, offering above-average yields for steady returns, even in uncertain times.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:2607

Fuji Oil

Manufactures and sells food and processed soybean ingredients in Japan, the Americas, Europe, Southeast Asia, and China.

Fair value with moderate growth potential.

Similar Companies

Market Insights

Community Narratives