Why Investors Shouldn't Be Surprised By Coca-Cola Bottlers Japan Holdings Inc.'s (TSE:2579) 25% Share Price Surge

Coca-Cola Bottlers Japan Holdings Inc. (TSE:2579) shares have had a really impressive month, gaining 25% after a shaky period beforehand. The last 30 days bring the annual gain to a very sharp 27%.

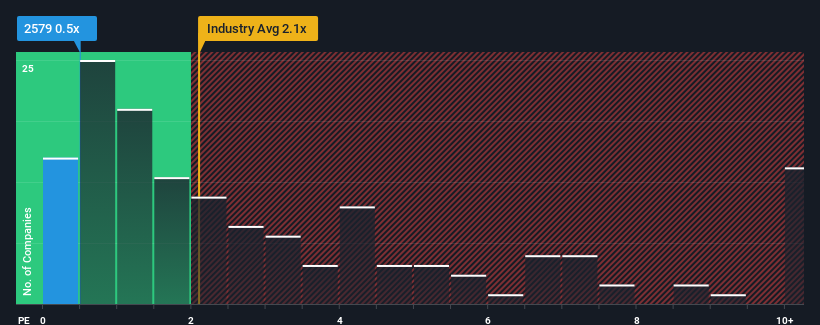

Although its price has surged higher, you could still be forgiven for feeling indifferent about Coca-Cola Bottlers Japan Holdings' P/S ratio of 0.5x, since the median price-to-sales (or "P/S") ratio for the Beverage industry in Japan is also close to 0.8x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

See our latest analysis for Coca-Cola Bottlers Japan Holdings

How Has Coca-Cola Bottlers Japan Holdings Performed Recently?

Recent times haven't been great for Coca-Cola Bottlers Japan Holdings as its revenue has been rising slower than most other companies. One possibility is that the P/S ratio is moderate because investors think this lacklustre revenue performance will turn around. You'd really hope so, otherwise you're paying a relatively elevated price for a company with this sort of growth profile.

Want the full picture on analyst estimates for the company? Then our free report on Coca-Cola Bottlers Japan Holdings will help you uncover what's on the horizon.How Is Coca-Cola Bottlers Japan Holdings' Revenue Growth Trending?

In order to justify its P/S ratio, Coca-Cola Bottlers Japan Holdings would need to produce growth that's similar to the industry.

Taking a look back first, we see that the company managed to grow revenues by a handy 2.6% last year. The latest three year period has also seen a 13% overall rise in revenue, aided somewhat by its short-term performance. So we can start by confirming that the company has actually done a good job of growing revenue over that time.

Shifting to the future, estimates from the seven analysts covering the company suggest revenue should grow by 0.4% each year over the next three years. With the industry predicted to deliver 2.1% growth per annum, the company is positioned for a comparable revenue result.

In light of this, it's understandable that Coca-Cola Bottlers Japan Holdings' P/S sits in line with the majority of other companies. Apparently shareholders are comfortable to simply hold on while the company is keeping a low profile.

What Does Coca-Cola Bottlers Japan Holdings' P/S Mean For Investors?

Coca-Cola Bottlers Japan Holdings' stock has a lot of momentum behind it lately, which has brought its P/S level with the rest of the industry. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Our look at Coca-Cola Bottlers Japan Holdings' revenue growth estimates show that its P/S is about what we expect, as both metrics follow closely with the industry averages. Right now shareholders are comfortable with the P/S as they are quite confident future revenue won't throw up any surprises. All things considered, if the P/S and revenue estimates contain no major shocks, then it's hard to see the share price moving strongly in either direction in the near future.

You always need to take note of risks, for example - Coca-Cola Bottlers Japan Holdings has 2 warning signs we think you should be aware of.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:2579

Coca-Cola Bottlers Japan Holdings

Engages in the purchases, sales, bottling, packaging, distribution and marketing of carbonated beverages, coffee beverages, tea-based beverages, mineral water, and other soft drinks in Japan.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Community Narratives