Kirin (TSE:2503): Evaluating Valuation as Shares Gain 11% Over Three Months

Reviewed by Simply Wall St

See our latest analysis for Kirin Holdings Company.

The past year has been a mixed ride for Kirin Holdings Company, with its share price recently climbing 11% over the last three months. This increase suggests that investors may be warming up to its growth prospects. However, the total shareholder return over the past year stands at just 1.5%, indicating that long-term momentum still has room to grow even as short-term price performance improves.

If this recent upswing has you wondering what else is catching investor interest, now is the perfect time to broaden your search and discover fast growing stocks with high insider ownership

With solid price gains and recent earnings growth, the question now is whether Kirin Holdings is still trading below its fair value or if the market has already accounted for its future potential. Could there be a buying opportunity, or is everything priced in?

Price-to-Earnings of 33.4x: Is it justified?

Kirin Holdings Company’s current Price-to-Earnings (P/E) ratio sits at 33.4x, which is notably above both the industry and its fair ratio benchmarks. At last close, the share price was ¥2,221.5, signaling that investors are paying a premium for each unit of recent earnings.

The P/E ratio compares a company’s market value to its earnings, making it a key indicator for evaluating whether a stock is over or undervalued. For Kirin Holdings, a P/E of 33.4x means the market is valuing its current earnings at a level generally reserved for higher-growth or more stable businesses in the beverages sector.

However, there is a clear divergence between Kirin’s multiple and the broader industry. The Asian Beverage industry average P/E is just 19.8x. Compared to its own fair P/E estimate of 30.6x, Kirin still appears on the expensive side. This suggests the market is either anticipating a ramp up in profitability or possibly overestimating future earnings potential from the recent share price momentum.

Despite being lower than its peer group’s average of 53.2x, Kirin’s current P/E sits above what fundamentals might justify. If market sentiment shifts, it could mean pressure on the share price to move closer to the fair P/E level.

Explore the SWS fair ratio for Kirin Holdings Company

Result: Price-to-Earnings of 33.4x (OVERVALUED)

However, slower revenue growth and a premium valuation could leave Kirin Holdings vulnerable if market expectations for future profitability are not quickly met.

Find out about the key risks to this Kirin Holdings Company narrative.

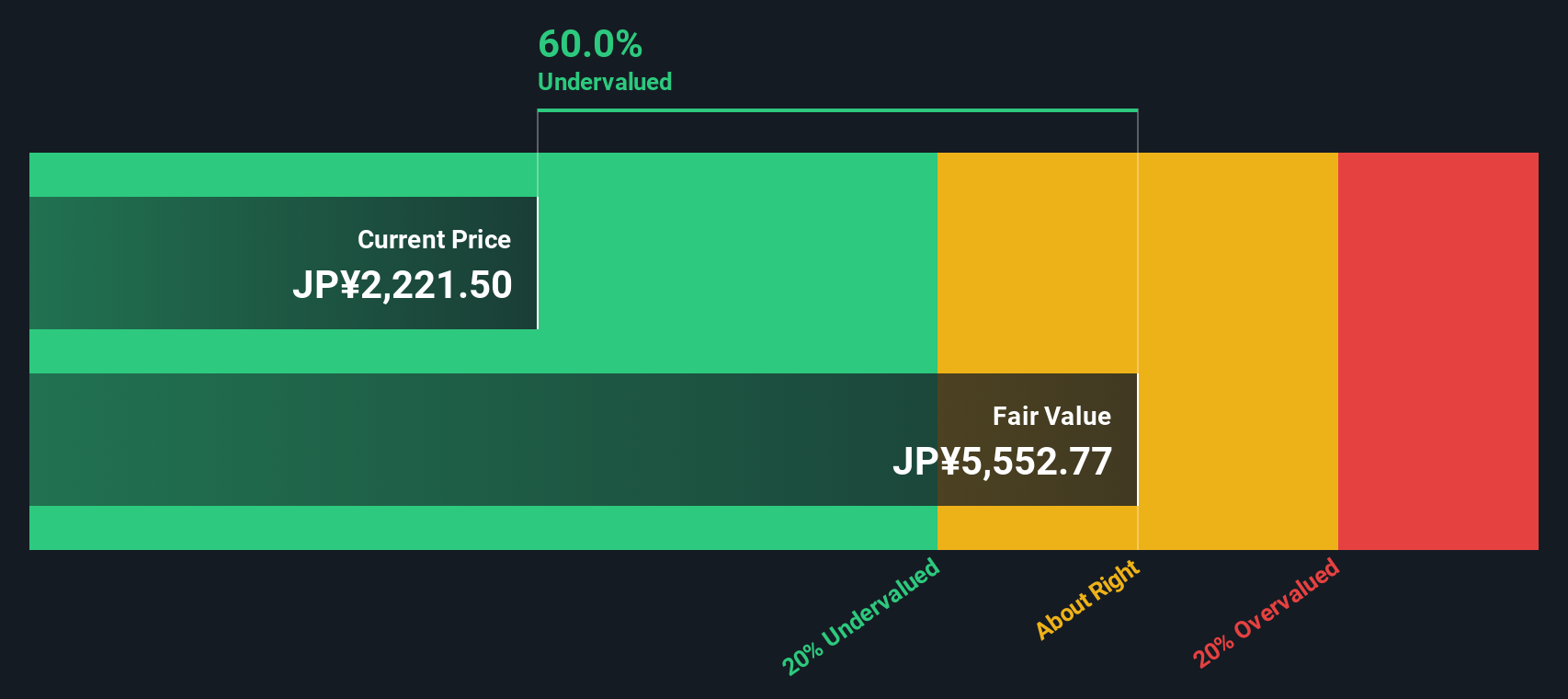

Another View: Discounted Cash Flow Model Says Undervalued

While the price-to-earnings ratio indicates Kirin Holdings is trading at a premium, our SWS DCF model offers a very different perspective. Based on projected future cash flows, Kirin is valued at just 40% of its estimated fair value. This is a substantial gap that flips the valuation narrative. Why does the market see things so differently?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Kirin Holdings Company for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Kirin Holdings Company Narrative

If you have a different perspective or would rather dive into the details personally, you can craft your own financial narrative in just a few minutes with Do it your way.

A great starting point for your Kirin Holdings Company research is our analysis highlighting 2 key rewards and 4 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Don’t settle for just one opportunity. Your next smart move could be finding the next breakout stock, a sector star, or even a future market leader. Expand your watchlist now with hand-picked options you simply can’t afford to overlook:

- Find exceptional returns from early-stage companies with potential as you check out these 3567 penny stocks with strong financials and see which ones are capturing investor attention right now.

- Tap into the future of medicine by reviewing these 33 healthcare AI stocks, featuring innovative companies transforming healthcare with artificial intelligence.

- Secure steady portfolio income this year by scanning these 17 dividend stocks with yields > 3% for stocks offering attractive yields over 3% and strong fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kirin Holdings Company might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:2503

Kirin Holdings Company

Engages in food and beverages, alcoholic beverages, pharmaceuticals, and health science businesses.

Slight risk and fair value.

Similar Companies

Market Insights

Community Narratives