Kirin Holdings (TSE:2503): Assessing Valuation After New Sustainable Coffee Cherry Ingredient Launch

Reviewed by Simply Wall St

Kirin Holdings (TSE:2503) has revealed a new fermented ingredient made from coffee cherries, highlighting its push toward sustainability and product innovation. The company is first introducing this ingredient to its ready-to-drink beverage lines.

See our latest analysis for Kirin Holdings Company.

Kirin Holdings' sustainable ingredient rollout comes as shares have enjoyed steady momentum, with a 7% increase over the last week and nearly 17% growth year-to-date. These movements contributed to a 15% total shareholder return over the past year, reflecting both short-term enthusiasm and long-run performance.

If Kirin’s creative push got you thinking about what else is on the rise, consider broadening your search and discover fast growing stocks with high insider ownership.

With Kirin’s recent product innovations and strong share price gains, the critical question for investors is whether the current valuation leaves room for upside or if the market has already factored in its future growth potential.

Price-to-Earnings of 23.4x: Is it justified?

Kirin Holdings is currently trading at a price-to-earnings (PE) ratio of 23.4x. This provides investors with a clear benchmark for assessing its valuation compared to peers and sector averages.

The price-to-earnings multiple is one of the most commonly used valuation metrics, measuring how much investors are willing to pay per yen of the company’s earnings. In consumer sectors like beverages, PE ratios can help indicate whether a stock is attracting a premium for stable profits or being discounted for risk or sluggish growth.

In this context, Kirin’s PE ratio of 23.4x appears attractive compared to both the average of its immediate peers at 55.3x and its estimated fair PE of 26.6x. On the other hand, it is higher than the broader Asian Beverage industry average of 19.5x, which suggests the market is pricing in anticipated earnings growth or perceived quality. The fair ratio analysis indicates that the share price could move closer to the fair value benchmark if market expectations align with forecast performance.

Explore the SWS fair ratio for Kirin Holdings Company

Result: Price-to-Earnings of 23.4x (UNDERVALUED)

However, weaker-than-expected revenue growth or broader market volatility could limit Kirin’s future upside. These factors could serve as potential catalysts for a shift in sentiment.

Find out about the key risks to this Kirin Holdings Company narrative.

Another View: What Does the SWS DCF Model Say?

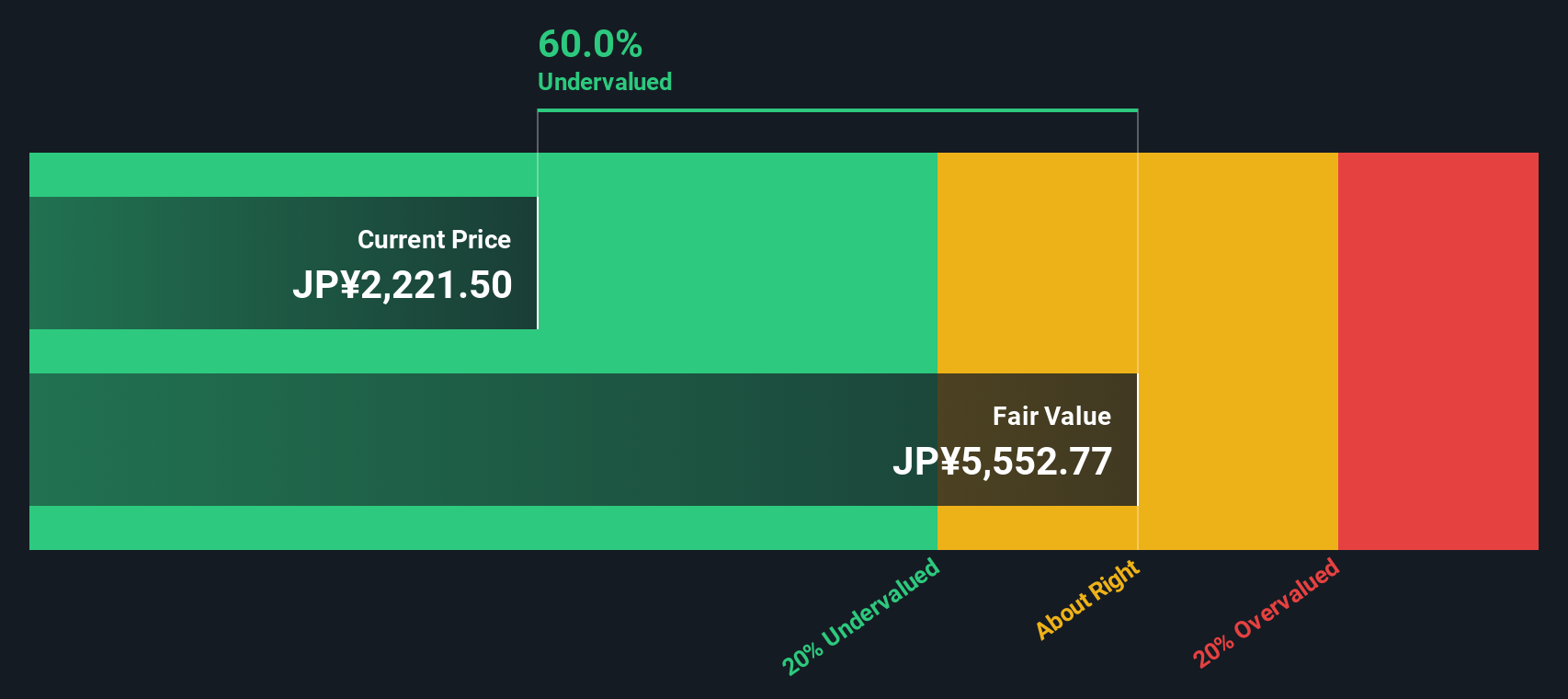

Looking from a different angle, our DCF model estimates Kirin Holdings is trading at a significant 58% discount to its calculated fair value (¥2,358.5 versus an estimated ¥5,663.32). This suggests that, based on cash flows, the shares could offer much more upside than the price-to-earnings ratio implies. Could the market be underestimating the company’s long-term potential?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Kirin Holdings Company for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 878 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Kirin Holdings Company Narrative

If you see things differently or want to dive deeper into the numbers yourself, crafting your own view of Kirin Holdings takes less than three minutes with our tools. Do it your way

A great starting point for your Kirin Holdings Company research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Smart investors move fast on the best opportunities, so don’t miss out. Use the Simply Wall Street Screener to find standout companies you might otherwise overlook.

- Fuel your portfolio’s growth by selecting from these 878 undervalued stocks based on cash flows, where proven cash flow performance supports attractive valuations.

- Capture long-term potential and robust yield prospects with these 14 dividend stocks with yields > 3%, integrating it directly into your strategy for stable returns beyond the headlines.

- Spot tomorrow’s AI leaders early by acting on these 27 AI penny stocks, leveraging providers driving innovation in automation and data intelligence.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kirin Holdings Company might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:2503

Kirin Holdings Company

Engages in food and beverages, alcoholic beverages, pharmaceuticals, and health science businesses.

Good value average dividend payer.

Similar Companies

Market Insights

Community Narratives