Assessing Asahi Group Holdings (TSE:2502) Valuation After Recent Stock Gains

Reviewed by Simply Wall St

Asahi Group Holdings (TSE:2502) has experienced some movement in its stock recently, drawing investor interest toward its performance over the past month. Many are evaluating what might be driving this renewed attention and how the fundamentals stack up.

See our latest analysis for Asahi Group Holdings.

After a notable climb, Asahi Group Holdings’ share price has delivered a strong 1-month return of 9.1 percent and a year-to-date advance of 12.6 percent, indicating building momentum. Over the past year, long-term holders have seen a total shareholder return of 14.6 percent. This suggests that renewed investor optimism is supported by resilient fundamentals and consistent performance rather than short-term speculation.

If you’re reassessing your portfolio in light of momentum-driven names, now is the perfect chance to explore fast growing stocks with high insider ownership.

With shares now trading at a substantial premium after recent gains, investors may be wondering whether Asahi Group Holdings is undervalued based on its fundamentals, or if the market has already accounted for the company’s future growth potential.

Price-to-Earnings of 15.4x: Is it justified?

Asahi Group Holdings is currently trading at a price-to-earnings (P/E) ratio of 15.4x, which signals the market is valuing its shares attractively compared to peers and its own historical averages.

The P/E ratio measures how much investors are willing to pay for each yen of earnings and is a central metric for mature beverage companies like Asahi, especially when evaluating long-term profitability and stability.

This multiple is supported by Asahi’s above-peer-value standing, reflecting high-quality past earnings and steady performance. The market appears to be underpricing Asahi’s ongoing earnings capacity, which is underpinned by reliable profit growth over the past five years.

Importantly, Asahi’s P/E of 15.4x stands well below the peer average of 34.8x and is also under the fair price-to-earnings ratio estimate of 24.1x. This is a level the market could reasonably move towards if the current trajectory is maintained.

Explore the SWS fair ratio for Asahi Group Holdings

Result: Price-to-Earnings of 15.4x (UNDERVALUED)

However, risks such as fluctuating global demand and competitive pressures could create headwinds for Asahi Group Holdings despite its recent strong performance.

Find out about the key risks to this Asahi Group Holdings narrative.

Another View: Discounted Cash Flow Perspective

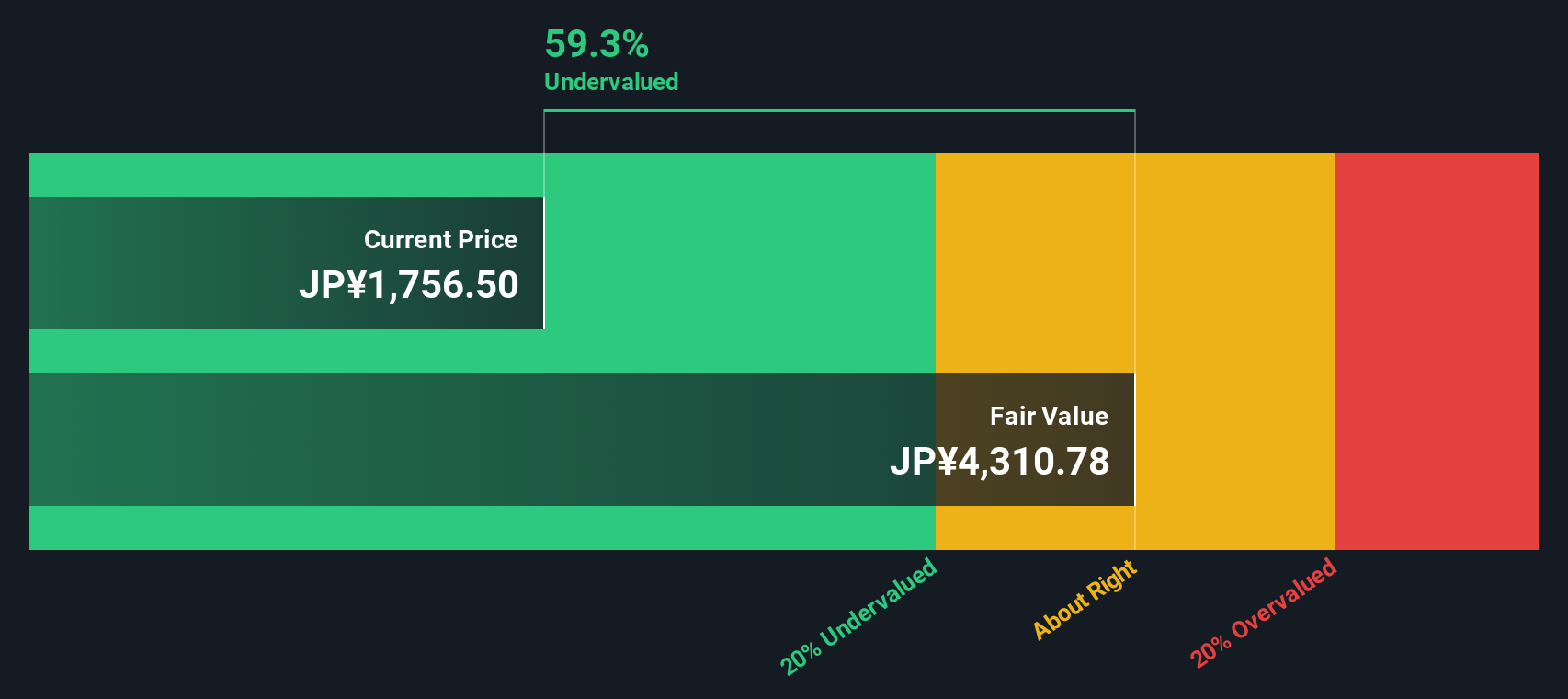

While the market is putting Asahi Group Holdings at a relatively modest price-to-earnings ratio, the SWS DCF model presents an even more compelling picture. According to our DCF, the shares are trading about 60 percent below estimated fair value, which suggests meaningful undervaluation if these long-term cash flow forecasts hold true. Could the broader market be missing something?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Asahi Group Holdings for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 914 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Asahi Group Holdings Narrative

Exploring the data firsthand can reveal unique insights. If you'd rather form your own perspective, you can craft a narrative yourself in just a few minutes. Do it your way

A great starting point for your Asahi Group Holdings research is our analysis highlighting 5 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Don't let your next opportunity slip away. There are standout stocks waiting to be found with just a few clicks. See what you've been missing and level up your investing approach today.

- Spot the potential for rapid gains in fast-moving markets by reviewing these 3560 penny stocks with strong financials that show strong financials and upward momentum.

- Tap into tech’s transformation and uncover tomorrow’s trends with these 25 AI penny stocks driving innovation in artificial intelligence.

- Boost your income potential by locking in attractive yields among these 15 dividend stocks with yields > 3% that offer stability plus rewarding dividends.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:2502

Asahi Group Holdings

Manufactures and sells beer, alcohol and non-alcohol beverages, and food products in Japan, Europe, Oceania, and Southeast Asia.

Very undervalued established dividend payer.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026