Sapporo (TSE:2501): Assessing Valuation After Upgraded Profit and Dividend Guidance Reflects Stronger Core Operations

Reviewed by Simply Wall St

Sapporo Holdings (TSE:2501) just made waves by updating its full-year guidance and dividend outlook after a board meeting. The company now expects higher profits and increased shareholder payouts, with core businesses showing resilience.

See our latest analysis for Sapporo Holdings.

Sapporo Holdings’ recent boost in profit and dividend guidance comes on the heels of a strong run for shareholders. While the 1-year total return clocks in at a modest 3.1%, the company’s 3-year total shareholder return stands at a remarkable 137%, and the 5-year figure tops 309%. This kind of sustained momentum hints that investors are recognizing real progress beneath the surface, especially as the company takes bold steps such as a stock split and bylaw changes to support future growth.

If news of Sapporo’s shareholder-focused moves got your attention, now’s a prime opportunity to explore fast growing stocks with high insider ownership

With Sapporo’s profit outlook brightening and the dividend rising, it begs the question: is the current valuation attractive for new investors, or is all this optimism already reflected in the share price?

Price-to-Sales Ratio of 1.2x: Is it justified?

Sapporo Holdings currently trades at a price-to-sales (P/S) ratio of 1.2x, which is higher than both its industry peers and the calculated fair ratio. This suggests investors may be paying a premium relative to its revenue base.

The P/S ratio measures how much investors are willing to pay for every yen of the company’s sales. It is especially relevant for businesses where profitability swings due to non-cash items or one-off events. Given Sapporo’s recent earnings volatility, this metric helps put valuation in perspective regardless of temporary profit fluctuations.

When compared with sector benchmarks, Sapporo’s P/S of 1.2x is expensive versus the Asian Beverage industry average of 2.3x, but it overshoots the estimated Fair Price-to-Sales Ratio of 0.9x. The current valuation could signal that the market expects future growth or margin improvement. However, it also introduces the risk that shares could re-rate lower toward the fair ratio if those improvements do not materialize.

Explore the SWS fair ratio for Sapporo Holdings

Result: Preferred multiple of 1.2x (OVERVALUED)

However, any slowdown in revenue growth or a pullback in profits could quickly sour the outlook and put pressure on Sapporo’s elevated valuations.

Find out about the key risks to this Sapporo Holdings narrative.

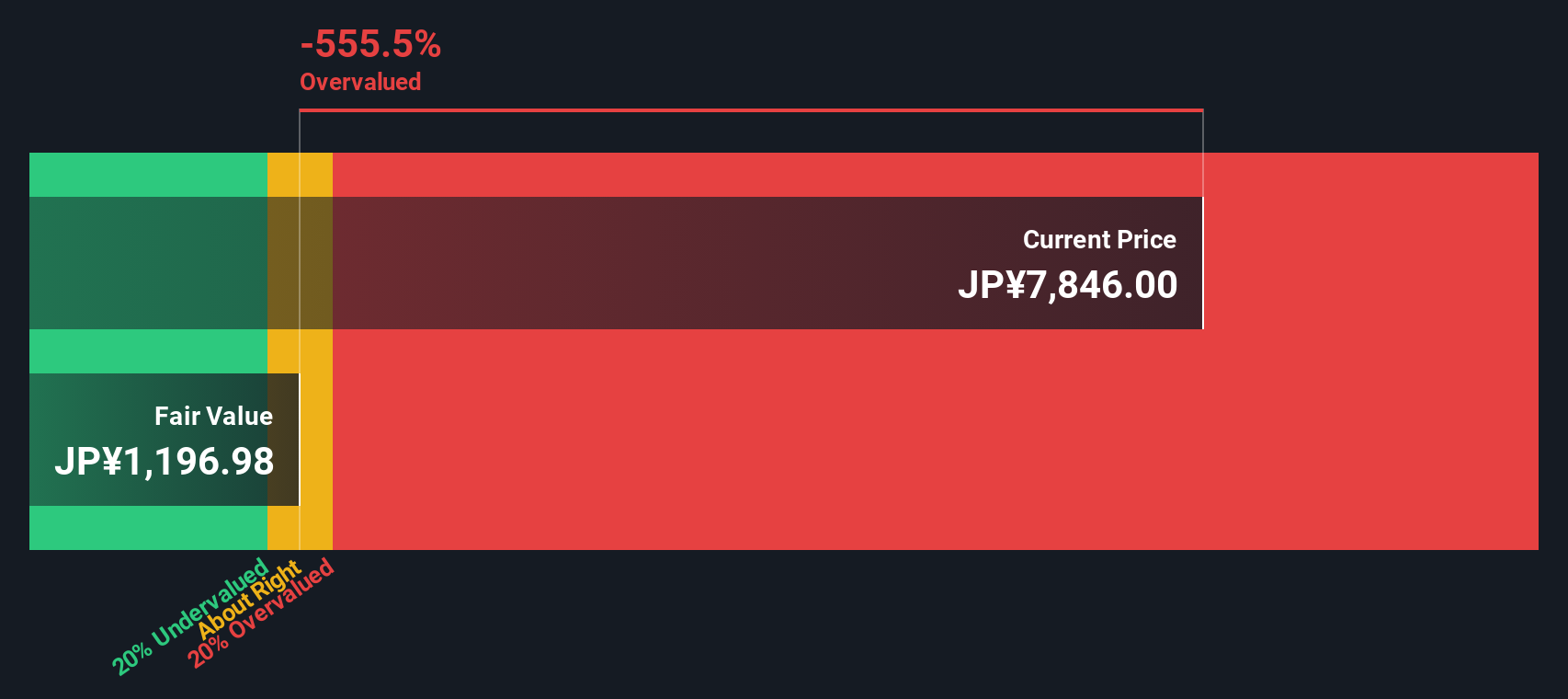

Another View: What Does the SWS DCF Model Say?

Switching perspective, our DCF model values Sapporo Holdings well below its current share price. According to this approach, the stock trades at a significant premium relative to its estimated fair value. Does this suggest the market is running ahead of fundamentals, or is something key being overlooked?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Sapporo Holdings for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 885 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Sapporo Holdings Narrative

If you see things differently or want to build your own perspective, you can dive in and create a custom narrative in just a few minutes. Do it your way

A great starting point for your Sapporo Holdings research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

Looking for more smart investing opportunities?

Don’t wait on the sidelines while others seize tomorrow’s winners. With the right research tools, you can spot undervalued gems and sector leaders before the crowd.

- Target bargain opportunities by tapping into these 885 undervalued stocks based on cash flows, which shows meaningful upside based on strong future cash flows and compelling value signals.

- Unlock steady income streams with these 14 dividend stocks with yields > 3%, highlighting companies offering yields above 3% and robust dividend histories for income-focused portfolios.

- Catalyze your next growth move by checking out these 27 AI penny stocks, which features companies shaping technological frontiers and changing the investing landscape through artificial intelligence innovation.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:2501

Sapporo Holdings

Engages in alcoholic beverages, foods and soft drinks, restaurants, and real estate businesses in Japan and internationally.

Moderate growth potential second-rate dividend payer.

Similar Companies

Market Insights

Community Narratives