Sapporo Holdings (TSE:2501): Assessing Valuation Following Recent Share Price Moves

Reviewed by Simply Wall St

See our latest analysis for Sapporo Holdings.

After a strong stretch in the past month with a 1-month share price return of 9.47%, Sapporo Holdings is showing hints of renewed momentum, even as its 1-year total shareholder return sits at -7.8%. The recent uptick follows a period of longer-term strength, highlighted by a remarkable 3-year total shareholder return of 136% and an impressive 5-year return of over 300%. These figures suggest that, despite some recent volatility, investor confidence in Sapporo’s broader trajectory and underlying growth story remains steady.

If these kinds of moves have you rethinking where to search for opportunity, now is the perfect moment to broaden your lens and discover fast growing stocks with high insider ownership

With Sapporo Holdings showing both notable long-term strength and recent volatility, the question for investors now is clear: does the market still underestimate the company’s future growth, or is everything already factored into the current price?

Price-to-Earnings of 88.9x: Is it justified?

Sapporo Holdings is currently trading with a price-to-earnings (P/E) ratio of 88.9x, while its last close stands at ¥8,101. This multiple suggests the market is pricing in exceptional future earnings growth compared to the company's peers.

The P/E ratio reflects how much investors are willing to pay for each yen of earnings. For Sapporo Holdings, such a high multiple points to strong expectations about its future profitability. This is notable in the context of the beverage industry, where growth rates are more moderate.

However, Sapporo Holdings' P/E of 88.9x is a stark contrast to the Asian Beverage industry average of 19.3x and the peer average of 18x. The market is assigning Sapporo a premium much higher than its sector peers. In addition, this P/E also exceeds the estimated fair P/E of 44.3x, implying a significant valuation gap that could adjust as market perceptions shift.

Explore the SWS fair ratio for Sapporo Holdings

Result: Price-to-Earnings of 88.9x (OVERVALUED)

However, a sharp slowdown in earnings growth or shifting industry trends could quickly pressure Sapporo Holdings' premium valuation.

Find out about the key risks to this Sapporo Holdings narrative.

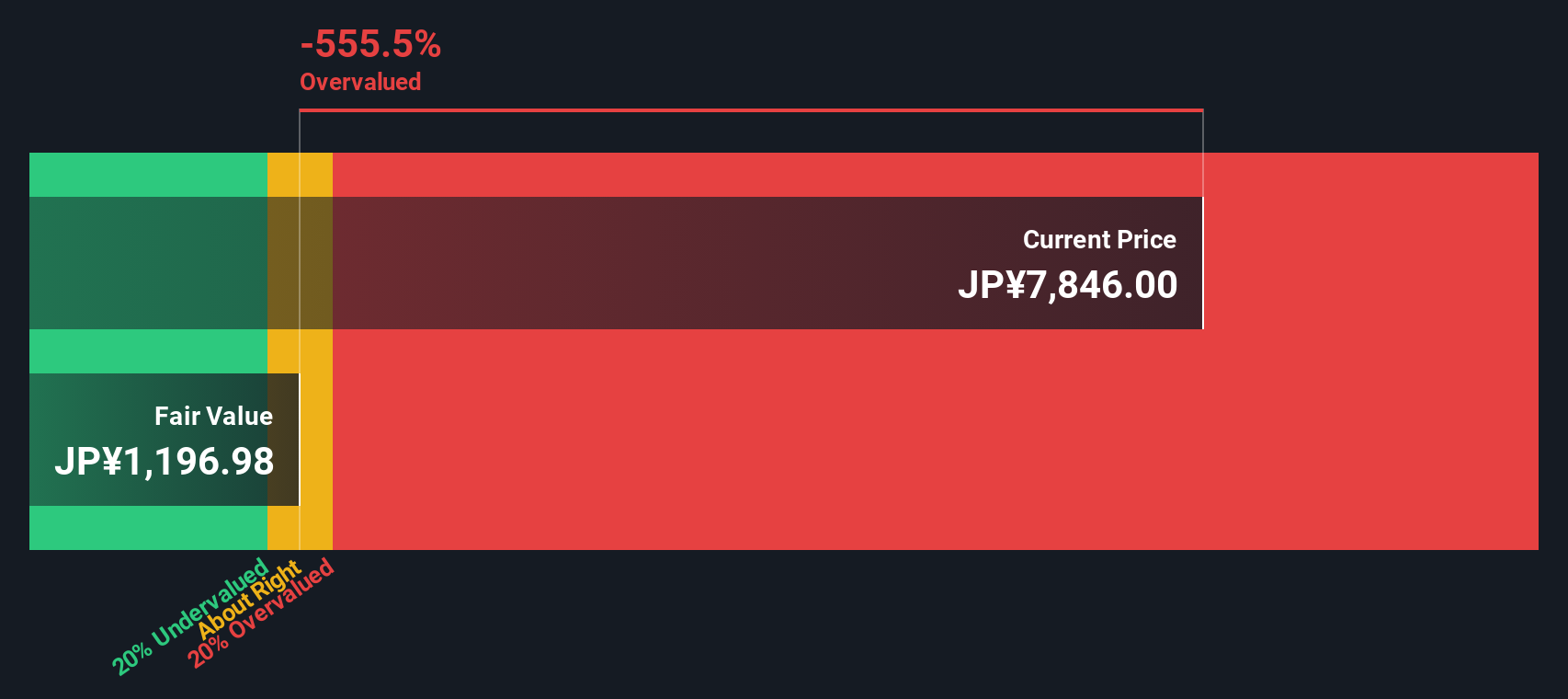

Another View: SWS DCF Model’s Perspective

Looking at our SWS DCF model, a very different picture emerges. The model estimates Sapporo Holdings’ fair value at ¥1,492.46, which is far below the current share price. This suggests the stock could be significantly overvalued using cash flow fundamentals. However, is the market seeing something the model cannot?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Sapporo Holdings for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 913 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Sapporo Holdings Narrative

If you have a different perspective or want to dig deeper into the numbers, you can craft your own narrative in just a few minutes. Do it your way.

A great starting point for your Sapporo Holdings research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Keep your momentum going by checking out unique opportunities that could transform your strategy and make your portfolio stand out from the crowd. Don’t let these standout sectors pass you by.

- Spot exciting potential in early-stage companies when you scan through these 3560 penny stocks with strong financials with strong financials and promising growth stories.

- Unlock rapid advancement in tech by reviewing these 25 AI penny stocks that are redefining business and automation through artificial intelligence and machine learning.

- Boost your passive income potential by searching for attractive yields with these 15 dividend stocks with yields > 3% offering annual returns above 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:2501

Sapporo Holdings

Engages in alcoholic beverages, foods and soft drinks, restaurants, and real estate businesses in Japan and internationally.

Average dividend payer with moderate growth potential.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026