Itoham Yonekyu Holdings (TSE:2296) Earnings Growth Rebounds, Raising Questions on Dividend Reliability

Reviewed by Simply Wall St

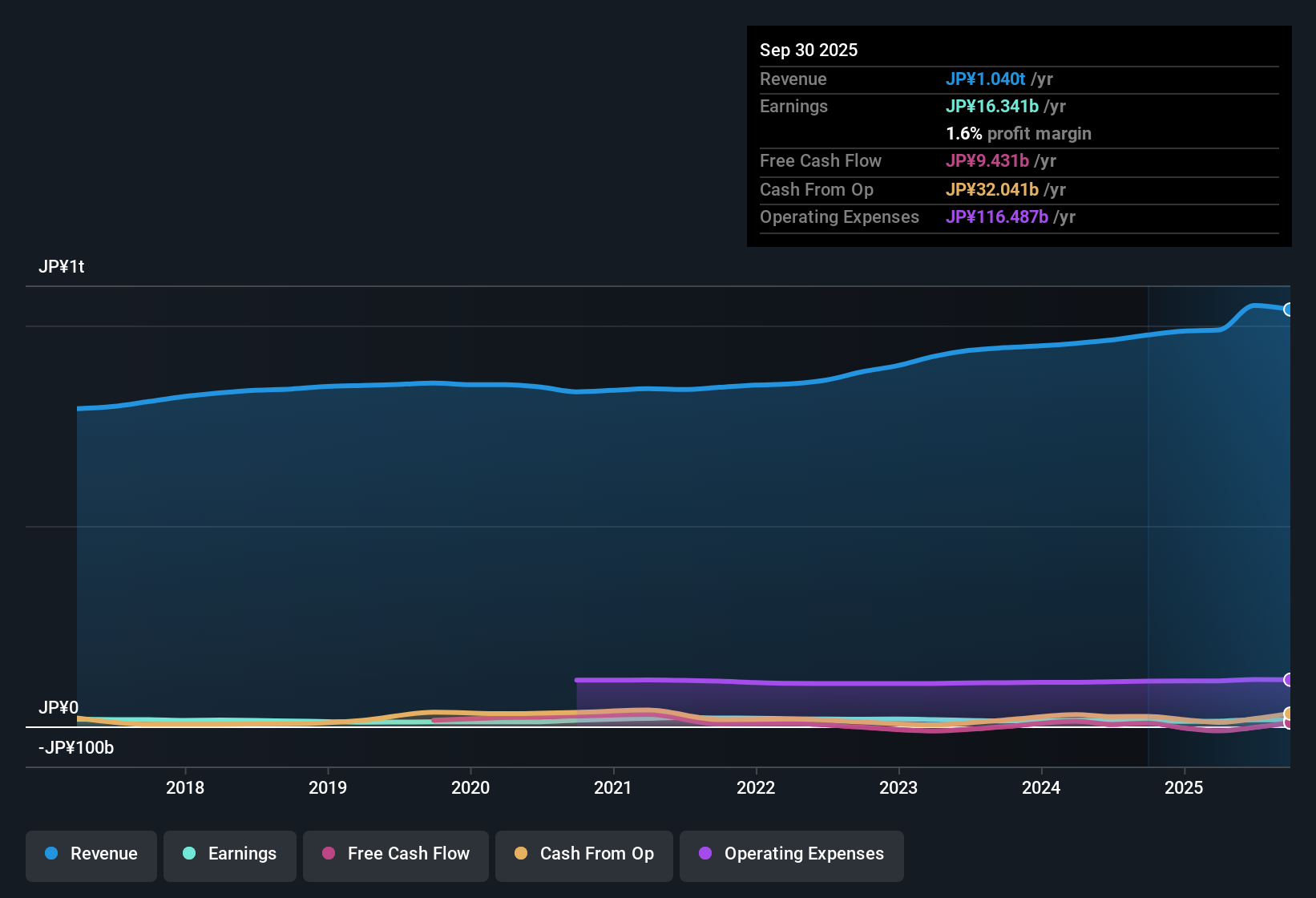

Itoham Yonekyu Holdings (TSE:2296) delivered 9% earnings growth over the past year, a significant turnaround compared to its five-year average annual decline of 8.2%. While earnings are forecast to grow by 1.29% per year and revenue is expected to rise just 0.8% annually, both estimates lag behind the broader Japanese market. Current net profit margins remain steady at 1.6% year on year, and analysts describe recent earnings as high quality.

See our full analysis for Itoham Yonekyu Holdings.Up next, we will see how these latest results stack up against widely held narratives and market expectations, and where the numbers might challenge conventional views.

Curious how numbers become stories that shape markets? Explore Community Narratives

Dividend Sustainability Flagged as a Risk

- The company’s dividend stability is specifically called into question by a flagged risk statement, despite recent profit growth and 1.6% net margins.

- Challenges around dividend sustainability directly test the view that Itoham Yonekyu can serve as a reliable income play for investors.

- Ongoing profit growth provides some cover; however, the explicit risk around dividends means income-focused investors must weigh whether underlying cash flows are robust enough to offset future payout pressures.

- The flagged risk tempers the usual expectation that steady net margins automatically translate into dependable dividends, putting a spotlight on underlying cash flow resilience.

Premium to Industry, Discount to Peers

- The company’s price-to-earnings ratio is 18.7x versus the broader Japanese food industry average of 15.9x, yet it trades well below the peer average P/E of 33.6x.

- This valuation creates a nuanced narrative where Itoham Yonekyu appears expensive compared to the sector, but relatively attractive next to direct competitors.

- What stands out is the tension for investors who value stability; the company’s price is at a premium within the industry, yet relative to peers, it looks more modestly priced given its solid margins and earnings quality.

- At a current share price of ¥5,430, the company also sits above its DCF fair value of ¥4,054.97, further complicating the judgment as to whether investors are paying extra for reliability or overreaching on valuation.

Forecast Growth Trails Market Trends

- Earnings are forecast to grow by just 1.29% per year and revenue by only 0.8% annually, both lagging behind broader Japanese market averages.

- These muted growth projections frame Itoham Yonekyu as a stable but slow-moving company, underscoring why it is viewed more as a defensive play than a growth stock.

- Investors inclined to favor “safe haven” stocks may accept slower growth; however, the subdued outlook means the company is unlikely to deliver outsized capital gains unless it can outperform these low expectations.

- Recent high quality earnings growth is meaningful, but without a lift in long-term growth guidance, the narrative of the company as a steady performer rather than a market leader seems well supported.

Consensus expectations highlight the trade-off between safety and upside. See how all viewpoints come together in the full narrative. 📊 Read the full Itoham Yonekyu Holdings Consensus Narrative.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Itoham Yonekyu Holdings's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Itoham Yonekyu’s muted long-term growth outlook, premium sector pricing, and flagged dividend risks suggest limited upside compared to faster-growing or more resilient alternatives.

If lagging growth projections and payout concerns don’t fit your goals, discover stronger options with steadier income potential through these these 1985 dividend stocks with yields > 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:2296

Itoham Yonekyu Holdings

Engages in the manufacture and sale of processed meat and processed/precooked food products in Japan.

Excellent balance sheet with proven track record.

Market Insights

Community Narratives