What MEGMILK SNOW BRAND (TSE:2270)'s Board Moves and Earnings Reveal About Its Asset Strategy

Reviewed by Sasha Jovanovic

- MEGMILK SNOW BRAND Co., Ltd. recently held a board meeting on November 14, 2025, to discuss the reason for and details of a potential asset transfer, alongside other matters, as well as announcing their Q2 2026 earnings call for the same day.

- This convergence of strategic agenda items and earnings disclosure offers an important window into possible shifts in MEGMILK SNOW BRAND’s operational or financial direction.

- Given the forthcoming board decision on asset transfers, we'll explore what these developments could mean for MEGMILK SNOW BRAND's investment narrative.

The latest GPUs need a type of rare earth metal called Dysprosium and there are only 38 companies in the world exploring or producing it. Find the list for free.

What Is MEGMILK SNOW BRANDLtd's Investment Narrative?

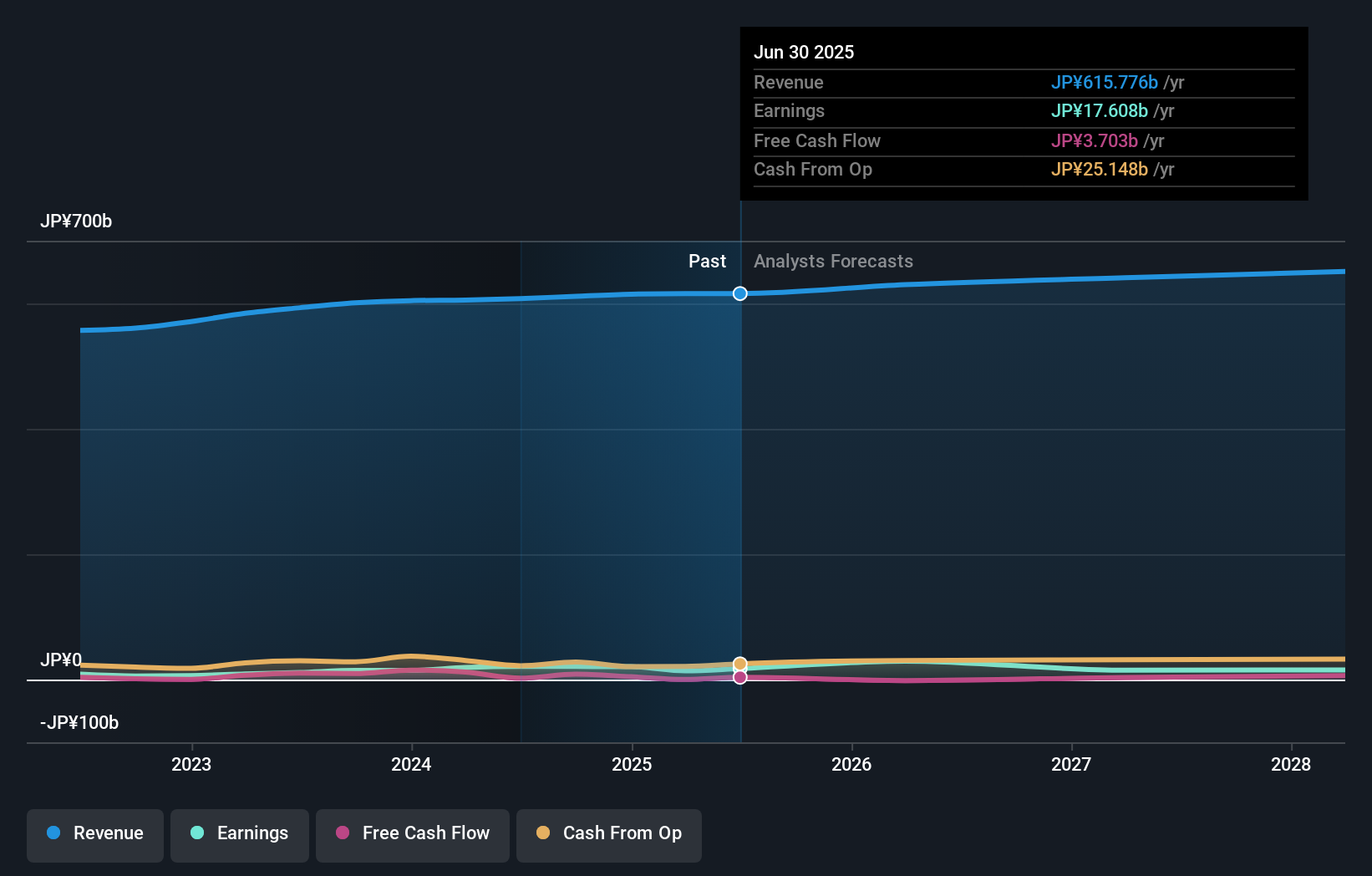

For MEGMILK SNOW BRAND, the core investment thesis has been grounded in steady returns via dividends, disciplined capital management, and a push for operational improvements, even as near-term earnings have faced pressure. The board’s recent decision to discuss the reason for and details of an asset transfer on the same day as Q2 2026 results signals a possible alteration in this narrative. If the asset transfer leads to a change in the business structure or financial position, it could represent a catalyst for value creation or expose new risks, potentially impacting both the consistency of dividends and medium-term earnings momentum. While recent share buybacks and stable payout policies continue to support shareholder returns, the Q2 disclosure and board actions may alter the risk balance, especially with earnings projected to see a 11% decline per year and recent price moves suggesting only modest optimism.

Still, concerns about the sustainability of dividend coverage stand out for investors right now.

Exploring Other Perspectives

Explore 2 other fair value estimates on MEGMILK SNOW BRANDLtd - why the stock might be worth just ¥3175!

Build Your Own MEGMILK SNOW BRANDLtd Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your MEGMILK SNOW BRANDLtd research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

- Our free MEGMILK SNOW BRANDLtd research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate MEGMILK SNOW BRANDLtd's overall financial health at a glance.

Interested In Other Possibilities?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- We've found 16 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:2270

MEGMILK SNOW BRANDLtd

Manufactures and sells milk, milk products, and other food products in Japan and internationally.

Flawless balance sheet average dividend payer.

Market Insights

Community Narratives