3 Asian Stocks Estimated To Be Trading Below Intrinsic Value By Up To 49%

Reviewed by Simply Wall St

As global markets adjust to recent economic shifts, including the Federal Reserve's interest rate cuts and trade developments between the U.S. and China, Asian markets are navigating a complex landscape marked by China's economic slowdown and Japan's monetary policy signals. In this environment, identifying stocks that are trading below their intrinsic value can be crucial for investors seeking potential opportunities amidst market fluctuations.

Top 10 Undervalued Stocks Based On Cash Flows In Asia

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Suzhou Hengmingda Electronic Technology (SZSE:002947) | CN¥46.00 | CN¥90.19 | 49% |

| Sheng Siong Group (SGX:OV8) | SGD2.16 | SGD4.30 | 49.8% |

| Pansoft (SZSE:300996) | CN¥17.03 | CN¥33.77 | 49.6% |

| NexTone (TSE:7094) | ¥2249.00 | ¥4456.32 | 49.5% |

| Japan Data Science ConsortiumLtd (TSE:4418) | ¥974.00 | ¥1933.14 | 49.6% |

| Inspur Digital Enterprise Technology (SEHK:596) | HK$9.58 | HK$18.81 | 49.1% |

| Guangdong Marubi Biotechnology (SHSE:603983) | CN¥39.13 | CN¥77.80 | 49.7% |

| FP Partner (TSE:7388) | ¥2245.00 | ¥4425.25 | 49.3% |

| Elite Advanced Laser (TWSE:3450) | NT$258.50 | NT$504.36 | 48.7% |

| Dekon Food and Agriculture Group (SEHK:2419) | HK$80.00 | HK$159.63 | 49.9% |

Here we highlight a subset of our preferred stocks from the screener.

J&T Global Express (SEHK:1519)

Overview: J&T Global Express Limited is an investment holding company providing integrated express delivery services across several countries including China, Indonesia, and Brazil, with a market cap of HK$88.15 billion.

Operations: The company's revenue is primarily generated from its transportation services, specifically air freight, which amounts to $10.90 billion.

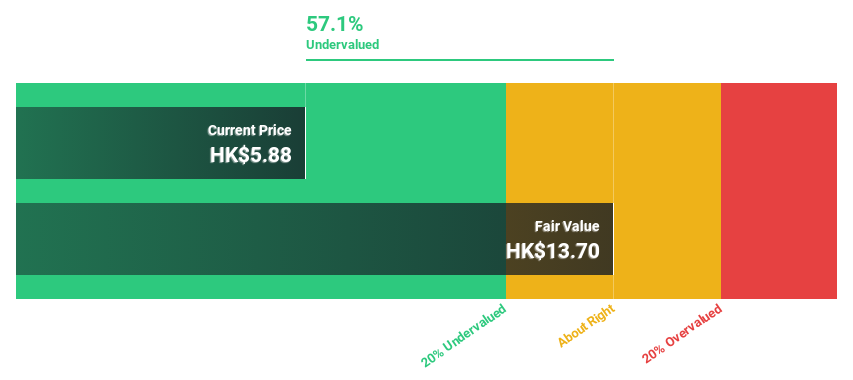

Estimated Discount To Fair Value: 36.4%

J&T Global Express appears undervalued, trading at HK$9.9, significantly below its estimated fair value of HK$15.57. The company has shown robust financial performance with a net income increase to US$86.37 million for H1 2025 from US$27.59 million the previous year, alongside strong parcel volume growth. Recent share buybacks could enhance earnings per share and net asset value per share, despite its removal from the Hang Seng China Enterprises Index in September 2025.

- The analysis detailed in our J&T Global Express growth report hints at robust future financial performance.

- Click to explore a detailed breakdown of our findings in J&T Global Express' balance sheet health report.

Suzhou Hengmingda Electronic Technology (SZSE:002947)

Overview: Suzhou Hengmingda Electronic Technology Co., Ltd. operates in the electronic technology sector and has a market capitalization of CN¥11.48 billion.

Operations: The company's revenue is primarily derived from Precision Flexible Structural Parts at CN¥2.35 billion and Precision Metal Structural Parts at CN¥399.44 million.

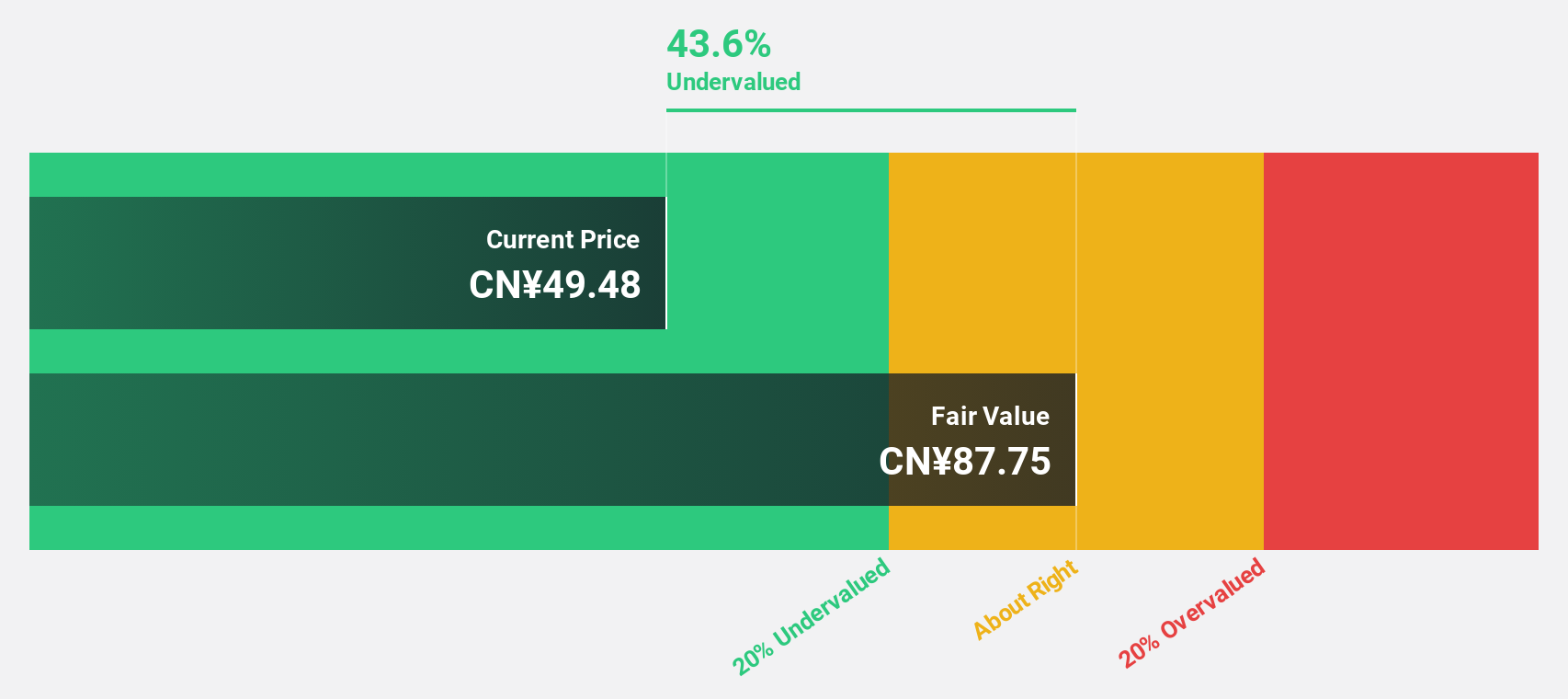

Estimated Discount To Fair Value: 49%

Suzhou Hengmingda Electronic Technology is trading at CN¥46, significantly below its estimated fair value of CN¥90.19, suggesting a strong undervaluation based on cash flows. The company's earnings and revenue are projected to grow substantially over the next few years, with recent reports showing sales increased to CN¥1.23 billion from CN¥929.3 million year-on-year. Despite an unstable dividend track record, its financial metrics indicate good relative value compared to peers and industry standards.

- Our expertly prepared growth report on Suzhou Hengmingda Electronic Technology implies its future financial outlook may be stronger than recent results.

- Navigate through the intricacies of Suzhou Hengmingda Electronic Technology with our comprehensive financial health report here.

Kotobuki Spirits (TSE:2222)

Overview: Kotobuki Spirits Co., Ltd. is a Japanese company that produces and sells sweets, with a market cap of ¥291.51 billion.

Operations: The company's revenue segments include KCC with ¥21.95 billion, Sucrey contributing ¥30.66 billion, and Sales Subsidiaries adding ¥7.27 billion.

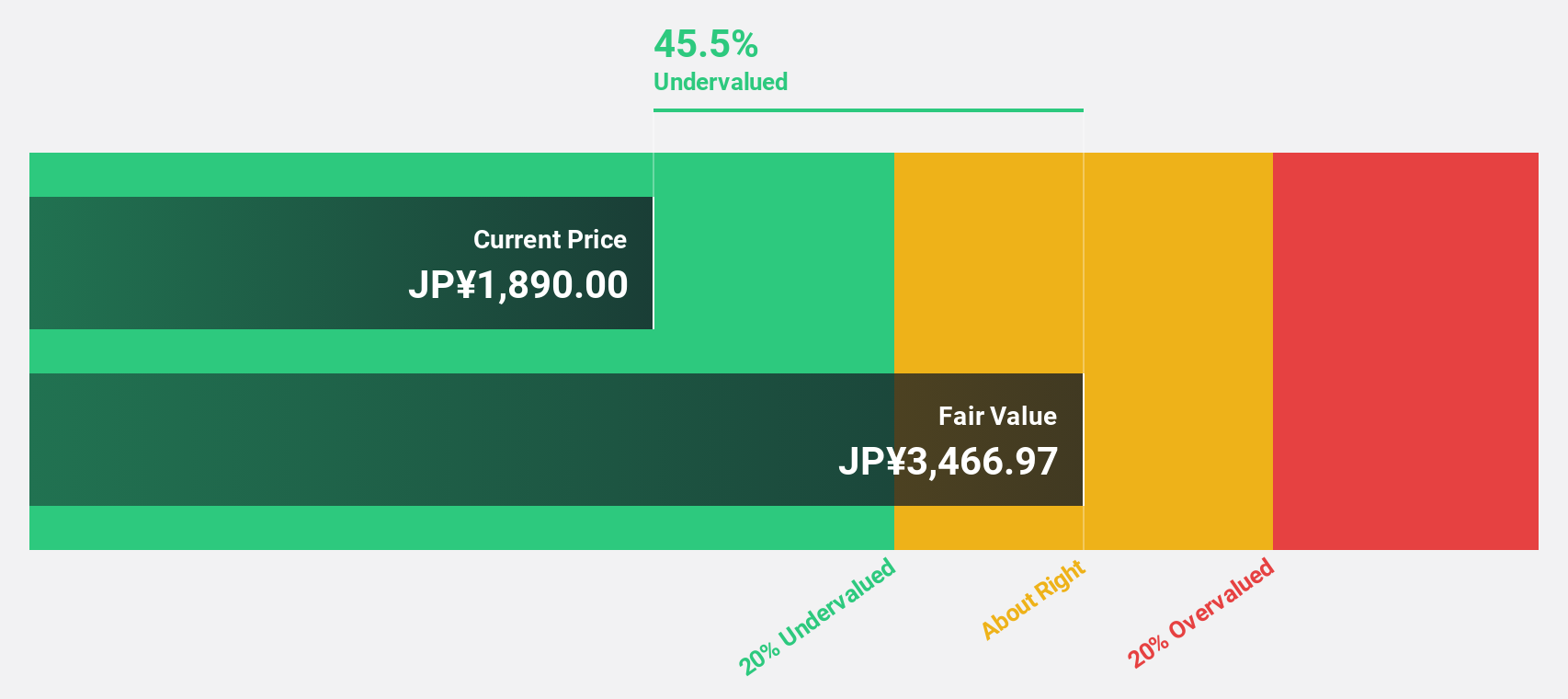

Estimated Discount To Fair Value: 45.5%

Kotobuki Spirits is trading at ¥1888.5, significantly below its fair value estimate of ¥3466.97, indicating strong undervaluation based on cash flows. Revenue growth is expected to outpace the JP market at 7.6% annually, with earnings projected to grow 10.37% per year. Recent guidance forecasts a sales increase to ¥16,976 million for Q1 2025 from ¥15,526 million a year ago despite an unstable dividend track record and plans for treasury stock disposal and director remuneration changes.

- The growth report we've compiled suggests that Kotobuki Spirits' future prospects could be on the up.

- Dive into the specifics of Kotobuki Spirits here with our thorough financial health report.

Seize The Opportunity

- Reveal the 280 hidden gems among our Undervalued Asian Stocks Based On Cash Flows screener with a single click here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:1519

J&T Global Express

An investment holding company, offers integrated express delivery services in the People’s Republic of China, Indonesia, the Philippines, Malaysia, Thailand, Vietnam, Saudi Arabia, the United Arab Emirates, Mexico, Brazil, and Egypt.

Reasonable growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives