Yamazaki Baking (TSE:2212) Forecasts Slower 3.33% Earnings Growth, Trades Below Fair Value

Reviewed by Simply Wall St

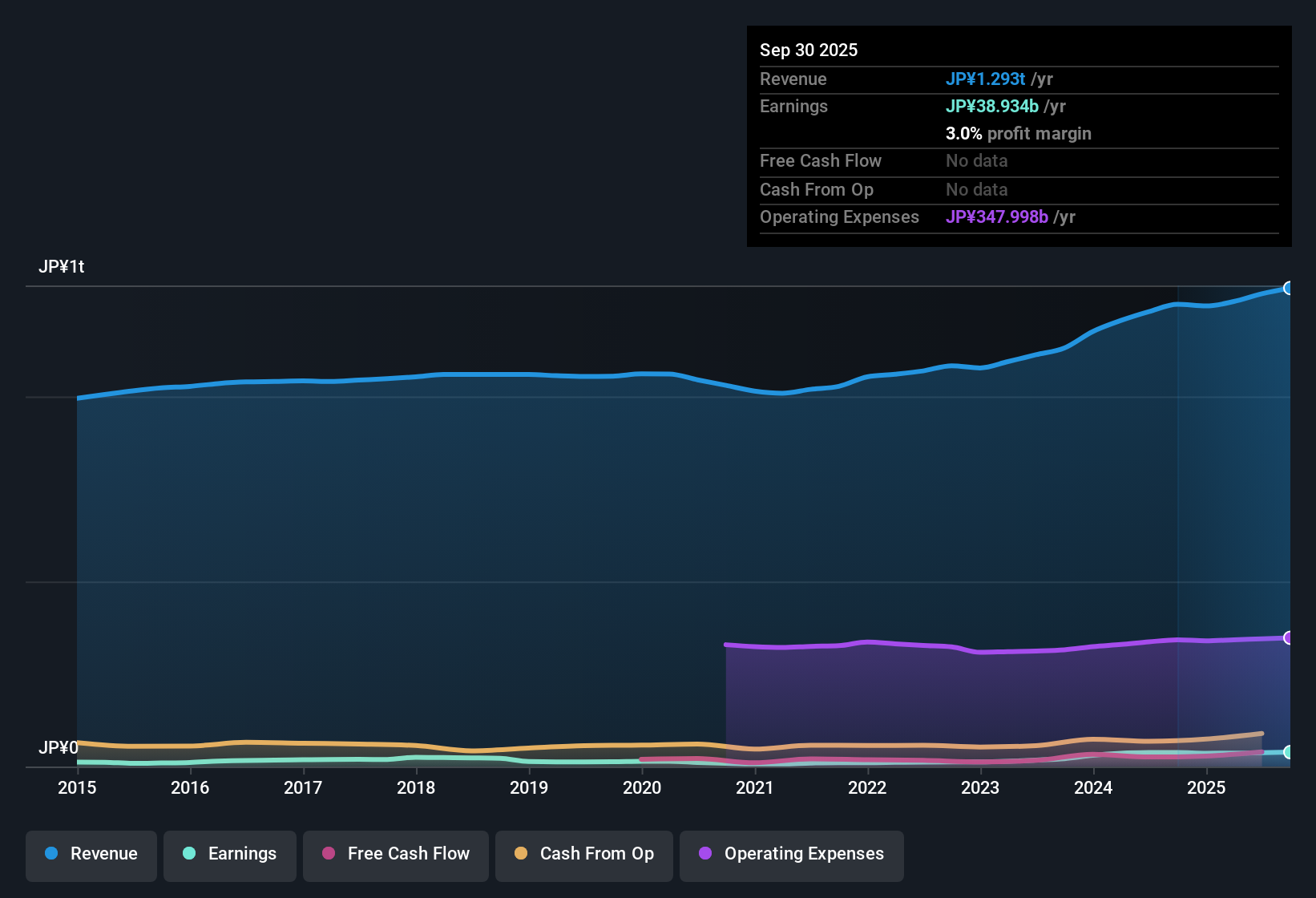

Yamazaki Baking (TSE:2212) reported an average annual earnings growth of 36.3% over the past five years. Its latest year-over-year earnings growth was a more modest 2.2%. Profit margins held steady at 3%, down only slightly from 3.1% last year, while top-line revenue is projected to grow at 1.7% annually going forward. With earnings quality still ranked as high and no risks currently identified by the company, the setup points to ongoing, if subdued, gains as the company continues to trade at a valuation discount compared to industry peers.

See our full analysis for Yamazaki Baking.Next up, we will put these numbers side by side with some of the prevailing narratives in the market to see where the facts confirm the story and where fresh questions might arise.

Curious how numbers become stories that shape markets? Explore Community Narratives

Forecast Growth Slows After Five-Year Surge

- Yamazaki Baking’s earnings are projected to grow by just 3.33% annually going forward, a notable slowdown compared to its average annual growth of 36.3% over the past five years.

- Despite the lower forward growth, the company's strong brand reputation and consistent operational execution are seen as supports for its continued stability.

- Market observers highlight that stable 3% net profit margins, maintained even as growth rates come down, underscore resilience in the face of a mature, slow-growth sector.

- Ongoing improvements in product mix and operational efficiencies are cited as factors that could help Yamazaki Baking sustain positive momentum, even if rapid gains from earlier years are behind it.

Profit Margins Hold Steady Amid Sector Pressures

- Net profit margin remains at 3%, down only marginally from 3.1% the previous year, demonstrating effective cost management despite competitive and inflationary headwinds across the packaged food sector.

- What stands out is how stable margins counter common industry concerns about rising input costs undermining profitability.

- Analysts note that maintaining margin stability during times of sector-wide cost pressure suggests stronger discipline than some rivals, in line with broader trends identified in defensive food producers.

- Consistency in profitability is interpreted as evidence of Yamazaki Baking’s reliable product demand and effective control of operating expenses, factors the market rewards with relatively benign sentiment toward future outlook.

Shares Still Trade Below DCF Fair Value

- Yamazaki Baking’s current share price of ¥2,971 is significantly below both its DCF fair value estimate of ¥4,931.92 and the peer average price-to-earnings ratio, with the company at 15.1x versus the JP Food industry’s 16.2x and peers’ 18.2x.

- The gap between market price and fundamental value is taken as a major plus, especially for investors attracted to companies with strong balance sheets and earnings quality.

- Ongoing trading below analyst price targets and fair value highlights the stock’s relative bargain status, with underlying fundamentals supporting a valuation rerating if sentiment turns more positive.

- Compared to some peers, Yamazaki’s valuation discount is seen as an opportunity grounded in stable margins and resilient profit growth, rather than risk-driven fear or uncertainty.

See our latest analysis for Yamazaki Baking.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Yamazaki Baking's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Growth at Yamazaki Baking has slowed sharply from its previous surge, signaling that rapid expansion may be behind it. The company appears to be entering a more mature, steady phase.

If you want to focus on stocks still delivering predictable expansion, check out stable growth stocks screener (2113 results) to find companies demonstrating consistent growth across different market conditions.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:2212

Very undervalued with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives