Fuji Nihon (TSE:2114) Margin Stability Reinforces Value Narrative Despite Slower EPS Growth

Reviewed by Simply Wall St

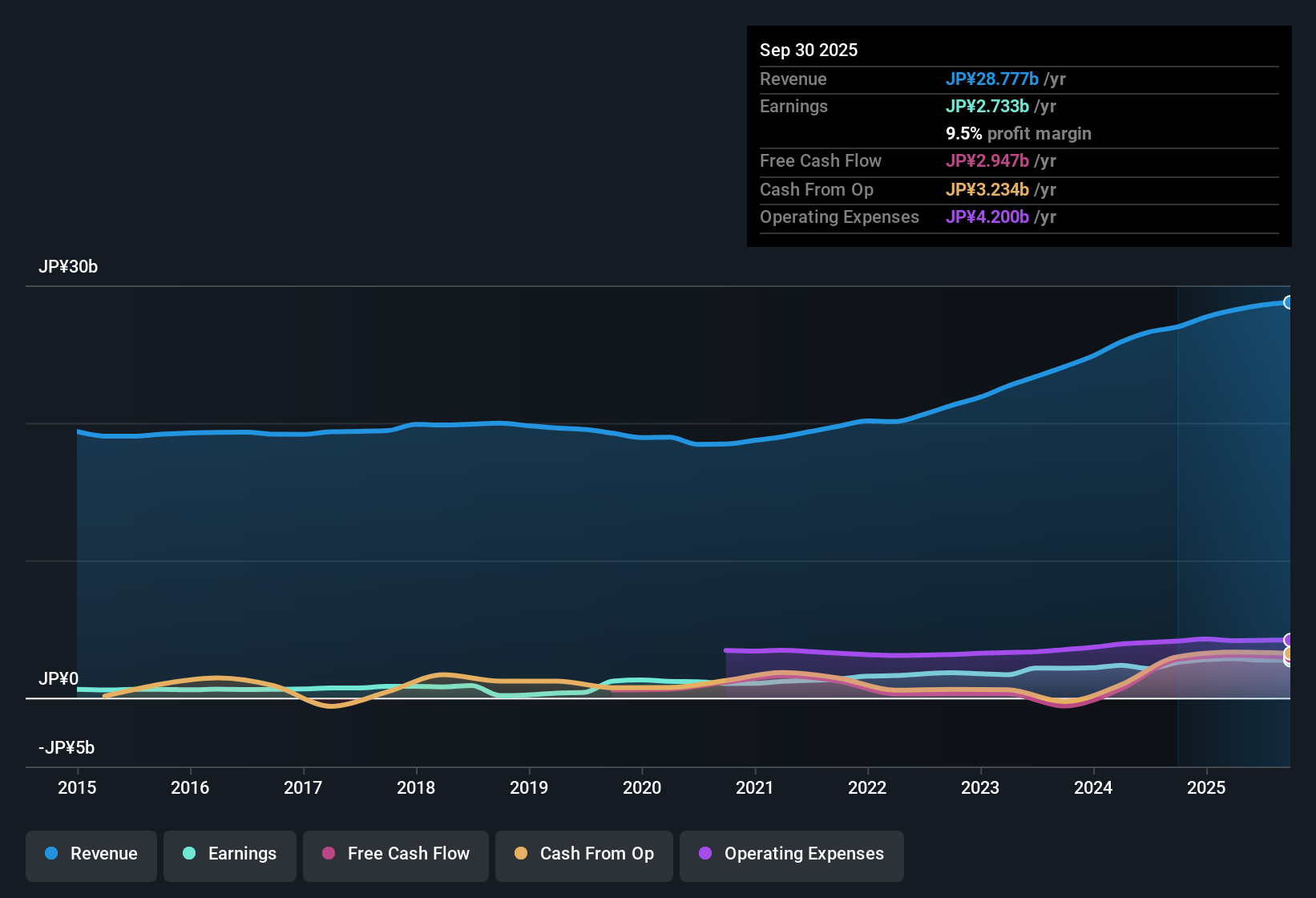

Fuji Nihon (TSE:2114) reported EPS growth of 6.7% over the past year, a pace slower than its five-year annual average of 19%. The company maintained a net profit margin of 9.5%, matching last year's level, with high-quality earnings reported once again. While earnings growth moderated this time around, investors will note that Fuji Nihon's shares trade at ¥1,051, which is well below an estimated fair value, supported by strong historical earnings consistency and attractive valuation metrics. However, dividend sustainability remains a key consideration.

See our full analysis for Fuji Nihon.Next, we’ll see how these headline numbers hold up against the prevailing market narratives and analyst outlooks. This is where the story really gets interesting.

Curious how numbers become stories that shape markets? Explore Community Narratives

DCF Fair Value Shows Market Discount

- Fuji Nihon’s share price of ¥1,051 trades at a 65% discount to its DCF fair value of ¥3,002. This is well below both the peer Price-to-Earnings average of 12.3x and the sector’s 16.3x, with Fuji Nihon sitting at just 9.9x P/E.

- Prevailing market analysis underscores that this steep discount, combined with the company’s defensive industry profile, heavily supports the case that Fuji Nihon could be undervalued relative to its consistent profit margins.

- Stable demand in the food industry combined with a lower valuation than competitors may cushion downside risk for investors who prioritize value over rapid growth.

- On the other hand, market sentiment appears to be neutral, with little short-term excitement reflected in trading volume or price action. This suggests that the discount persists mainly because investors are waiting for a clear catalyst before re-rating the stock.

Profit Margins Defy Inflation Fears

- Fuji Nihon maintained a net profit margin of 9.5% this year, matching the previous year's margin, despite inflation pressures often squeezing food sector peers.

- Reviewing the current environment, prevailing analysis notes that consistently high-quality earnings and steady margins reinforce the company's reputation for operational reliability, especially during periods of macroeconomic volatility.

- This margin stability may attract investors who view the broader food production space as a safe haven when markets are turbulent.

- However, without major new product launches or growth initiatives, some market participants view Fuji Nihon as a solid but unspectacular holding, more likely to preserve capital than generate dramatic gains in the short term.

Dividend Reliability Is in Focus

- While Fuji Nihon’s profitability and valuation metrics are attractive, the main risk highlighted from filings is concern over future dividend sustainability, as flagged in the latest report.

- The prevailing narrative argues that although the company’s steady earnings suggest room for continued payouts, long-term investors will want to see clear evidence that dividends can be maintained without sacrificing reinvestment in growth.

- This tension between rewarding shareholders today and funding future expansion may be especially relevant as sector peers look for ways to innovate or consolidate in response to shifting consumer demand.

- Growth-oriented investors could lose patience if management does not signal a strategy for strengthening the dividend track record or capitalizing on new trends in the food sector.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Fuji Nihon's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Fuji Nihon’s dividend outlook is uncertain, as concerns about sustaining payouts without compromising growth leave long-term income investors seeking more reassurance.

If future dividend reliability is your top priority, look for more consistent income opportunities with these 2000 dividend stocks with yields > 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:2114

Fuji Nihon

Engages in the manufacture and sale of refined sugar and sugar-related products in Japan.

Excellent balance sheet, good value and pays a dividend.

Market Insights

Community Narratives