Chubu Shiryo (TSE:2053) Earnings Decline Reinforces Value Versus Growth Narrative

Reviewed by Simply Wall St

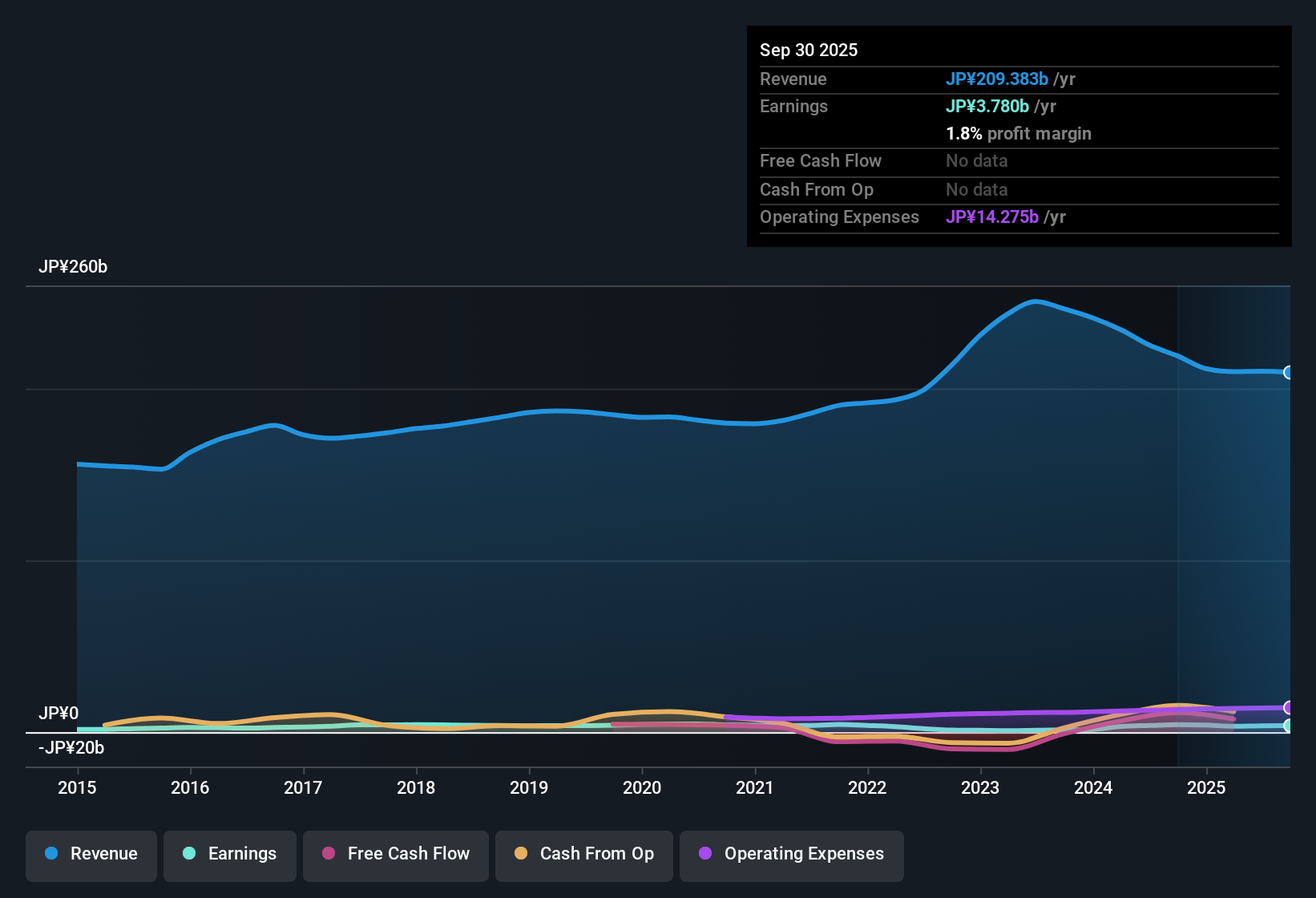

Chubu Shiryo (TSE:2053) posted a 1.6% annual decline in earnings over the past five years, with net profit margins currently at 1.8%, slightly below last year’s 2%. Although the company experienced negative earnings growth in the latest period, its valuation metrics look appealing, trading at 12.3x Price-to-Earnings relative to higher industry and peer averages. For investors, a below-market P/E ratio combined with dividend appeal supports the reward case. However, growth concerns remain a key risk to watch.

See our full analysis for Chubu Shiryo.Next, we will see how these results stack up against the broader narratives and expectations in the market, and where views might get challenged or reinforced.

Curious how numbers become stories that shape markets? Explore Community Narratives

Margin Quality Holds Despite Pressure

- Net profit margins are currently at 1.8%, a decrease from last year's 2%. Company filings still describe these as "high quality" earnings, highlighting operational consistency even as profitability softened.

- The narrative points out that stability in margins supports the case for Chubu Shiryo as a defensive investment, especially in the food sector, where steady demand and a defensive profile are valued.

- Yet, the margin decline introduces tension, showing that while the business may be reliably consistent, pressures from costs or competition can still erode profitability year-on-year.

- This steadiness is still prized by many investors, but it underlines why bulls are looking for operational improvements or positive sector news before expecting meaningful upside.

Dividend Profile Adds Reward Appeal

- Chubu Shiryo is regarded as offering dividend attractiveness, which, alongside its value positioning, continues to support the reward side of the investment thesis.

- The prevailing view is that dividends and fair valuation heavily support the bullish case.

- The company’s below-market Price-to-Earnings ratio (12.3x) combines with dividends to make the stock attractive for income-focused investors, even though margins are slightly compressed.

- Investors searching for steady returns, rather than rapid growth, may see this profile as tipping the risk-reward balance in their favor.

Trading at a Discount to Industry

- With a Price-to-Earnings ratio of 12.3x, Chubu Shiryo trades at a noticeable discount to the Japanese food industry average (16.3x) and peer average (25.1x), signaling that the market is skeptical about growth prospects despite the attractive valuation.

- This dynamic highlights why investors remain divided:

- The low multiple and current share price of 1,602.0 both reinforce the idea that near-term growth is lacking, and this is the main risk anchoring the market’s cautious stance on the stock.

- At the same time, the discount could present opportunity if the company manages to spark new growth or defend its margins better than expected, turning this skepticism into a catalyst for re-rating.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Chubu Shiryo's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Chubu Shiryo’s persistently low earnings growth and compressed margins highlight a business that is struggling to deliver consistent performance in a competitive sector.

If you want steadier expansion and fewer growth risks, use our stable growth stocks screener (2101 results) to find companies that consistently grow revenue and earnings across market cycles.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:2053

Chubu Shiryo

Manufactures and sells compound feed for livestock and fisheries in Japan.

Flawless balance sheet 6 star dividend payer.

Market Insights

Community Narratives