Nippn (TSE:2001): Assessing Valuation Following Newly Announced Share Buyback Program

Reviewed by Simply Wall St

Nippn (TSE:2001) just unveiled a new buyback program, planning to repurchase up to 2,200,000 shares by March 2026. This move is intended to boost shareholder returns and improve capital efficiency.

See our latest analysis for Nippn.

Momentum around Nippn has been mixed lately, with the share price slipping 6.95% over the past month but earning a 1-year total shareholder return of 5.36%. The buyback announcement follows a steady multi-year uptrend, with three- and five-year total returns of 55% and 49% respectively. This suggests long-term performance remains resilient.

If you’re tracking companies making proactive moves for shareholders, this is a great chance to discover fast growing stocks with high insider ownership

But with mixed recent returns and a fresh buyback in play, investors may be wondering whether Nippn now presents an undervalued opportunity or if the market has already factored in its growth prospects.

Price-to-Earnings of 9.4x: Is it justified?

Nippn currently trades at a price-to-earnings (P/E) ratio of 9.4x, which stands out as a potential value opportunity given recent share price dynamics at ¥2,236. This ratio indicates the market values Nippn's earnings more conservatively compared to key peers and industry standards.

The price-to-earnings multiple is a core tool for gauging how much investors are willing to pay today for each unit of a company’s earnings. For a mature, established food industry company like Nippn, a lower-than-average P/E may signal undervaluation or market hesitation about future growth.

Nippn's P/E of 9.4x trails both the peer average of 12.7x and the broader JP Food industry average of 16.4x. Even when compared to an estimated fair price-to-earnings ratio of 12.7x, the current multiple appears conservative. This suggests there may be room for market sentiment to adjust upward if business fundamentals hold steady.

Explore the SWS fair ratio for Nippn

Result: Price-to-Earnings of 9.4x (UNDERVALUED)

However, slowing annual revenue growth and a recent decline in net income raise questions about whether earnings momentum can be sustained going forward.

Find out about the key risks to this Nippn narrative.

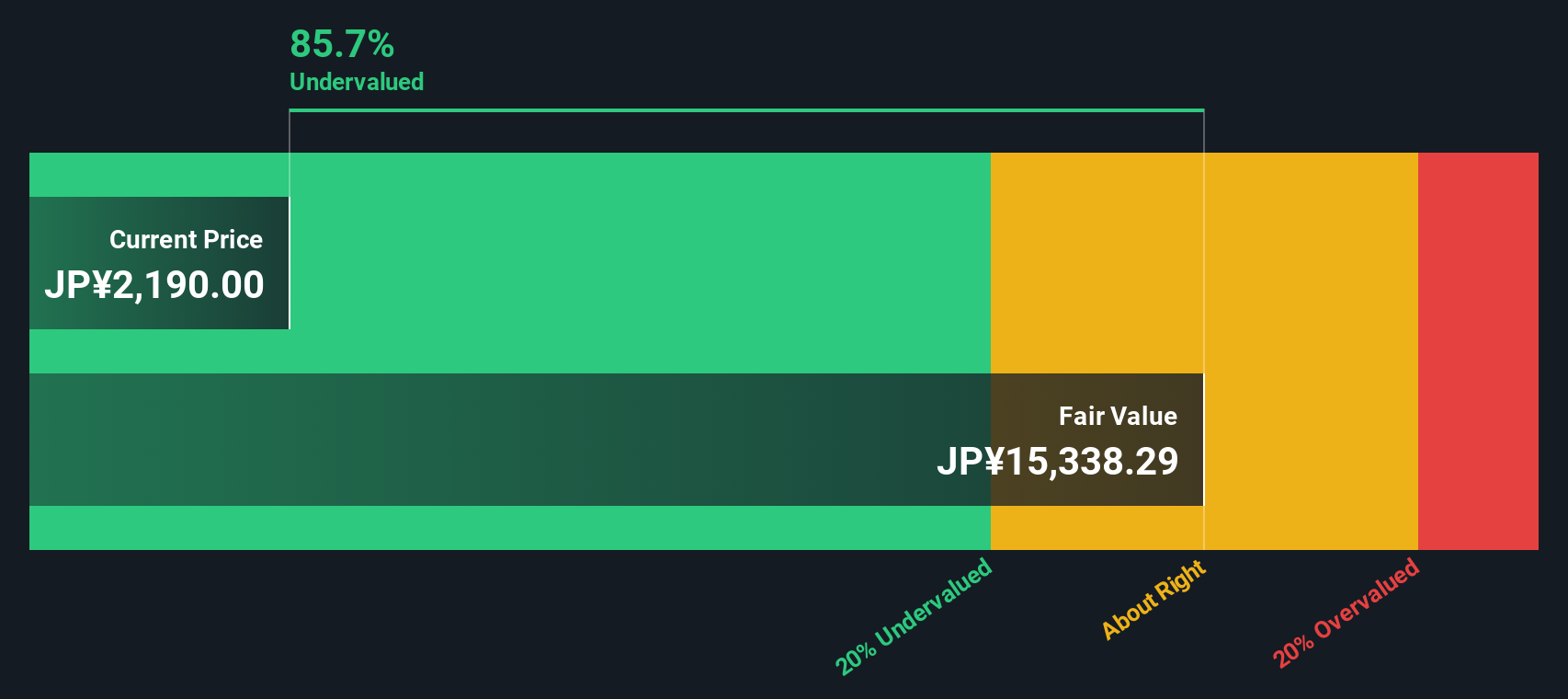

Another View: What Does the DCF Model Say?

While the price-to-earnings ratio paints Nippn as undervalued compared to peers, our DCF model offers a starkly different outlook. According to this method, Nippn is trading well below its calculated fair value. Does this discrepancy reveal a hidden opportunity, or does it highlight risks the market is reacting to?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Nippn for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Nippn Narrative

If you think there’s a different angle or want to dig into the numbers yourself, you can quickly put together your own perspective. Do it your way

A great starting point for your Nippn research is our analysis highlighting 2 key rewards and 4 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Expand your opportunities and open the door to new possibilities with screens designed to spotlight companies offering growth, innovation, and reliable returns.

- Accelerate your search for future returns by tapping into smart picks among these 871 undervalued stocks based on cash flows. These highlight companies trading at attractive prices based on cash flows.

- Maximize your earning potential and secure steady payouts by targeting these 19 dividend stocks with yields > 3%, which features strong yields exceeding 3%.

- Stay ahead of tomorrow’s tech curve by checking out these 27 AI penny stocks, where AI-driven innovation aligns with powerful business momentum.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nippn might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:2001

Nippn

Engages in flour milling and food business in Japan and internationally.

Flawless balance sheet and undervalued.

Market Insights

Community Narratives