- Japan

- /

- Construction

- /

- TSE:1898

Discovering Undiscovered Gems with Potential This December 2024

Reviewed by Simply Wall St

As the year draws to a close, global markets have experienced moderate gains despite a dip in U.S. consumer confidence and mixed economic indicators, with major indices like the S&P 500 and Nasdaq Composite showing strength while small-cap stocks face challenges amid declining durable goods orders and rising unemployment claims. In this environment of fluctuating market sentiment, identifying potential opportunities requires focusing on companies with solid fundamentals and resilience to navigate economic uncertainties, making them potential "undiscovered gems" for investors seeking growth beyond large-cap favorites.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Jih Lin Technology | 56.44% | 4.23% | 3.89% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Indeks Bilgisayar Sistemleri Mühendislik Sanayi ve Ticaret Anonim Sirketi | 56.22% | 44.24% | 26.23% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Wealth First Portfolio Managers | 4.08% | -43.42% | 42.63% | ★★★★★☆ |

| BBGI Global Infrastructure | 0.02% | 3.08% | 6.85% | ★★★★★☆ |

| Kirac Galvaniz Telekominikasyon Metal Makine Insaat Elektrik Sanayi ve Ticaret Anonim Sirketi | 14.19% | 33.12% | 44.33% | ★★★★★☆ |

| AMCIL | NA | 5.16% | 5.31% | ★★★★★☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Chongqing Gas Group | 17.09% | 9.78% | 0.53% | ★★★★☆☆ |

Here we highlight a subset of our preferred stocks from the screener.

Seikitokyu Kogyo (TSE:1898)

Simply Wall St Value Rating: ★★★★★☆

Overview: Seikitokyu Kogyo Co., Ltd. specializes in the paving of roads, expressways, and bridges across Japan with a market capitalization of approximately ¥56.70 billion.

Operations: Seikitokyu generates revenue primarily from its Construction Business and Paving Materials Manufacturing and Sales Business, with the former contributing ¥74.77 billion and the latter ¥32.35 billion.

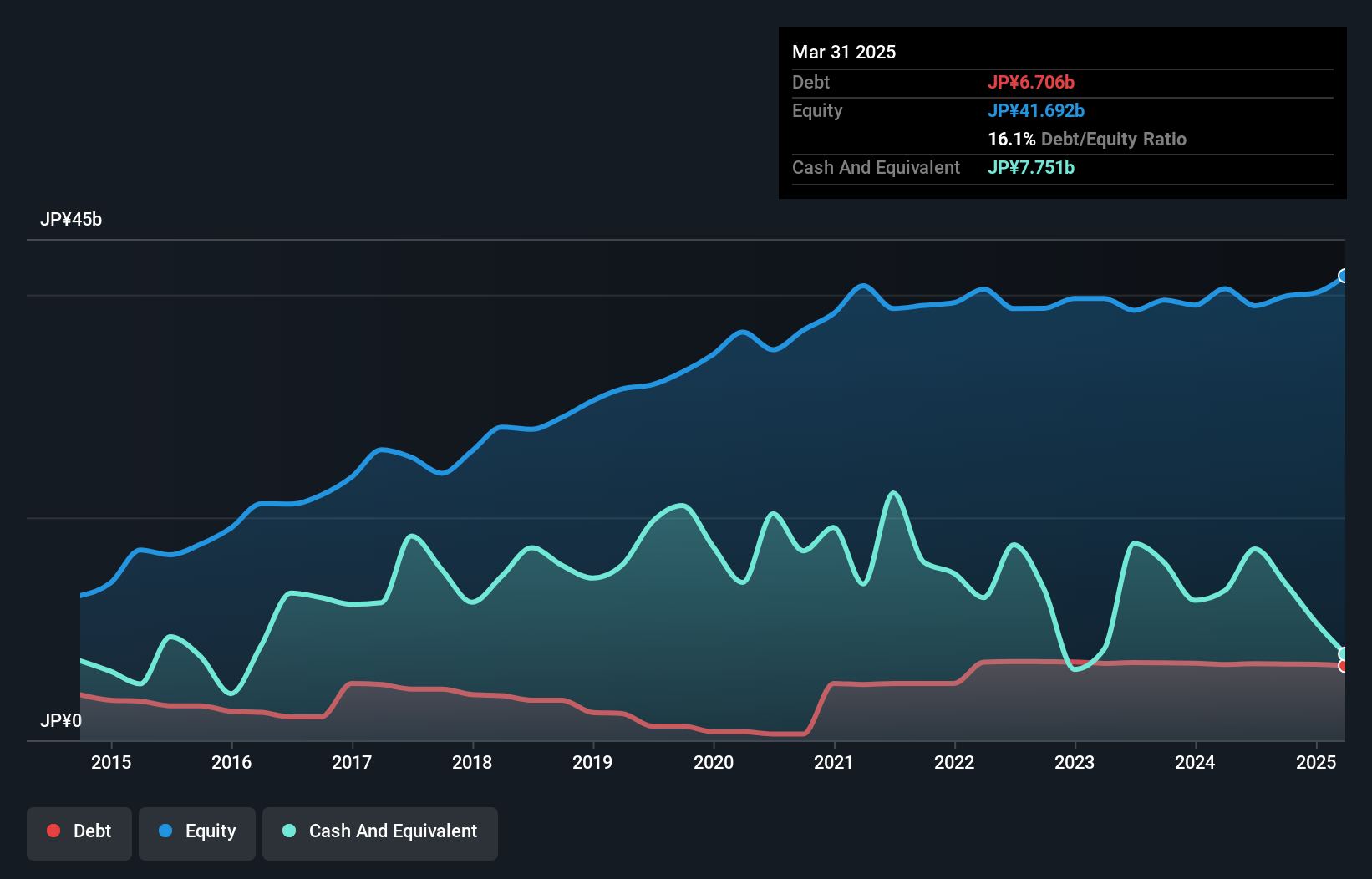

Seikitokyu Kogyo, a small player in the construction industry, has shown impressive growth with earnings surging by 48% over the past year, outpacing the industry's 21%. Despite a challenging five-year period with an annual earnings drop of 24%, it maintains high-quality earnings and strong financial health. The company's interest payments are well-covered by EBIT at 94 times coverage. Looking ahead, Seikitokyu forecasts consolidated net sales of ¥96.9 billion and an operating profit of ¥5.52 billion for fiscal year-end March 2025, indicating potential stability amidst fluctuating past performance.

- Dive into the specifics of Seikitokyu Kogyo here with our thorough health report.

Understand Seikitokyu Kogyo's track record by examining our Past report.

Nippn (TSE:2001)

Simply Wall St Value Rating: ★★★★★★

Overview: Nippn Corporation is involved in flour milling and food businesses both domestically in Japan and internationally, with a market capitalization of ¥169.14 billion.

Operations: Nippn generates revenue primarily from its Food Business and Flour Milling Business, with ¥234.41 billion and ¥126.16 billion respectively. The company's net profit margin is a key financial metric to consider when evaluating its performance over time.

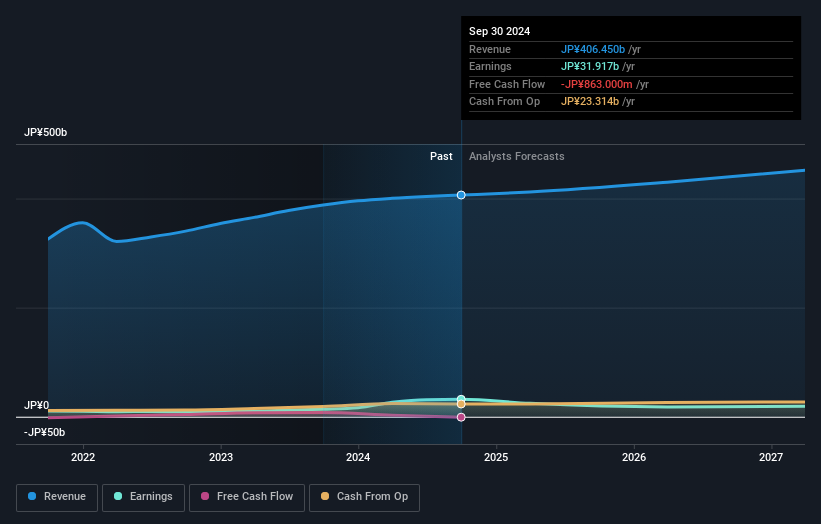

Nippn, a relatively small player in the food industry, has shown notable earnings growth of 131.5% over the past year, surpassing the industry's 19.5%. The company experienced a significant one-off gain of ¥21.7 billion affecting its recent financial results till September 2024. Despite this boost, future earnings are expected to decrease by an average of 20.8% annually over the next three years while revenue is projected to grow at a modest rate of 4.34% per year. With a net debt-to-equity ratio at a satisfactory level of 6.1%, Nippn seems well-positioned financially amidst these mixed prospects.

PAL GROUP Holdings (TSE:2726)

Simply Wall St Value Rating: ★★★★★★

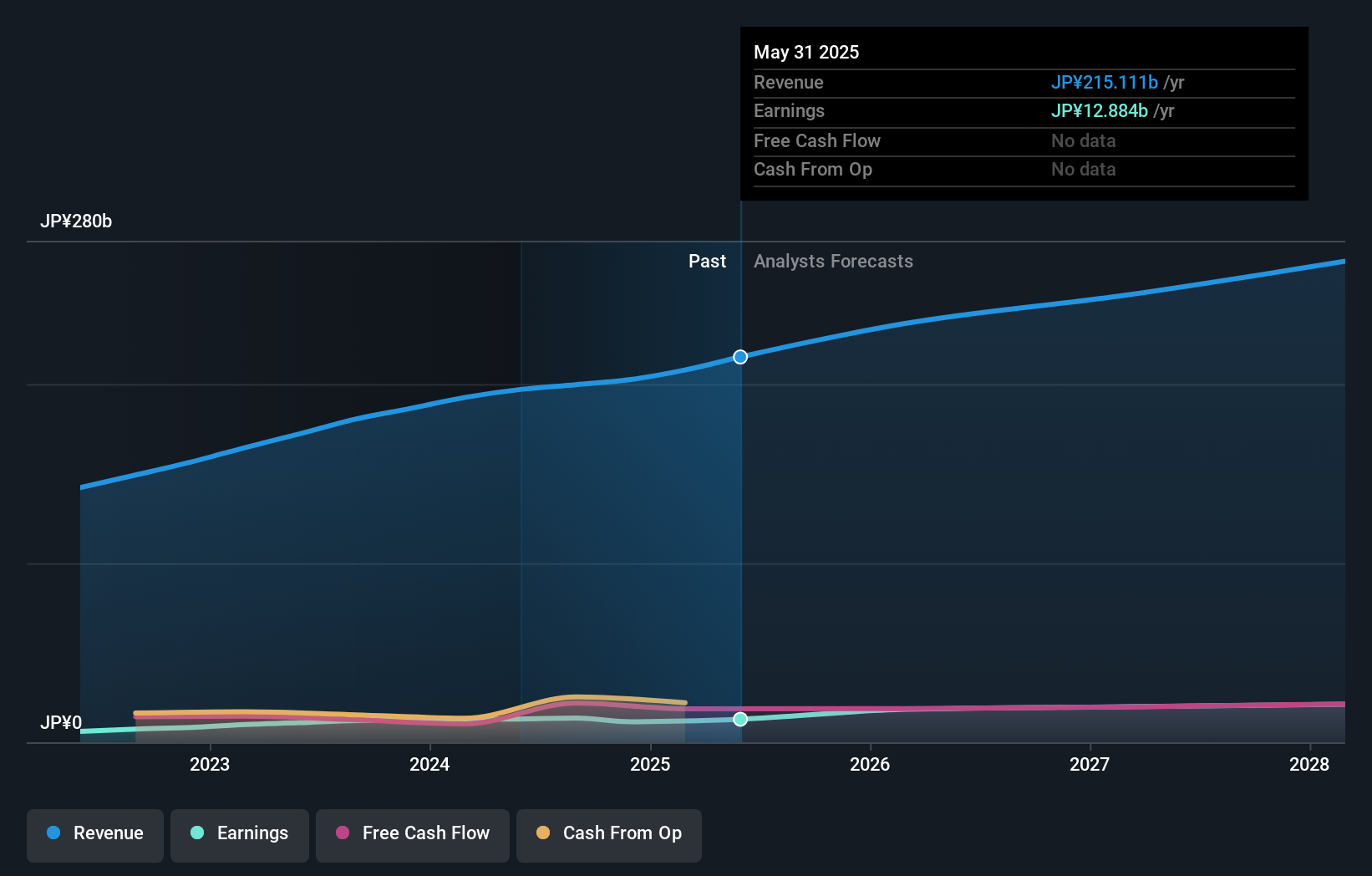

Overview: PAL GROUP Holdings CO., LTD. operates in Japan, focusing on the planning, manufacture, wholesale, and retail of men's and women's clothing and accessories, with a market capitalization of ¥272.63 billion.

Operations: The company generates revenue primarily through the planning, manufacture, wholesale, and retail of clothing products in Japan. It has a market capitalization of ¥272.63 billion.

PAL GROUP Holdings, a dynamic player in the specialty retail sector, has shown robust financial health with its debt to equity ratio decreasing from 44% to 17.9% over five years and more cash than total debt. Their earnings growth of 11.2% last year surpassed the industry average of 5.8%, showcasing their competitive edge. The company is trading at a value estimated to be 21.1% below fair value, indicating potential for investors seeking undervalued stocks. With well-covered interest payments by EBIT at an impressive 216x and positive free cash flow, PAL appears financially sound despite recent share price volatility.

- Delve into the full analysis health report here for a deeper understanding of PAL GROUP Holdings.

Evaluate PAL GROUP Holdings' historical performance by accessing our past performance report.

Turning Ideas Into Actions

- Click through to start exploring the rest of the 4627 Undiscovered Gems With Strong Fundamentals now.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:1898

Seikitokyu Kogyo

Engages in the paving of roads, expressways, and bridges in Japan.

Proven track record with adequate balance sheet and pays a dividend.

Market Insights

Community Narratives