- Japan

- /

- Diversified Financial

- /

- TSE:7148

Undiscovered Gems in Japan Tsuburaya Fields Holdings and 2 Other Small Caps with Strong Fundamentals

Reviewed by Simply Wall St

Japan’s stock markets have been on an upswing, with the Nikkei 225 Index gaining 3.1% and the broader TOPIX Index up 2.8%, buoyed by a weaker yen following the U.S. Federal Reserve’s recent rate cut. This positive market sentiment creates an opportune moment to explore small-cap stocks in Japan, which often go unnoticed despite having strong fundamentals. In this article, we will highlight three such undiscovered gems: Tsuburaya Fields Holdings and two other small-cap companies that stand out due to their robust financial health and growth potential in today’s dynamic economic landscape.

Top 10 Undiscovered Gems With Strong Fundamentals In Japan

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| NCD | 11.89% | 8.95% | 25.43% | ★★★★★★ |

| Nitto Fuji Flour MillingLtd | 0.80% | 6.26% | 4.41% | ★★★★★★ |

| Kanda HoldingsLtd | 30.47% | 4.35% | 18.02% | ★★★★★★ |

| Ad-Sol Nissin | NA | 4.02% | 7.90% | ★★★★★★ |

| Denyo | 3.49% | 4.30% | 3.66% | ★★★★★☆ |

| MIRARTH HOLDINGSInc | 266.33% | 3.00% | -2.40% | ★★★★☆☆ |

| GENOVA | 0.93% | 33.82% | 30.22% | ★★★★☆☆ |

| Hakuto | 56.93% | 8.02% | 27.72% | ★★★★☆☆ |

| FDK | 89.57% | -0.88% | 25.34% | ★★★★☆☆ |

| Human Technologies | 0.40% | 19.37% | 83.27% | ★★★★☆☆ |

Here's a peek at a few of the choices from the screener.

Tsuburaya Fields Holdings (TSE:2767)

Simply Wall St Value Rating: ★★★★★★

Overview: Tsuburaya Fields Holdings Inc. operates in content-related businesses in Japan with a market cap of ¥149.44 billion.

Operations: The company generates revenue primarily from its PS Business Segment, which contributed ¥120.91 billion, and the Content & Digital Business Segment, which added ¥15.80 billion.

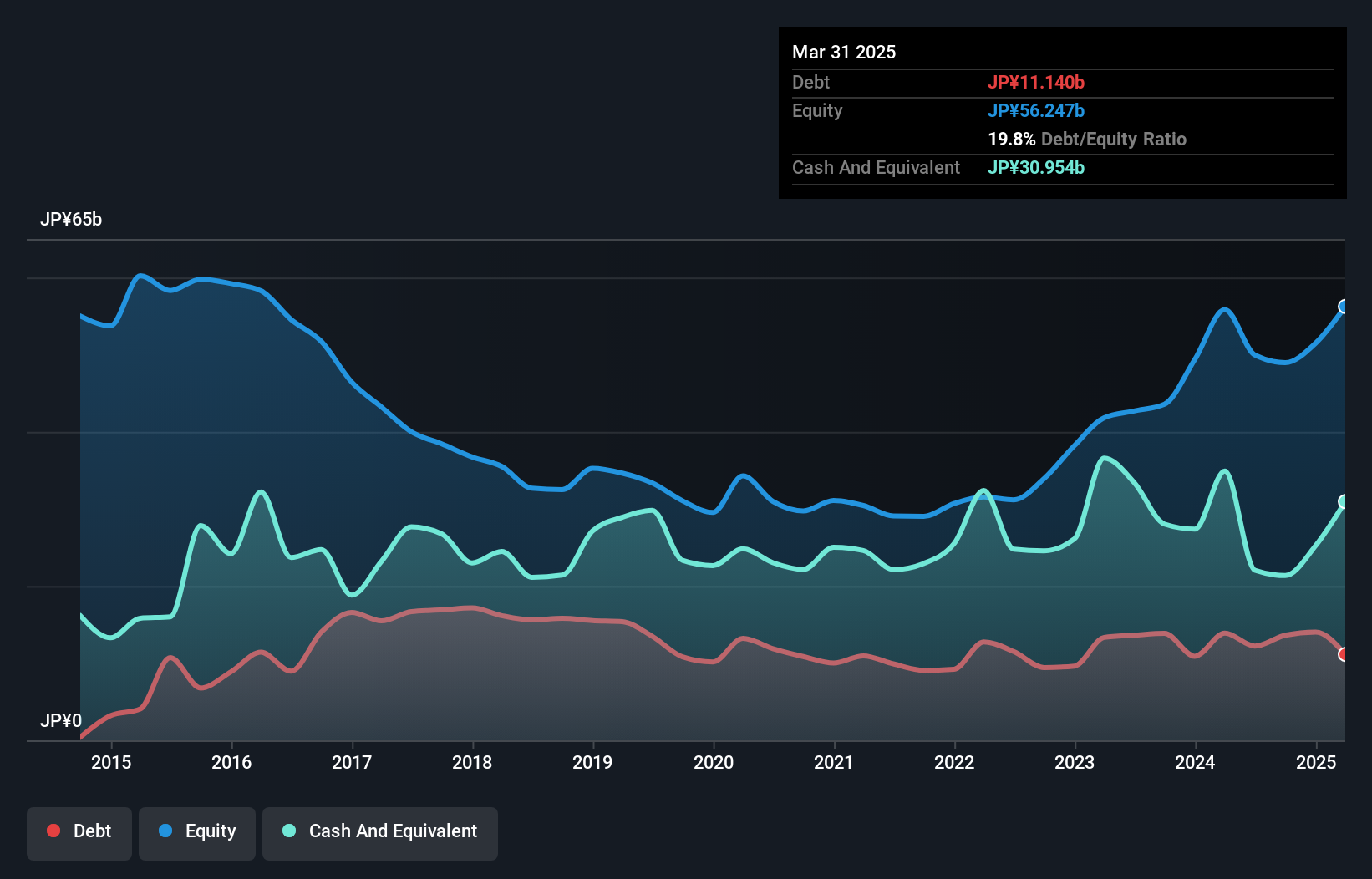

Tsuburaya Fields Holdings has demonstrated impressive growth with earnings up 20.9% over the past year, outperforming the Leisure industry’s 8.6%. The company is trading at 59.1% below its estimated fair value, presenting a potentially attractive investment opportunity. Additionally, Tsuburaya's debt to equity ratio improved from 40.4% to 24.5% in five years, and its interest payments are well covered by EBIT at 614x coverage, indicating strong financial health despite recent share price volatility.

- Get an in-depth perspective on Tsuburaya Fields Holdings' performance by reading our health report here.

Assess Tsuburaya Fields Holdings' past performance with our detailed historical performance reports.

MODEC (TSE:6269)

Simply Wall St Value Rating: ★★★★☆☆

Overview: MODEC, Inc. is a general contractor specializing in the engineering, procurement, construction, and installation of floating production systems globally, with a market cap of ¥221.99 billion.

Operations: MODEC generates revenue primarily from engineering, procurement, construction, and installation services for floating production systems. The company operates on a global scale with significant financial figures reflecting its market presence.

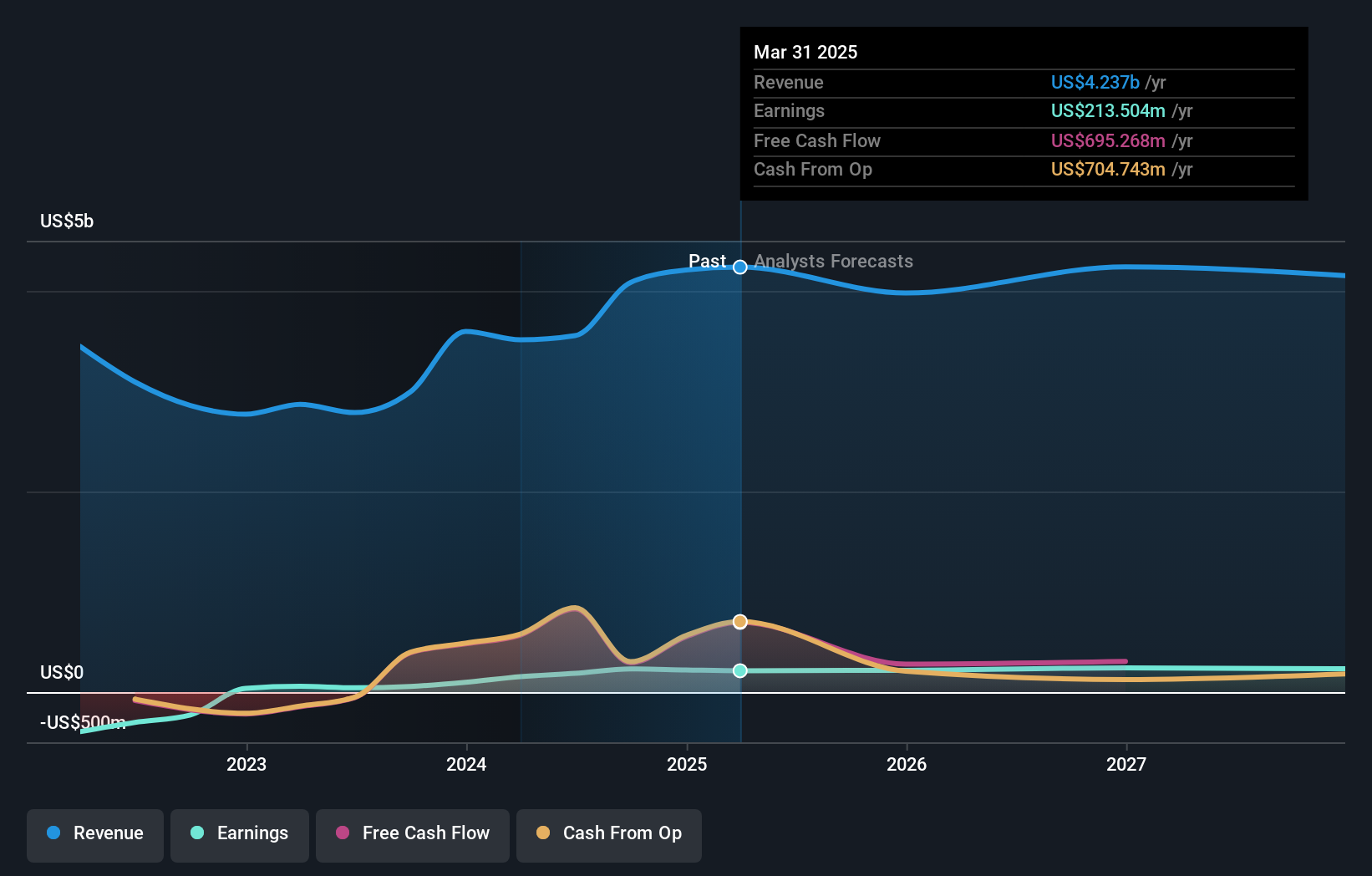

MODEC, a small-cap player in the energy sector, has shown remarkable earnings growth of 375.8% over the past year, significantly outpacing the industry average of 23.6%. The company recently raised its revenue forecast to US$4.3 million and operating profit to US$290,000 for 2024. Additionally, MODEC increased its interim dividend from JPY10 to JPY30 per share. A joint R&D agreement with Terra Drone aims to enhance inspection drones for FPSO systems, potentially tripling inspection efficiency and reducing costs.

- Click here to discover the nuances of MODEC with our detailed analytical health report.

Examine MODEC's past performance report to understand how it has performed in the past.

Financial Partners GroupLtd (TSE:7148)

Simply Wall St Value Rating: ★★★★★☆

Overview: Financial Partners Group Co., Ltd., along with its subsidiaries, offers a range of financial products and services in Japan and has a market cap of ¥199.12 billion.

Operations: Financial Partners Group Co., Ltd. generates revenue primarily through its diverse financial products and services in Japan. The company has a market cap of ¥199.12 billion, reflecting its substantial presence in the financial sector.

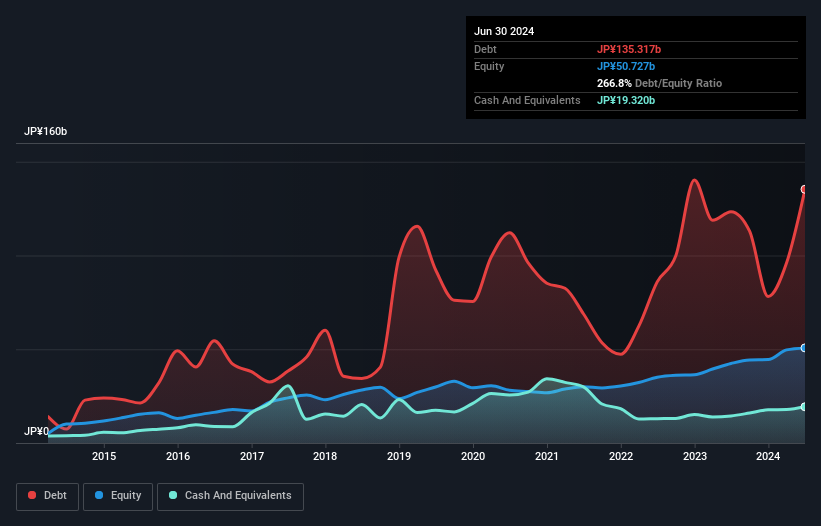

Financial Partners Group Ltd. has seen its debt-to-equity ratio improve from 309.6% to 266.8% over the past five years, though it remains high at 228.7%. The company repurchased 360,000 shares for ¥756.25 million between April and June 2024, reflecting confidence in its valuation with a P/E ratio of 10.8x against the JP market's 13.4x average. Earnings surged by an impressive 55.9% last year, significantly outpacing industry growth of 24.9%.

Summing It All Up

- Unlock more gems! Our Japanese Undiscovered Gems With Strong Fundamentals screener has unearthed 748 more companies for you to explore.Click here to unveil our expertly curated list of 751 Japanese Undiscovered Gems With Strong Fundamentals.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:7148

Financial Partners GroupLtd

Provides various financial products and services in Japan.

Excellent balance sheet established dividend payer.