Japan's stock markets have shown positive momentum recently, with the Nikkei 225 Index gaining 2.45% and the broader TOPIX Index up 0.45%, supported by yen weakness that has improved profit outlooks for exporters amid a backdrop of cautious central bank policies. In this environment, evaluating high-growth tech stocks involves considering factors such as their adaptability to market shifts, innovation potential, and ability to leverage favorable currency conditions to enhance competitiveness and growth prospects.

Top 10 High Growth Tech Companies In Japan

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Material Group | 20.45% | 24.01% | ★★★★★★ |

| Hottolink | 50.99% | 61.55% | ★★★★★★ |

| eWeLLLtd | 26.52% | 27.53% | ★★★★★★ |

| Cyber Security Cloud | 20.71% | 25.73% | ★★★★★☆ |

| Medley | 24.98% | 30.36% | ★★★★★★ |

| Bengo4.comInc | 20.76% | 46.76% | ★★★★★★ |

| Kanamic NetworkLTD | 20.75% | 28.25% | ★★★★★★ |

| Mental Health TechnologiesLtd | 27.88% | 79.61% | ★★★★★★ |

| ExaWizards | 21.96% | 75.16% | ★★★★★★ |

| Money Forward | 21.33% | 71.29% | ★★★★★★ |

Let's explore several standout options from the results in the screener.

GNI Group (TSE:2160)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: GNI Group Ltd. is involved in the research, development, manufacture, and sale of pharmaceutical drugs both in Japan and internationally, with a market cap of approximately ¥148.68 billion.

Operations: GNI Group Ltd. generates revenue primarily from its pharmaceutical segment, contributing ¥19.35 billion, alongside a smaller medical device segment at ¥4.30 billion. The company focuses on the international market for its pharmaceutical products while also operating in Japan.

GNI Group, a player in the high-growth tech sector in Japan, is demonstrating robust potential with its earnings and revenue trajectories outpacing broader market trends. With an impressive 393.9% earnings growth over the past year, significantly surpassing the biotech industry's average of 4%, GNI Group also boasts projected annual revenue increases of 24.6%. This figure not only eclipses the Japanese market's forecast of 4.3% but also indicates a strategic alignment with evolving market demands. The firm’s commitment to innovation is evident from its R&D spending, crucial for sustaining long-term competitiveness in biotechnology—a field driven by rapid technological advancements. Looking ahead, while GNI faces challenges typical of high-tech industries, including market volatility and intense competition, its strong growth metrics and proactive investment in R&D may well position it favorably for future opportunities.

- Delve into the full analysis health report here for a deeper understanding of GNI Group.

Evaluate GNI Group's historical performance by accessing our past performance report.

Shochiku (TSE:9601)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Shochiku Co., Ltd. operates in the audio and video, theatre, and real estate sectors both in Japan and internationally, with a market cap of ¥130.81 billion.

Operations: Shochiku Co., Ltd. generates revenue through its audio and video, theatre, and real estate businesses across Japan and internationally. The company leverages its diverse operations to tap into multiple entertainment and property markets, contributing to its overall financial performance.

Shochiku Co., Ltd., navigating the competitive landscape of Japan's tech sector, is aligning its growth trajectory with significant R&D investments. The company's earnings are poised to surge by 82.2% annually, reflecting a strategic emphasis on innovation in entertainment technologies. With revenue growth forecasted at 5.5% per year, Shochiku outpaces the broader Japanese market expectation of 4.3%. This performance underscores their potential to leverage technological advancements and expand their market footprint, especially as they announced promising Q2 results for 2025 on October 11, highlighting their ongoing fiscal health and operational momentum.

- Click to explore a detailed breakdown of our findings in Shochiku's health report.

Examine Shochiku's past performance report to understand how it has performed in the past.

Fuji Soft (TSE:9749)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Fuji Soft Incorporated is an IT company with operations in Japan and internationally, and it has a market capitalization of approximately ¥606.40 billion.

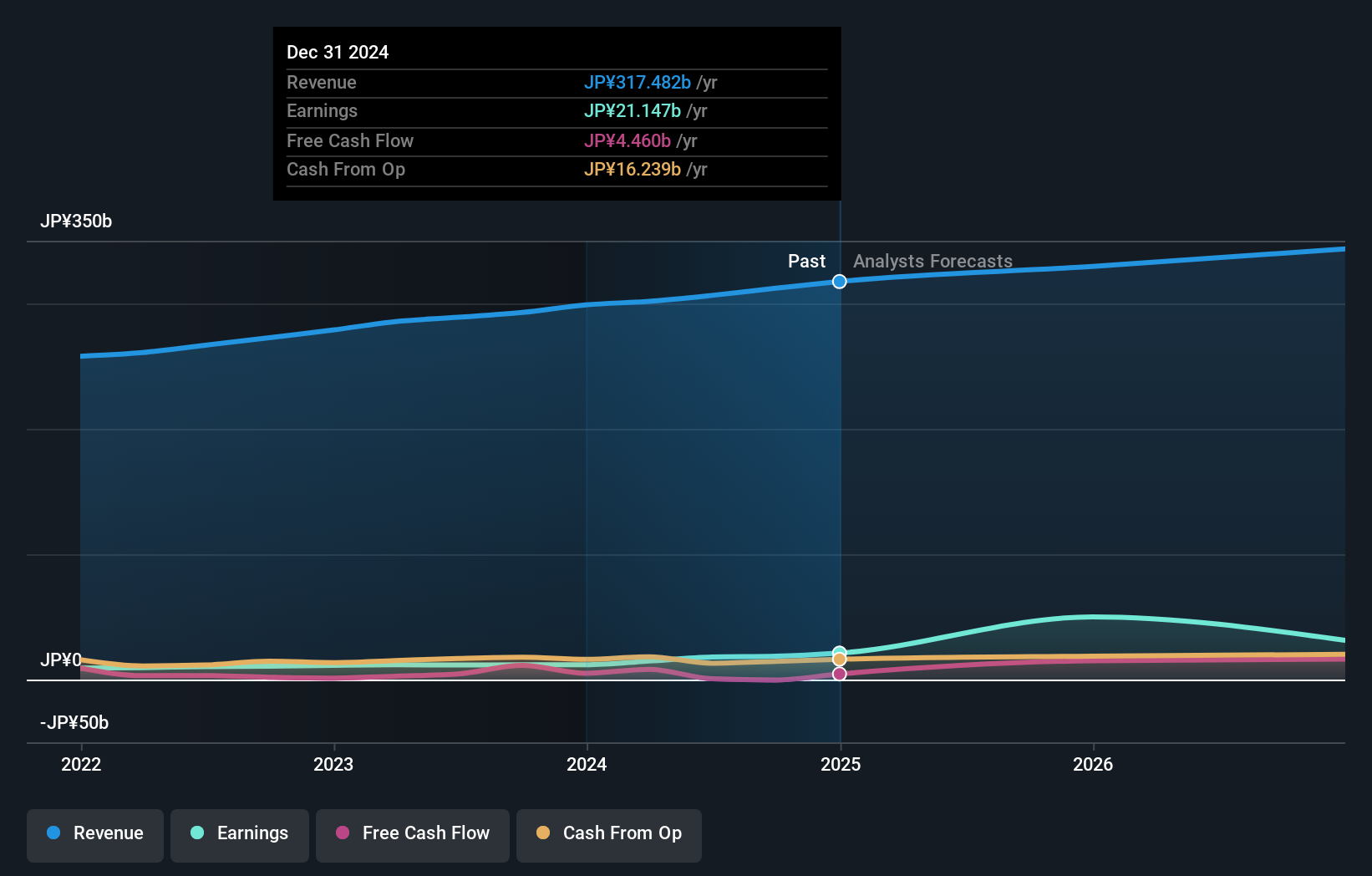

Operations: The company generates revenue primarily from its SI Business, which accounts for ¥290.11 billion, while the Facility Business contributes ¥3.42 billion.

Fuji Soft, amidst a transformative period in Japan's tech landscape, is making significant strides with its R&D investments, which totaled ¥5.6 billion last year, representing 4.7% of its revenue. This focus on innovation is pivotal as the company navigates through recent acquisition bids by KKR & Co., emphasizing the strategic value Fuji Soft holds in the burgeoning fields of cloud computing and AI technologies. With an anticipated earnings growth rate of 21.7% annually, these developments signal Fuji Soft's robust potential to adapt and thrive in a rapidly evolving digital ecosystem.

- Take a closer look at Fuji Soft's potential here in our health report.

Review our historical performance report to gain insights into Fuji Soft's's past performance.

Key Takeaways

- Unlock more gems! Our Japanese High Growth Tech and AI Stocks screener has unearthed 116 more companies for you to explore.Click here to unveil our expertly curated list of 119 Japanese High Growth Tech and AI Stocks.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:2160

GNI Group

Engages in the research, development, manufacture, and sale of pharmaceutical drugs in Japan and internationally.

Excellent balance sheet with reasonable growth potential.