- Japan

- /

- Energy Services

- /

- TSE:6269

MODEC (TSE:6269) Lifts Dividend Despite Lower Revenue Forecast—Is Its Capital Allocation Strategy Evolving?

Reviewed by Sasha Jovanovic

- MODEC, Inc. recently issued updated guidance, announcing that for the fiscal year ending December 31, 2025, it expects to pay a dividend of ¥80.00 per share, up from ¥50.00 a year earlier, while also raising its projected profits despite a reduction in revenue estimates.

- This combination of a substantially higher dividend and improved profitability outlook highlights the company's focus on shareholder returns even as top-line expectations adjust.

- We'll explore how MODEC's commitment to a higher dividend payout impacts its overall investment narrative and market positioning.

Find companies with promising cash flow potential yet trading below their fair value.

What Is MODEC's Investment Narrative?

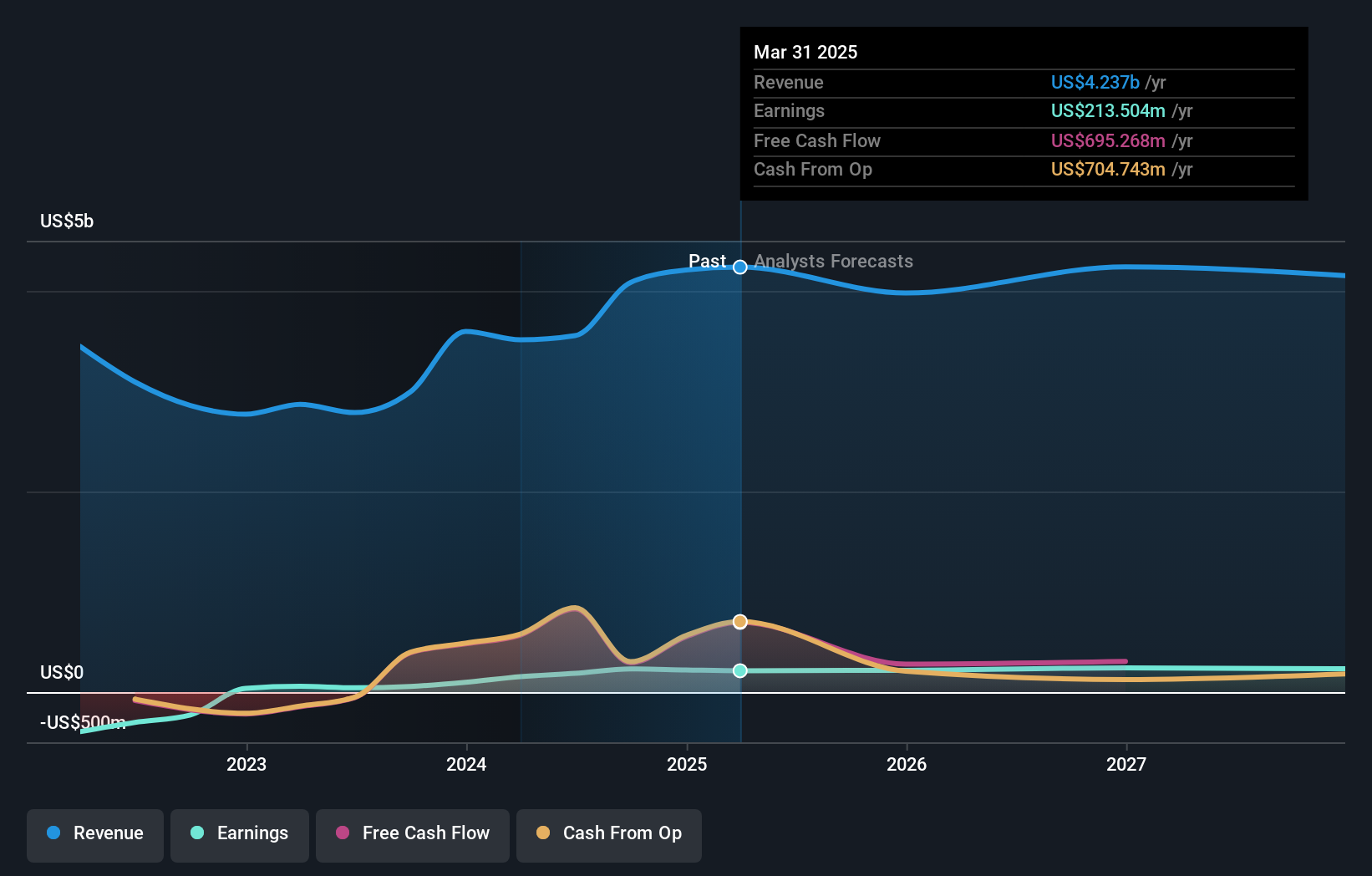

MODEC's latest guidance dramatically reshapes the near-term picture for shareholders. The headline: despite lowering its revenue targets to US$3.7 billion, MODEC aims to deliver higher operating profits and has committed to a sizable dividend increase to ¥80 per share, reinforcing the message that shareholder value is a top priority. This willingness to lift profit outlooks even when revenues decline could signal improved operational efficiency, cost controls, or favorable contract margins, factors that now seem like clear positive catalysts. Still, the picture is not without risk: persistent revenue contraction, a fresh management team, and recent boardroom turnover add uncertainty to the consistency of execution. MODEC’s volatile share price and a valuation that looks high against sector averages further sharpen those risks. The recent announcement arguably recalibrates near-term optimism, but also elevates questions about how sustainable these levels of profitability and payouts could be if revenues continue to slip.

But short-term earnings upgrades don't erase the challenge of declining sales, a factor worth deeper investigation. MODEC's shares have been on the rise but are still potentially undervalued by 28%. Find out what it's worth.Exploring Other Perspectives

Explore another fair value estimate on MODEC - why the stock might be worth as much as ¥11267!

Build Your Own MODEC Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your MODEC research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free MODEC research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate MODEC's overall financial health at a glance.

Looking For Alternative Opportunities?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 26 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6269

MODEC

Operates as engineering, procurement, construction and installation (EPCI) general contractor of floating production systems in Brazil, Guyana, Senegal, Cote d' Ivoire, Ghana, Mexico, and internationally.

Solid track record with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success