- Japan

- /

- Oil and Gas

- /

- TSE:1662

How a Surprise Earnings Upgrade and Dividend Cut at Japan Petroleum Exploration (TSE:1662) Is Shaping Its Investment Story

Reviewed by Sasha Jovanovic

- On November 12, 2025, Japan Petroleum Exploration Co., Ltd. raised its full-year earnings guidance for the fiscal year ending March 31, 2026, citing higher-than-expected crude oil and natural gas sales prices, while also announcing a significant decrease in its interim dividend to ¥20.00 per share from ¥125.00 a year earlier.

- This marked revision highlights how commodity price movements can outweigh dividend policy shifts in influencing earnings outlooks for resource-focused companies.

- We'll examine how higher crude oil and natural gas prices, and the resulting earnings upgrade, affect Japan Petroleum Exploration's investment narrative.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 26 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

What Is Japan Petroleum Exploration's Investment Narrative?

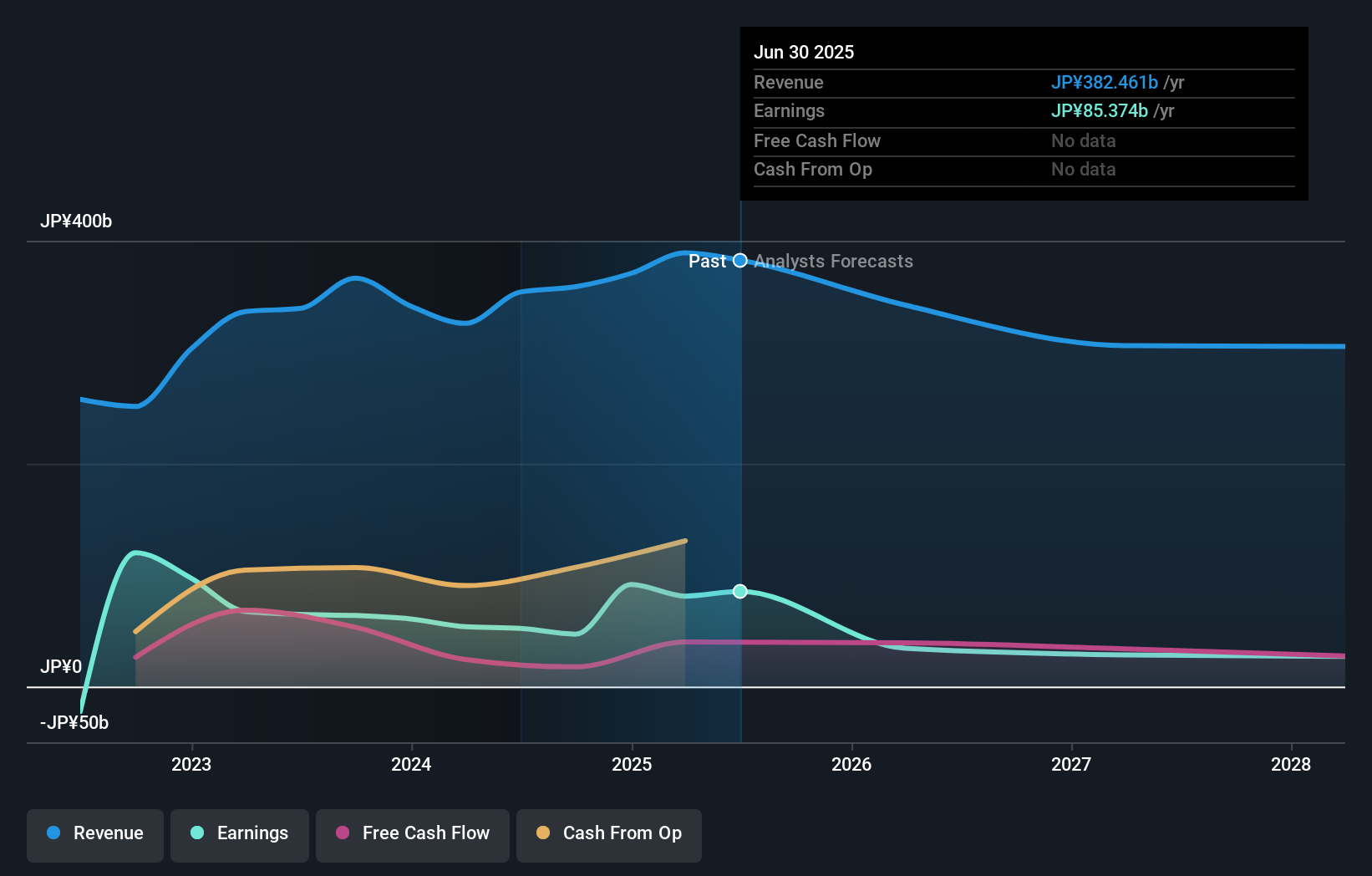

Owning shares in Japan Petroleum Exploration means buying into the belief that oil and gas price movements will continue to drive the company’s performance, sometimes overpowering factors like dividends or board changes. The recent upward revision in full-year guidance points to higher short-term profitability as a key catalyst, thanks to stronger commodity prices. However, the sharp interim dividend cut illustrates how management is prioritizing earnings stability and potentially dampening the short-term appeal for income-focused investors. Considering pre-existing risks such as declining future revenue and earnings forecasts, frequent board turnover, and reliance on large one-off gains, the company’s guidance upgrade may alleviate near-term concerns, but doesn’t fully offset structural headwinds flagged in earlier analysis. Ultimately, this news tilts the current risk and catalyst balance in favor of price-driven outperformance, but underlying challenges remain front of mind. In contrast, board turnover and an unstable dividend policy remain issues investors should watch.

Japan Petroleum Exploration's shares have been on the rise but are still potentially undervalued. Find out how large the opportunity might be.Exploring Other Perspectives

Explore 3 other fair value estimates on Japan Petroleum Exploration - why the stock might be worth just ¥1521!

Build Your Own Japan Petroleum Exploration Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Japan Petroleum Exploration research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Japan Petroleum Exploration research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Japan Petroleum Exploration's overall financial health at a glance.

Looking For Alternative Opportunities?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- Rare earth metals are the new gold rush. Find out which 38 stocks are leading the charge.

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:1662

Japan Petroleum Exploration

Explores, develops, produces, and sells oil, natural gas, and other energy resources in Japan, Europe, North America, and the Middle East.

Flawless balance sheet, undervalued and pays a dividend.

Market Insights

Community Narratives