- Japan

- /

- Oil and Gas

- /

- TSE:1605

Inpex (TSE:1605) Valuation in Focus After Upgraded Earnings Guidance and Buyback Expansion

Reviewed by Simply Wall St

Inpex (TSE:1605) just raised its earnings guidance for the year, citing solid operational results, better than expected sales volumes, and revised outlooks for crude oil prices and foreign exchange rates.

See our latest analysis for Inpex.

Inpex’s recent announcements come as the share price has surged more than 11% over the past month and recorded an impressive 58% year-to-date return, while the one-year total shareholder return now stands at nearly 66%. Momentum is clearly building, fueled by these upward earnings revisions and a larger buyback plan. Together, these factors signal management’s confidence and are catching the attention of long-term investors.

If you are interested in broadening your horizons, now is a great time to discover fast growing stocks with high insider ownership

With such strong momentum and an enhanced buyback plan, investors may be wondering if Inpex still stands out as a bargain in the energy sector, or if the market has already priced in its future growth prospects.

Most Popular Narrative: 13% Overvalued

Despite analysts raising their fair value estimate to ¥2,801, Inpex's last close at ¥3,170 suggests the market is now pricing in a premium. This valuation sets the stage for debate over which assumptions are driving the latest narrative.

The current valuation appears to assume that INPEX's large-scale LNG and upstream expansion projects (notably Ichthys expansion and Abadi FID) will execute on time and on budget, unlocking substantial future earnings and cash flows. This is despite industry risks such as execution delays, cost overruns, and commodity price volatility that could significantly compress net margins if not managed well.

Curious what bold growth projections and high-stakes project assumptions are packed into this fair value? The market's narrative leans heavily on big expansion bets. Can this momentum hold if the future turns out differently? Dive in to discover which numbers and uncertainties are powering this elevated price call.

Result: Fair Value of ¥2,801 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, stronger-than-expected Asian LNG demand or successful expansion projects could quickly disrupt this view of overvaluation and restore market optimism.

Find out about the key risks to this Inpex narrative.

Another View: What Does the SWS DCF Model Suggest?

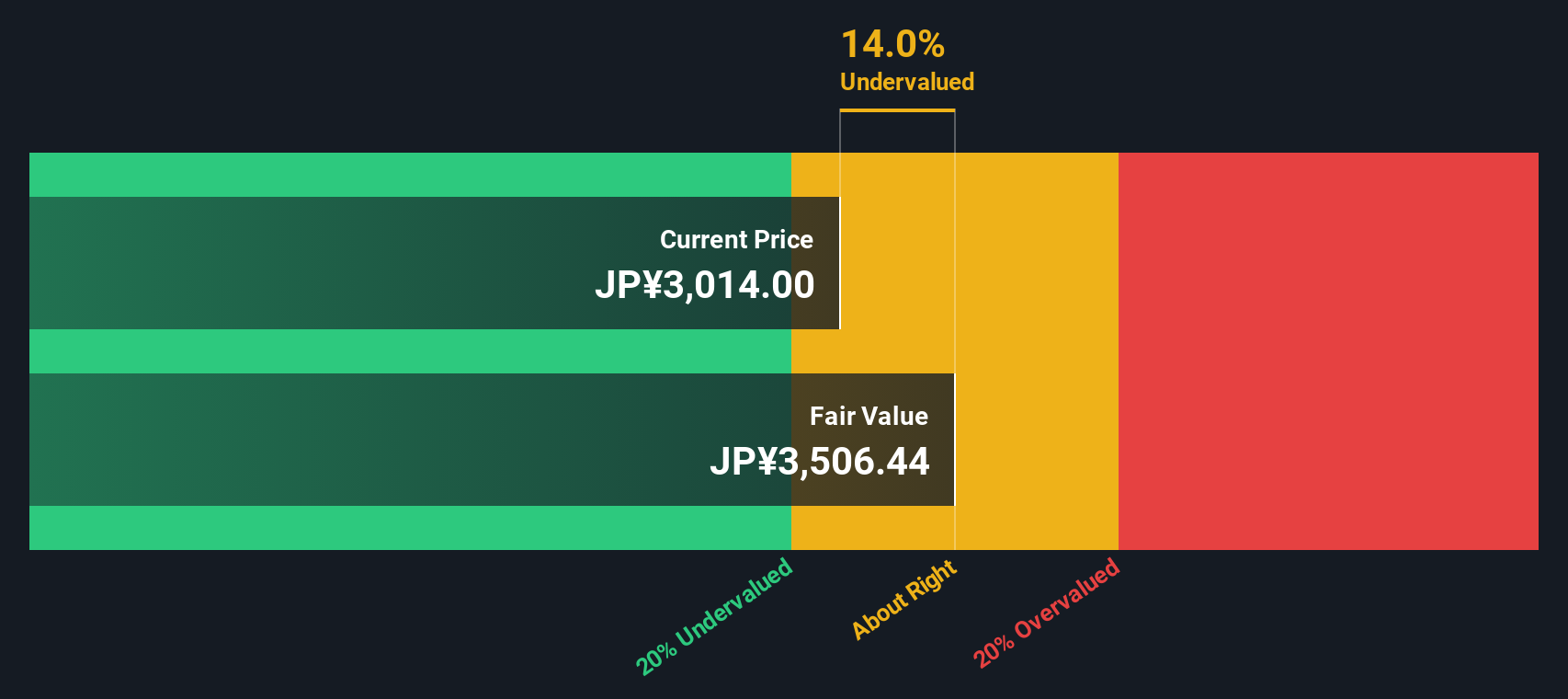

While current market pricing looks stretched on analyst targets, our SWS DCF model presents a different perspective. By estimating long-term cash flows, this method suggests Inpex could actually be undervalued by a significant margin. Is the market potentially overlooking its true earning power?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Inpex Narrative

If you see things differently or want to dig into the details for yourself, it's easy to build your own story from the ground up in just a few minutes. Do it your way

A great starting point for your Inpex research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Sharpen your portfolio by seeking out stocks that match your style. These handpicked ideas could be the edge you need to stay ahead of the market.

- Capitalize on emerging technologies by tracking these 26 AI penny stocks, which are at the forefront of artificial intelligence innovation and rapid growth potential.

- Boost your income stream with these 16 dividend stocks with yields > 3%, which consistently reward shareholders with attractive yields above the norm.

- Ride the next wave in digital finance by adding exposure to these 81 cryptocurrency and blockchain stocks and access leaders driving blockchain breakthroughs and cryptocurrency adoption.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:1605

Inpex

Engages in the research, exploration, development, production, and sale of oil, natural gas, and other mineral resources in Japan and internationally.

Undervalued with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success