- Japan

- /

- Capital Markets

- /

- TSE:8746

Take Care Before Jumping Onto Unbanked,Inc. (TSE:8746) Even Though It's 28% Cheaper

The Unbanked,Inc. (TSE:8746) share price has fared very poorly over the last month, falling by a substantial 28%. Longer-term shareholders will rue the drop in the share price, since it's now virtually flat for the year after a promising few quarters.

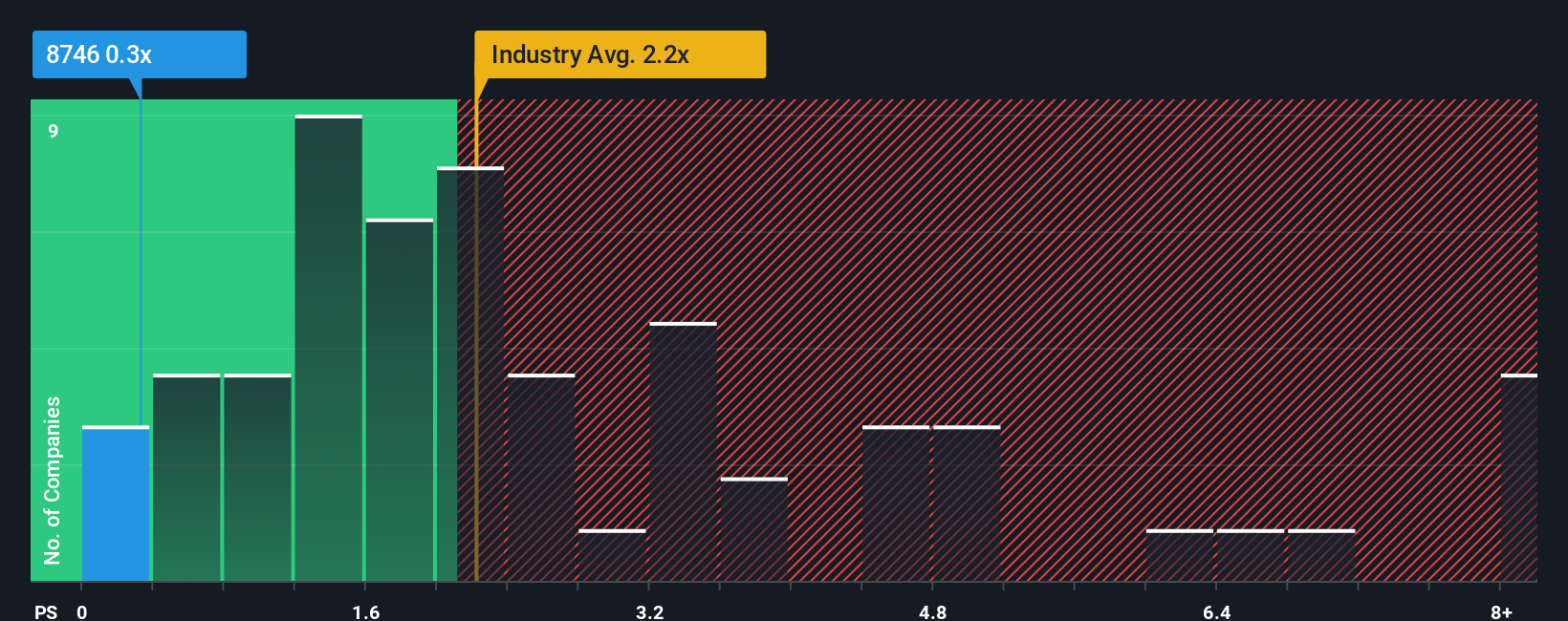

After such a large drop in price, when close to half the companies operating in Japan's Capital Markets industry have price-to-sales ratios (or "P/S") above 2.2x, you may consider UnbankedInc as an enticing stock to check out with its 0.3x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

Check out our latest analysis for UnbankedInc

How Has UnbankedInc Performed Recently?

Recent times have been quite advantageous for UnbankedInc as its revenue has been rising very briskly. Perhaps the market is expecting future revenue performance to dwindle, which has kept the P/S suppressed. Those who are bullish on UnbankedInc will be hoping that this isn't the case, so that they can pick up the stock at a lower valuation.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on UnbankedInc will help you shine a light on its historical performance.Is There Any Revenue Growth Forecasted For UnbankedInc?

In order to justify its P/S ratio, UnbankedInc would need to produce sluggish growth that's trailing the industry.

Retrospectively, the last year delivered an exceptional 61% gain to the company's top line. Pleasingly, revenue has also lifted 89% in aggregate from three years ago, thanks to the last 12 months of growth. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Weighing the recent medium-term upward revenue trajectory against the broader industry's one-year forecast for contraction of 0.8% shows it's a great look while it lasts.

In light of this, it's quite peculiar that UnbankedInc's P/S sits below the majority of other companies. Apparently some shareholders believe the recent performance has exceeded its limits and have been accepting significantly lower selling prices.

The Final Word

UnbankedInc's recently weak share price has pulled its P/S back below other Capital Markets companies. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Looking at the figures, it's surprising to see UnbankedInc currently trades on a much lower than expected P/S since its recent three-year revenue growth is beating forecasts for a struggling industry. There could be some major unobserved threats to revenue preventing the P/S ratio from matching this positive performance. The most obvious risk is that its revenue trajectory may not keep outperforming under these tough industry conditions. At least the risk of a price drop looks to be subdued, but investors think future revenue could see a lot of volatility.

Don't forget that there may be other risks. For instance, we've identified 2 warning signs for UnbankedInc (1 makes us a bit uncomfortable) you should be aware of.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:8746

Adequate balance sheet and slightly overvalued.

Market Insights

Community Narratives