- Japan

- /

- Capital Markets

- /

- TSE:8473

3 Dividend Stocks To Consider With Up To 5.1% Yield

Reviewed by Simply Wall St

As global markets navigate through a period of heightened inflation and interest rate volatility, U.S. stock indexes are climbing toward record highs, buoyed by strong performance in growth stocks and easing tariff concerns. In this dynamic environment, dividend stocks can offer a blend of income and potential stability, making them an attractive consideration for investors seeking to balance growth with steady returns amidst economic fluctuations.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Guaranty Trust Holding (NGSE:GTCO) | 5.89% | ★★★★★★ |

| Chongqing Rural Commercial Bank (SEHK:3618) | 8.24% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.54% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 4.90% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 4.33% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 3.95% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 3.88% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.23% | ★★★★★★ |

| Southside Bancshares (NYSE:SBSI) | 4.60% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.40% | ★★★★★★ |

Click here to see the full list of 1987 stocks from our Top Dividend Stocks screener.

Let's explore several standout options from the results in the screener.

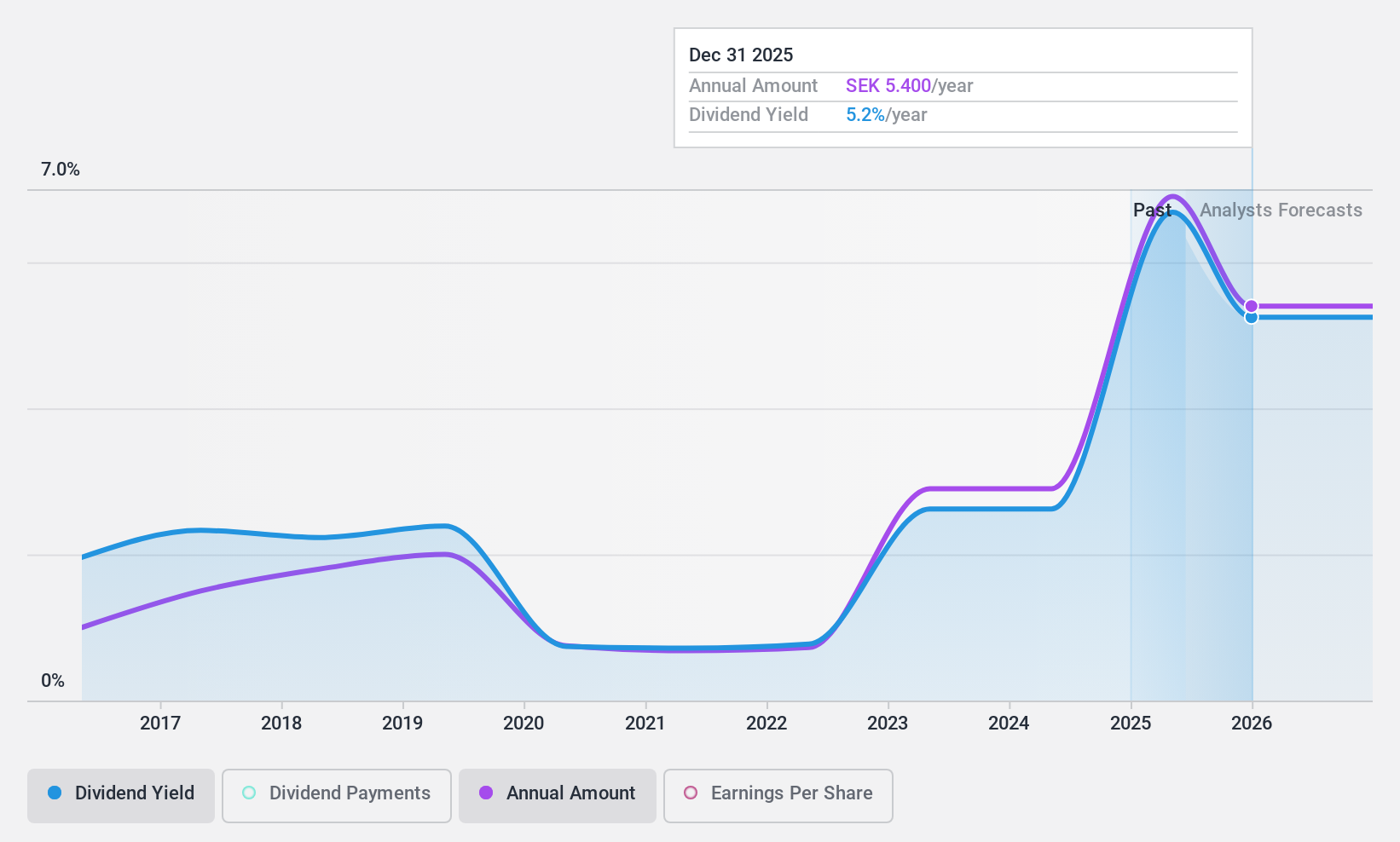

BioGaia (OM:BIOG B)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: BioGaia AB (publ) is a healthcare company that offers probiotic products globally, with a market capitalization of SEK13.16 billion.

Operations: BioGaia AB (publ) generates revenue primarily from its Pediatrics segment, which accounts for SEK1.09 billion, and the Adult Health segment, contributing SEK321.29 million.

Dividend Yield: 5.2%

BioGaia's dividend yield of 5.18% is among the top 25% in Sweden, yet its sustainability is questionable due to a high cash payout ratio of 194.4%, indicating dividends are not well covered by free cash flows. Despite a reasonable earnings payout ratio of 56.1%, dividend stability remains an issue with past volatility and unreliability over ten years. Recent earnings growth and proposed extra dividends highlight potential for income, but caution is warranted regarding long-term consistency.

- Dive into the specifics of BioGaia here with our thorough dividend report.

- Our comprehensive valuation report raises the possibility that BioGaia is priced higher than what may be justified by its financials.

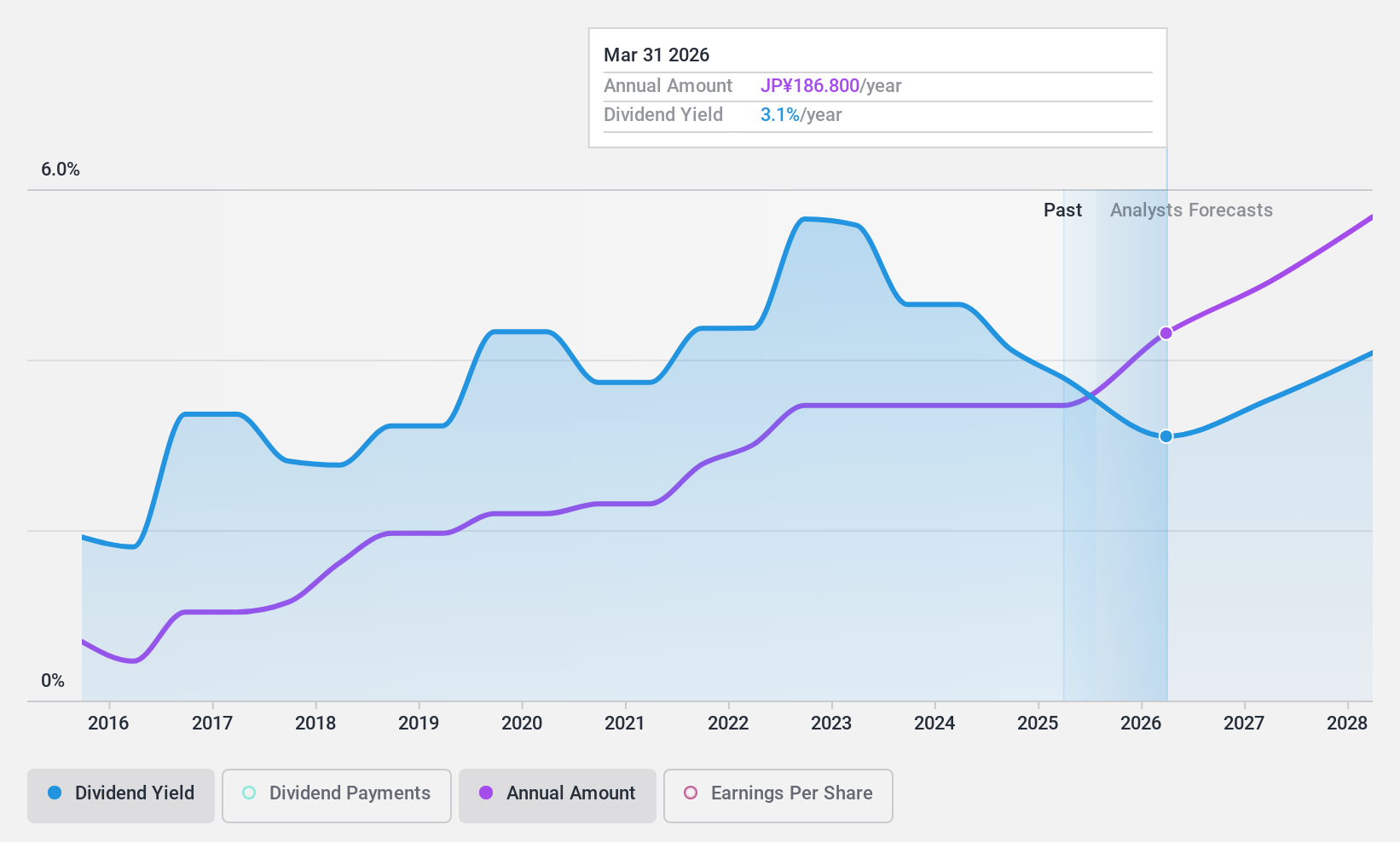

SBI Holdings (TSE:8473)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: SBI Holdings, Inc. operates in the online securities and investment sectors in Japan and Saudi Arabia, with a market cap of ¥1.36 trillion.

Operations: SBI Holdings, Inc. generates revenue through several key segments: the Finance Service Segment at ¥1.12 trillion, the Investment Segment at ¥130.38 million, the Crypto Asset Business at ¥89.11 million, the Next Generation Business at ¥26.86 million, and the Asset Management Business at ¥33.31 million.

Dividend Yield: 3.3%

SBI Holdings' dividend yield of 3.35% is below Japan's top 25% dividend payers, but its sustainability is supported by a low cash payout ratio of 2.6% and an earnings payout ratio of 34.6%, indicating strong coverage from both earnings and cash flows. Despite past volatility in dividend payments, recent strategic alliances in gaming and energy sectors could enhance growth prospects, while fixed-income offerings totaling ¥70 billion may bolster financial stability for consistent future payouts.

- Delve into the full analysis dividend report here for a deeper understanding of SBI Holdings.

- According our valuation report, there's an indication that SBI Holdings' share price might be on the cheaper side.

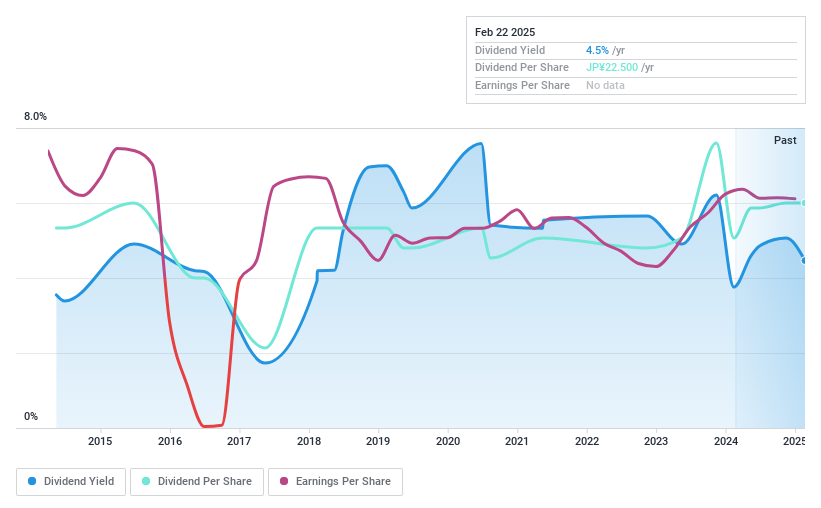

Akatsuki (TSE:8737)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Akatsuki Corp., along with its subsidiaries, operates in the real estate and securities sectors in Japan, with a market capitalization of ¥15.22 billion.

Operations: Akatsuki Corp. generates revenue through its operations in the real estate and securities sectors within Japan.

Dividend Yield: 4.5%

Akatsuki's dividend yield of 4.47% ranks among the top 25% in Japan, yet its sustainability is questionable due to a lack of free cash flow coverage and past volatility. While dividends have grown over the last decade, they remain unreliable and are not supported by cash flows despite a low payout ratio of 15.6%. The recent ¥1 billion fixed-income offering could provide some financial stability for future payouts amidst these challenges.

- Unlock comprehensive insights into our analysis of Akatsuki stock in this dividend report.

- Insights from our recent valuation report point to the potential undervaluation of Akatsuki shares in the market.

Key Takeaways

- Gain an insight into the universe of 1987 Top Dividend Stocks by clicking here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:8473

SBI Holdings

Engages in the online securities and investment businesses in Japn and Saudi Arabia.

Undervalued with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives