- Japan

- /

- Diversified Financial

- /

- TSE:8729

Sony Financial Group (TSE:8729) Valuation in Focus Following Major Buyback and Index Status Changes

Reviewed by Kshitija Bhandaru

Sony Financial Group (TSE:8729) has captured attention following its announcement of a major share buyback initiative, along with recent shifts in its index status. These moves are sparking fresh conversations about the stock’s overall appeal.

See our latest analysis for Sony Financial Group.

It’s been a volatile few weeks for Sony Financial Group, with a flurry of share buyback announcements and rapid shifts in its index listings sending mixed signals to investors. After a tough year-to-date share price return of -11.1%, the past week’s 6.3% jump suggests renewed market interest. However, long-term total shareholder return remains deeply negative. The latest swings reflect both changing risk perceptions and speculation about the company’s true value.

If you want to see how other companies in the market are capturing momentum, now’s a smart time to explore fast growing stocks with high insider ownership

With the stock trading at a steep discount compared to some valuation models, but facing skepticism from sector comparisons, the real question is whether investors are overlooking an opportunity or if future growth is already priced in.

Price-to-Earnings of 22.7x: Is it justified?

Sony Financial Group’s shares are trading at a price-to-earnings (P/E) ratio of 22.7 times earnings, with the last close at ¥154.5. This makes the valuation appear relatively high compared to some sector peers and raises questions about what the market is pricing in.

The price-to-earnings ratio measures how much investors are willing to pay today for each unit of the company’s earnings. In the diversified financials space, this metric often reflects growth expectations, risk, and market sentiment about profitability.

Currently, Sony Financial Group’s 22.7x P/E ratio is significantly higher than the JP Diversified Financial industry average of 12.7x. This suggests the market is placing a premium on the company relative to many local rivals. However, it is worth noting that when compared to the average P/E of its direct peers, which sits at 24.7x, Sony Financial actually looks more reasonable. This indicates that some investors might view its growth or quality more favorably than the broader industry.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price-to-Earnings of 22.7x (OVERVALUED)

However, declining annual revenue and a significant five-year total return loss both pose challenges that could dampen optimism around Sony Financial Group’s outlook.

Find out about the key risks to this Sony Financial Group narrative.

Another View: DCF Model Shows a Different Picture

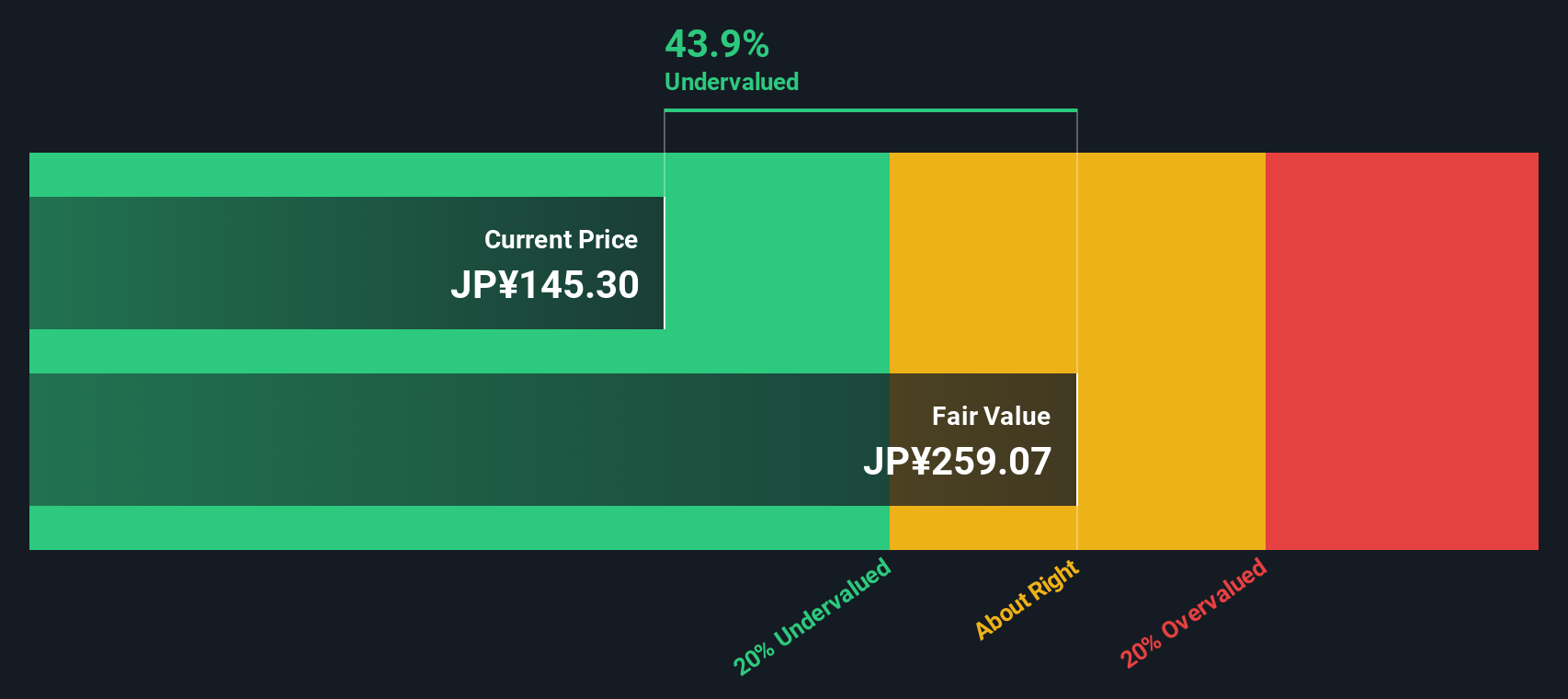

While Sony Financial Group may look expensive based on its price-to-earnings ratio, our SWS DCF model estimates its fair value at ¥258.73, which is far above the current share price. This suggests shares could be undervalued if these long-term cash flow assumptions hold true. But is the market missing something or reflecting real risks?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Sony Financial Group for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Sony Financial Group Narrative

If the data points here do not quite align with your perspective or you would rather dive into the details firsthand, crafting your own view is quick and simple. You can create a personalized analysis in just a few minutes. Do it your way

A great starting point for your Sony Financial Group research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Don't let your next big opportunity slip by. Powerful trends could shape the future of your portfolio, so positioning yourself ahead of the crowd can help you find compelling companies across emerging sectors.

- Tap into new income streams by checking out these 19 dividend stocks with yields > 3% with reliable yields that can enhance your portfolio stability right now.

- Ride the wave of innovation as you track these 24 AI penny stocks gaining momentum from breakthroughs in artificial intelligence and automation.

- Capture value before others do by searching for potential gems among these 898 undervalued stocks based on cash flows currently trading well below their intrinsic worth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:8729

Good value with moderate growth potential.

Market Insights

Community Narratives