- Japan

- /

- Capital Markets

- /

- TSE:8708

Aizawa Securities Group Co., Ltd. (TSE:8708) Stock's 31% Dive Might Signal An Opportunity But It Requires Some Scrutiny

The Aizawa Securities Group Co., Ltd. (TSE:8708) share price has fared very poorly over the last month, falling by a substantial 31%. Longer-term shareholders will rue the drop in the share price, since it's now virtually flat for the year after a promising few quarters.

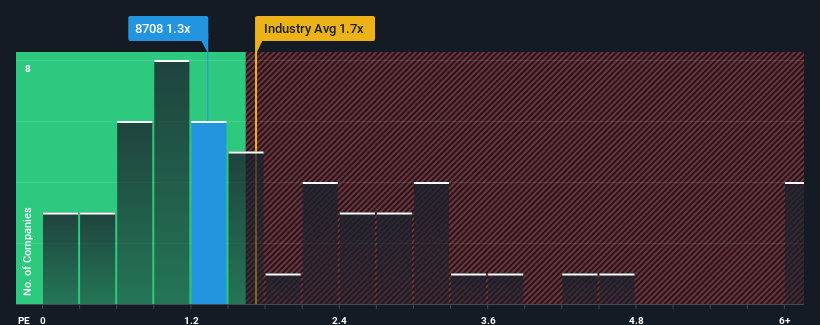

Although its price has dipped substantially, there still wouldn't be many who think Aizawa Securities Group's price-to-sales (or "P/S") ratio of 1.3x is worth a mention when the median P/S in Japan's Capital Markets industry is similar at about 1.7x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

Check out our latest analysis for Aizawa Securities Group

How Has Aizawa Securities Group Performed Recently?

The revenue growth achieved at Aizawa Securities Group over the last year would be more than acceptable for most companies. Perhaps the market is expecting future revenue performance to only keep up with the broader industry, which has keeping the P/S in line with expectations. Those who are bullish on Aizawa Securities Group will be hoping that this isn't the case, so that they can pick up the stock at a lower valuation.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Aizawa Securities Group will help you shine a light on its historical performance.Is There Some Revenue Growth Forecasted For Aizawa Securities Group?

The only time you'd be comfortable seeing a P/S like Aizawa Securities Group's is when the company's growth is tracking the industry closely.

If we review the last year of revenue growth, the company posted a terrific increase of 25%. The latest three year period has also seen a 21% overall rise in revenue, aided extensively by its short-term performance. Accordingly, shareholders would have probably been satisfied with the medium-term rates of revenue growth.

This is in contrast to the rest of the industry, which is expected to grow by 1.2% over the next year, materially lower than the company's recent medium-term annualised growth rates.

With this information, we find it interesting that Aizawa Securities Group is trading at a fairly similar P/S compared to the industry. It may be that most investors are not convinced the company can maintain its recent growth rates.

The Key Takeaway

Following Aizawa Securities Group's share price tumble, its P/S is just clinging on to the industry median P/S. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We've established that Aizawa Securities Group currently trades on a lower than expected P/S since its recent three-year growth is higher than the wider industry forecast. It'd be fair to assume that potential risks the company faces could be the contributing factor to the lower than expected P/S. While recent revenue trends over the past medium-term suggest that the risk of a price decline is low, investors appear to see the likelihood of revenue fluctuations in the future.

We don't want to rain on the parade too much, but we did also find 4 warning signs for Aizawa Securities Group (1 is a bit concerning!) that you need to be mindful of.

If these risks are making you reconsider your opinion on Aizawa Securities Group, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:8708

Aizawa Securities Group

Operates financial securities, investment, asset management, and financial instruments brokerage businesses in Japan.

Average dividend payer with mediocre balance sheet.

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026