Stock Analysis

- Japan

- /

- Capital Markets

- /

- TSE:8628

Steering Clear Of Matsui Securities And Exploring One Attractive Dividend Stock

Reviewed by Sasha Jovanovic

In the realm of dividend investing, consistency and growth in payouts are key indicators of a company's financial health and stability. However, not every firm promising high dividends delivers on this front over time. For instance, Matsui Securities has experienced a decline in its dividend growth, making it a less attractive option for those seeking reliable income from their investments in Japan.

Top 10 Dividend Stocks In Japan

| Name | Dividend Yield | Dividend Rating |

| Yamato Kogyo (TSE:5444) | 3.80% | ★★★★★★ |

| Business Brain Showa-Ota (TSE:9658) | 3.51% | ★★★★★★ |

| Globeride (TSE:7990) | 3.75% | ★★★★★★ |

| Yahagi ConstructionLtd (TSE:1870) | 3.57% | ★★★★★★ |

| HITO-Communications HoldingsInc (TSE:4433) | 3.47% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.64% | ★★★★★★ |

| KurimotoLtd (TSE:5602) | 5.04% | ★★★★★★ |

| Japan Pulp and Paper (TSE:8032) | 4.06% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.08% | ★★★★★★ |

| Innotech (TSE:9880) | 3.99% | ★★★★★★ |

Click here to see the full list of 376 stocks from our Top Dividend Stocks screener.

Let's review one of the notable picks from our screened stocks and one not so great.

Top Pick

Kawasaki Kisen Kaisha (TSE:9107)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Kawasaki Kisen Kaisha, Ltd. operates globally, offering marine, land, and air transportation services with a market capitalization of approximately ¥1.71 trillion.

Operations: The company's revenue is primarily derived from its Product Logistics, Dry Bulk, and Resource segments, generating ¥554.52 billion, ¥295.16 billion, and ¥107.00 billion respectively.

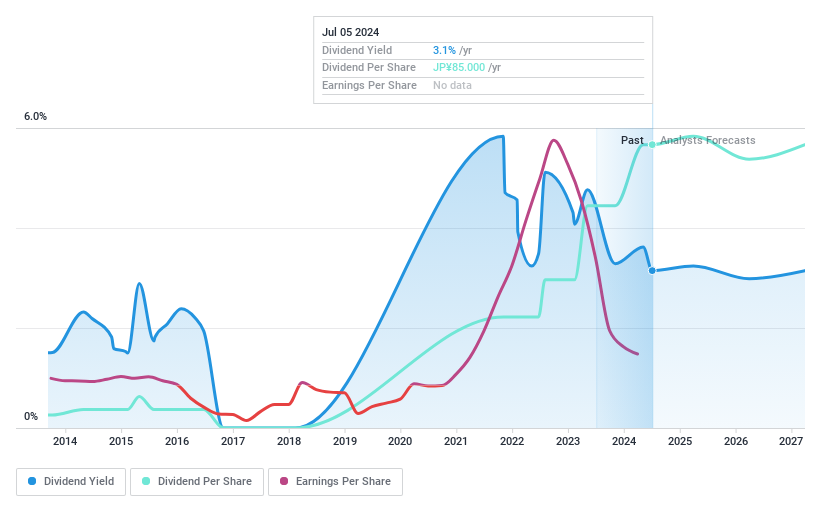

Dividend Yield: 3.4%

Kawasaki Kisen Kaisha has demonstrated a commitment to shareholder returns with its recent share buyback, repurchasing shares for ¥71.87 billion, enhancing shareholder value by reducing outstanding shares. Despite a 3-for-1 stock split affecting per-share figures, the company maintains a consistent dividend of ¥42.50 post-split, reflecting stability in payouts amidst volatile earnings and dividends over the past decade. The firm's dividends are well-covered by earnings and cash flows with payout ratios of 57.4% and 49.1%, respectively, ensuring sustainability despite forecasted declines in earnings over the next three years.

- Navigate through the intricacies of Kawasaki Kisen Kaisha with our comprehensive dividend report here.

- Our comprehensive valuation report raises the possibility that Kawasaki Kisen Kaisha is priced higher than what may be justified by its financials.

One To Reconsider

Matsui Securities (TSE:8628)

Simply Wall St Dividend Rating: ★★☆☆☆☆

Overview: Matsui Securities Co., Ltd. operates as an online securities brokerage firm catering to retail investors in Japan, with a market capitalization of approximately ¥213.52 billion.

Operations: The firm generates approximately ¥31.17 billion from its core online brokerage services.

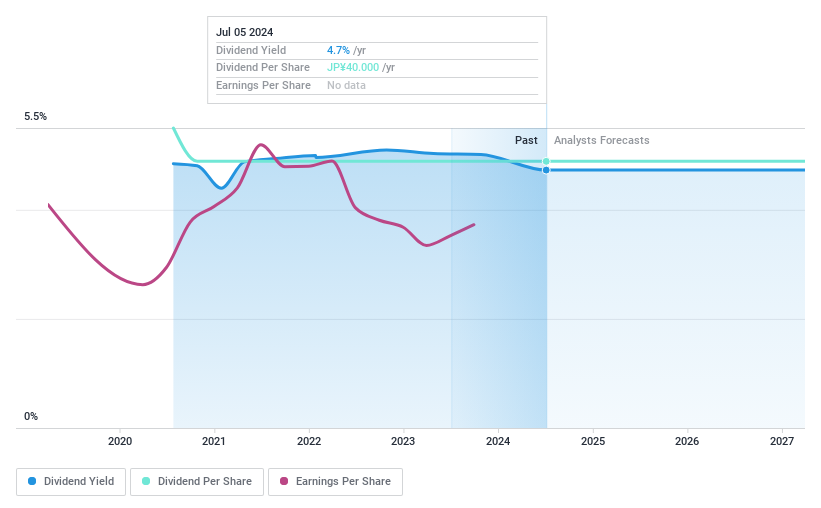

Dividend Yield: 4.8%

Matsui Securities exhibits significant concerns for dividend-focused investors, primarily due to its unstable dividend history and high payout ratio. Despite a competitive yield of 4.82%, the company has only been distributing dividends for four years, with payments showing a declining trend. The payout ratio stands at 118%, indicating dividends are not sufficiently covered by earnings, which raises sustainability issues. Additionally, the lack of recent financial data and volatile dividend payments further underscore the risks associated with this investment.

Next Steps

- Dive into all 376 of the Top Dividend Stocks we have identified here.

- Got skin in the game with some of these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're helping make it simple.

Find out whether Matsui Securities is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:8628

Matsui Securities

Provides online securities brokerage services to retail investors in Japan.

Mediocre balance sheet with limited growth.