- Japan

- /

- Capital Markets

- /

- TSE:8628

How a Dividend Increase at Matsui Securities (TSE:8628) Has Changed Its Investment Story

Reviewed by Sasha Jovanovic

- Matsui Securities Co., Ltd. has announced an increase in its interim dividend to ¥25.00 per share for the second quarter of the fiscal year ending March 2026, up from ¥22.00 per share a year earlier, with payments scheduled to commence on November 25, 2025.

- This dividend hike, presented just ahead of the company's Q2 2026 earnings call, offers fresh insight into management’s outlook and their approach to rewarding shareholders.

- We'll explore how Matsui Securities' decision to raise dividends highlights management confidence and influences the company's investment narrative.

AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

What Is Matsui Securities' Investment Narrative?

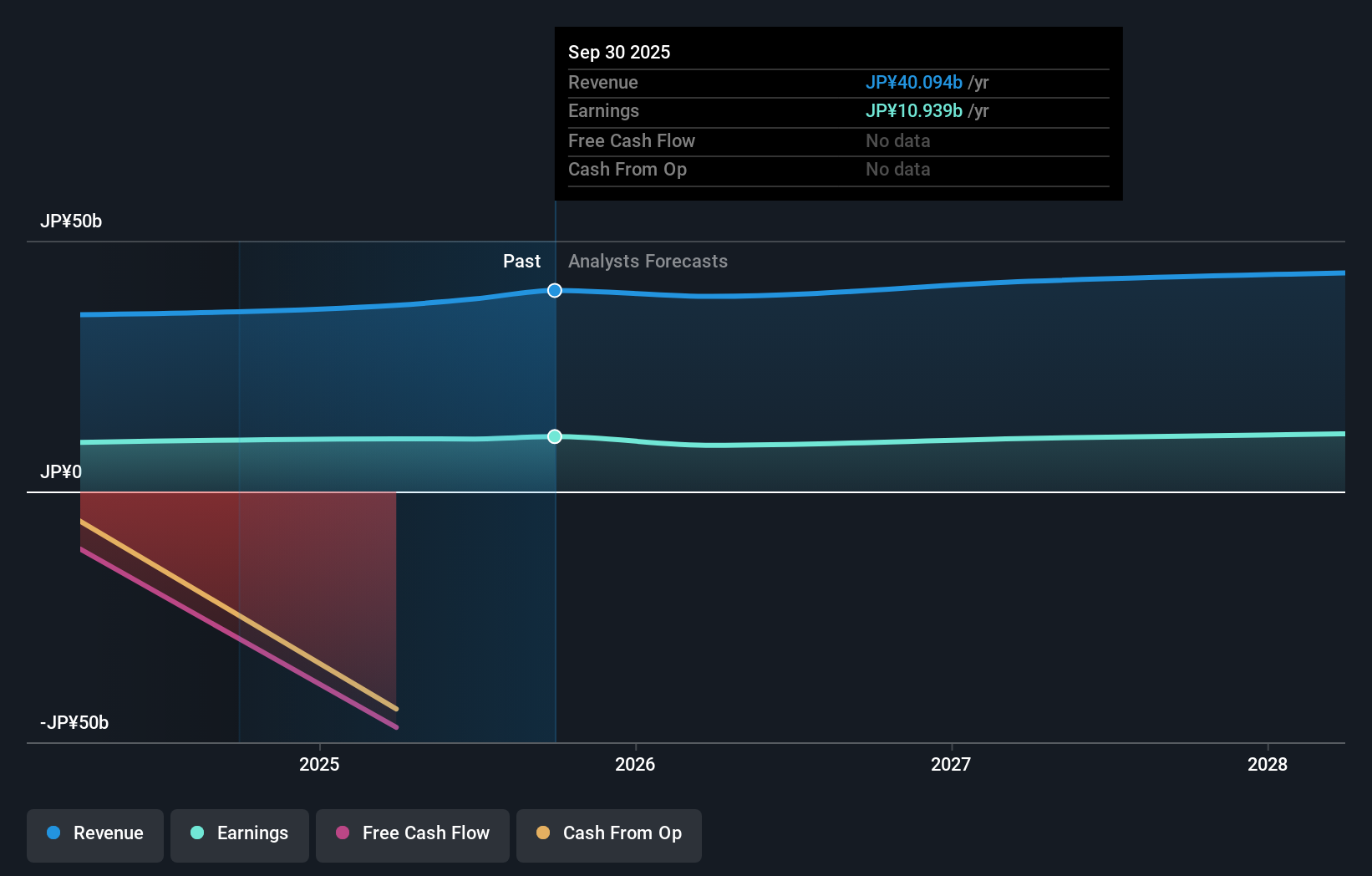

For shareholders of Matsui Securities, the investment case rests on believing in the firm’s ability to balance consistent shareholder returns with manageable growth, even with slower profit and revenue expansion relative to the broader market. The recent announcement of a higher interim dividend, coupled with its timing right before the Q2 2026 earnings call, underscores management’s continued commitment to high payout ratios despite softening growth. While this could be seen as a signal of confidence, it also sharpens the focus on sustainability, given concerns about coverage from earnings and cash flow. Removal from major indices lingers as a potential headwind for share demand, but the dividend increase could offset some sentiment risk in the near term. Short-term catalysts now hinge on market reaction to the dividend news and upcoming results, with valuation and payout sustainability remaining front and center.

On the other hand, the risk of high dividends outpacing profit growth is something investors should keep an eye on.

Matsui Securities' shares are on the way up, but could they be overextended? Uncover how much higher they are than fair value.Exploring Other Perspectives

Explore 2 other fair value estimates on Matsui Securities - why the stock might be worth 10% less than the current price!

Build Your Own Matsui Securities Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Matsui Securities research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Matsui Securities research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Matsui Securities' overall financial health at a glance.

Looking For Alternative Opportunities?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 37 best rare earth metal stocks of the very few that mine this essential strategic resource.

- This technology could replace computers: discover 28 stocks that are working to make quantum computing a reality.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:8628

Matsui Securities

Provides online securities brokerage services to retail investors in Japan.

Mediocre balance sheet with questionable track record.

Market Insights

Community Narratives