- Japan

- /

- Diversified Financial

- /

- TSE:8593

Mitsubishi HC Capital (TSE:8593) Valuation After Strong Earnings Growth and Dividend Hike

Reviewed by Simply Wall St

Mitsubishi HC Capital (TSE:8593) just reported solid gains for the first half of the fiscal year, with both sales and net income up compared to last year. The company also raised its interim dividend, catching investors’ attention.

See our latest analysis for Mitsubishi HC Capital.

The upbeat earnings and dividend hike have given Mitsubishi HC Capital’s share price a noticeable lift lately, helping build on impressive momentum. Investors have enjoyed a 17.8% year-to-date share price return and a strong 26% total shareholder return over twelve months. With management signaling confidence for the year ahead, the long-term track record remains particularly robust, highlighted by a 204% total shareholder return over five years.

If Mitsubishi HC Capital’s growth story has you thinking bigger, this could be a perfect opportunity to discover fast growing stocks with high insider ownership

But after such an impressive run, is Mitsubishi HC Capital’s strong performance leaving room for further gains or have market expectations already baked in future growth? Could this be a buying opportunity, or is everything priced in?

Price-to-Earnings of 10.9x: Is it justified?

Mitsubishi HC Capital’s shares are trading at a price-to-earnings (P/E) ratio of 10.9x based on the last close, which positions the stock as notably cheaper than both its direct peers and the broader industry.

The price-to-earnings ratio compares a company’s market price to its earnings per share, acting as a gauge of how much investors are willing to pay for each unit of profit. For a diversified financials business like Mitsubishi HC Capital, the P/E ratio is a key measure of market expectations for future profitability and growth.

This comparatively low multiple suggests the market may be underestimating the company’s growth prospects, especially given recent strong earnings growth and a history of robust shareholder returns. Relative to the Japanese Diversified Financial industry average of 12.4x, Mitsubishi HC Capital’s shares offer even greater value. The price-to-earnings ratio also stands well below our estimated fair ratio of 15.5x, indicating considerable upside potential as market sentiment evolves.

Explore the SWS fair ratio for Mitsubishi HC Capital

Result: Price-to-Earnings of 10.9x (UNDERVALUED)

However, slower-than-expected revenue growth or a reversal in recent net income trends could temper optimism, particularly if broader market sentiment declines.

Find out about the key risks to this Mitsubishi HC Capital narrative.

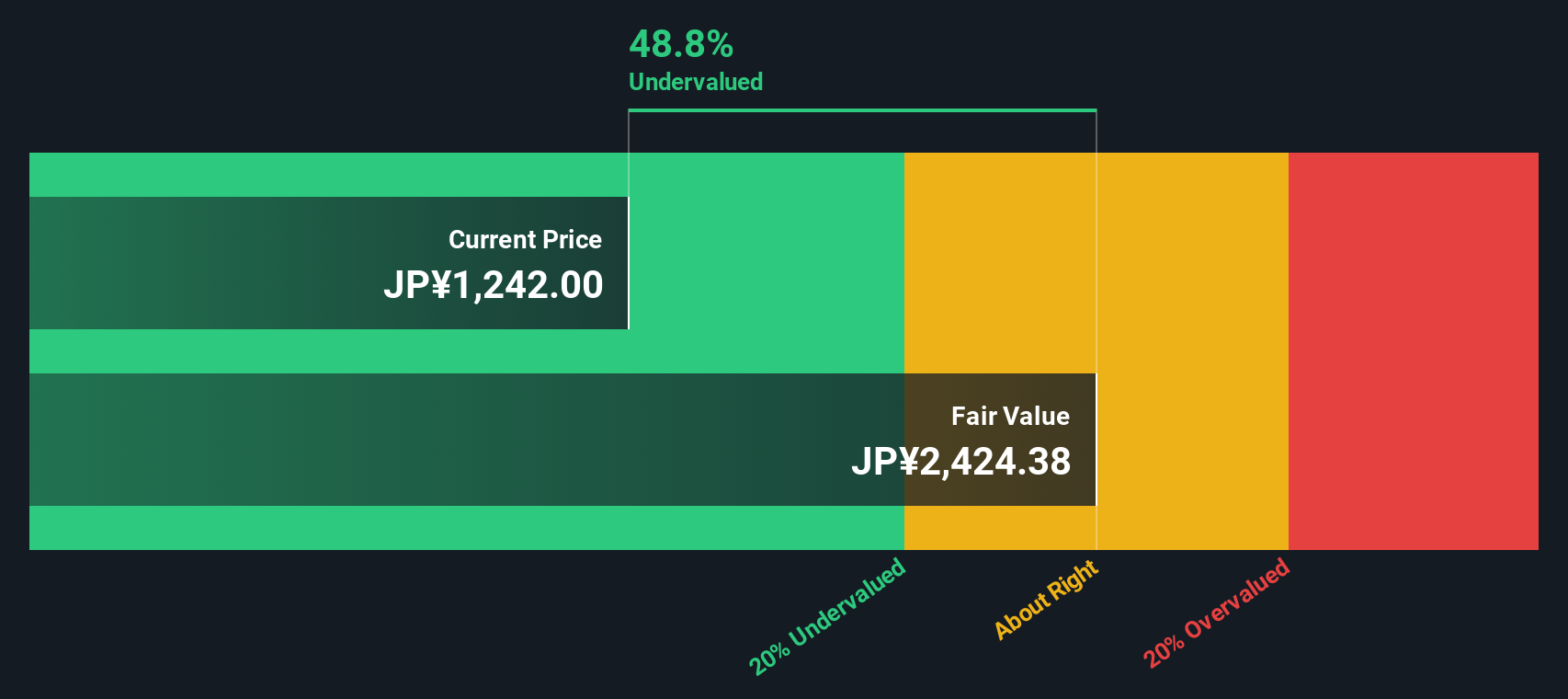

Another Perspective: Discounted Cash Flow Says Undervalued

Our SWS DCF model takes a different approach by estimating Mitsubishi HC Capital’s intrinsic worth based on its future cash flows. According to this method, the shares appear deeply undervalued and are trading around 50% below our calculated fair value. Does this suggest there is much more upside that the market is missing, or is there a reason for such a significant gap?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Mitsubishi HC Capital for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 926 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Mitsubishi HC Capital Narrative

If you want to dig deeper or simply trust your own analysis over market consensus, crafting your own perspective takes less than three minutes. So why not Do it your way?

A great starting point for your Mitsubishi HC Capital research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Spot your next standout investment by taking advantage of tools designed to reveal tomorrow's opportunities. Don't let these smart stock ideas pass you by.

- Tap into the growth potential of rapid innovation by starting with these 26 AI penny stocks, which are making waves in artificial intelligence.

- Catch strong income prospects by assessing these 16 dividend stocks with yields > 3%, which boast reliable yields above 3%.

- Accelerate your watchlist with these 926 undervalued stocks based on cash flows, which reflect exceptional value based on their cash flow fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:8593

Mitsubishi HC Capital

Engages in the lease, installment sale, and other financing activities in Japan, North America, the United Kingdom, rest of Europe, the Middle and Near East, Asia, Oceania, and internationally.

Undervalued with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives