- Japan

- /

- Capital Markets

- /

- TSE:8473

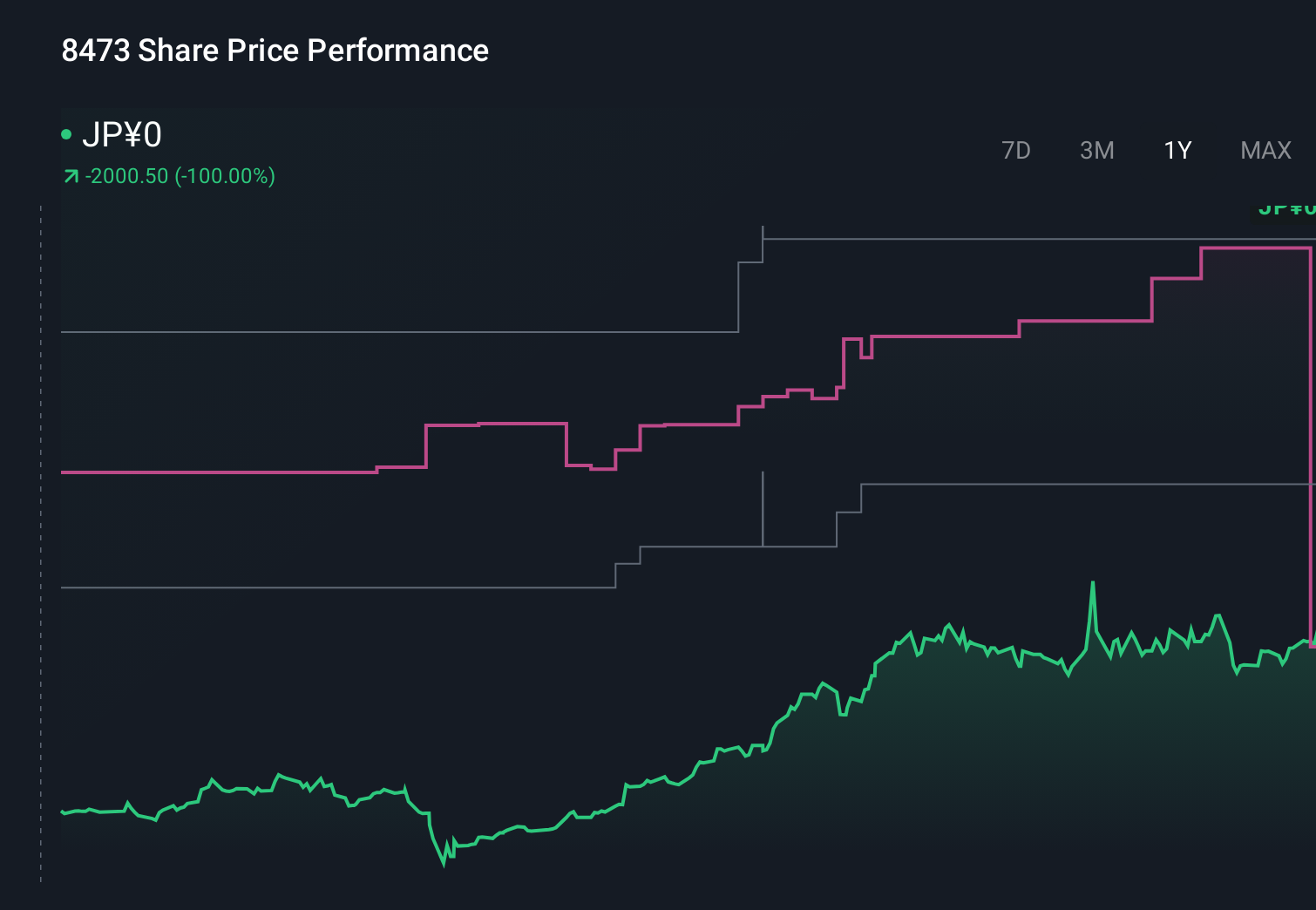

SBI Shinsei Listing and Yen Stablecoin Push Might Change The Case For Investing In SBI Holdings (TSE:8473)

Reviewed by Sasha Jovanovic

- SBI Holdings recently completed the successful listing of its subsidiary SBI Shinsei Bank on the Tokyo Stock Exchange Prime Market, partially sold its stake to realize an extraordinary gain, advanced plans for a regulated yen-denominated stablecoin with Startale Group, and held a board meeting to consider issuing stock options to employees.

- Together, these moves highlight how SBI Holdings is both crystallizing value from existing assets and pushing deeper into regulated digital finance, while also using equity-based incentives to align employees with its longer-term growth agenda.

- We’ll now examine how the Shinsei Bank listing and stablecoin initiative may influence SBI Holdings’ existing investment narrative and risk profile.

Rare earth metals are the new gold rush. Find out which 35 stocks are leading the charge.

SBI Holdings Investment Narrative Recap

To be a shareholder in SBI Holdings, you generally need to believe in its ability to compound value across a diversified financial platform while managing volatility from investment and digital asset activities. The Shinsei Bank listing, partial stake sale, and stablecoin plan collectively appear additive to the existing story but do not materially change the key near term catalyst of earnings normalization or the central risk around regulatory and market uncertainty in digital finance.

Among the recent announcements, the plan to launch a fully regulated yen stablecoin with Startale and group entities like Shinsei Trust & Banking and SBI VC Trade stands out as most relevant. It directly intersects with SBI’s push into digital assets, heightening both the potential upside from new fee and platform revenues and the exposure to shifting crypto and stablecoin rules that could pressure compliance costs and profitability.

Yet behind the appeal of a regulated yen stablecoin, investors should also be aware of how future changes in crypto and stablecoin rules could...

Read the full narrative on SBI Holdings (it's free!)

SBI Holdings’ narrative projects ¥1696.9 billion revenue and ¥181.7 billion earnings by 2028.

Uncover how SBI Holdings' forecasts yield a ¥3323 fair value, in line with its current price.

Exploring Other Perspectives

Four fair value estimates from the Simply Wall St Community range widely from ¥3,323 to ¥12,832, showing how far apart individual views can be. You may want to compare these with the risks around rising regulatory scrutiny on SBI’s expanding digital asset and stablecoin ambitions, which could influence how sustainable current earnings and returns prove to be over time.

Explore 4 other fair value estimates on SBI Holdings - why the stock might be worth over 3x more than the current price!

Build Your Own SBI Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your SBI Holdings research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

- Our free SBI Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate SBI Holdings' overall financial health at a glance.

No Opportunity In SBI Holdings?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- We've found 13 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:8473

SBI Holdings

Engages in the online securities and investment businesses in Japan and Saudi Arabia.

Undervalued with solid track record and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion