- Japan

- /

- Capital Markets

- /

- TSE:8473

How Investors May Respond To SBI Holdings (TSE:8473) Backing US AI Fund to Advance Digital Finance

Reviewed by Sasha Jovanovic

- SBI Holdings recently invested in AI2 Incubator Fund III, launched by US-based AI2 Incubator Partners, reinforcing its commitment to expanding its AI and blockchain capabilities within the financial sector.

- This move could enable SBI Holdings to apply cutting-edge AI models to blockchain-based risk assessment and asset management, particularly as Japan considers regulatory changes around digital assets.

- We'll explore how SBI’s investment in AI2 may strengthen its positioning as a leader in integrating AI and blockchain in digital finance.

We've found 17 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

SBI Holdings Investment Narrative Recap

To own SBI Holdings, you need to believe the company can keep leveraging tech-focused investments like its recent AI2 Incubator Fund III move to stay ahead in digital finance, even as it faces profit normalization risks. While the news highlights SBI’s continued push into AI and blockchain, the most immediate catalyst for shares remains delivery of sustained earnings momentum off a high base, and this specific investment is unlikely to materially impact near-term results.

Another announcement worth considering is SBI's recent agreement to transfer all SBI Sumishin Net Bank shares to NTT Docomo, signaling an ongoing reallocation of assets and alliances. This relates directly to SBI’s efforts to sharpen its operational focus and resource deployment, but success will depend on the group’s continued ability to scale digital initiatives and maintain robust profit margins across business segments.

Yet, with all these advances, it’s also important to remember that increased regulatory scrutiny of crypto and digital assets could introduce new compliance costs for SBI Holdings that investors should be aware of, especially if...

Read the full narrative on SBI Holdings (it's free!)

SBI Holdings' outlook anticipates ¥1,696.9 billion in revenue and ¥181.7 billion in earnings by 2028. This is based on a 2.9% yearly revenue growth rate and a decrease in earnings of ¥43.7 billion from the current ¥225.4 billion.

Uncover how SBI Holdings' forecasts yield a ¥5950 fair value, a 10% downside to its current price.

Exploring Other Perspectives

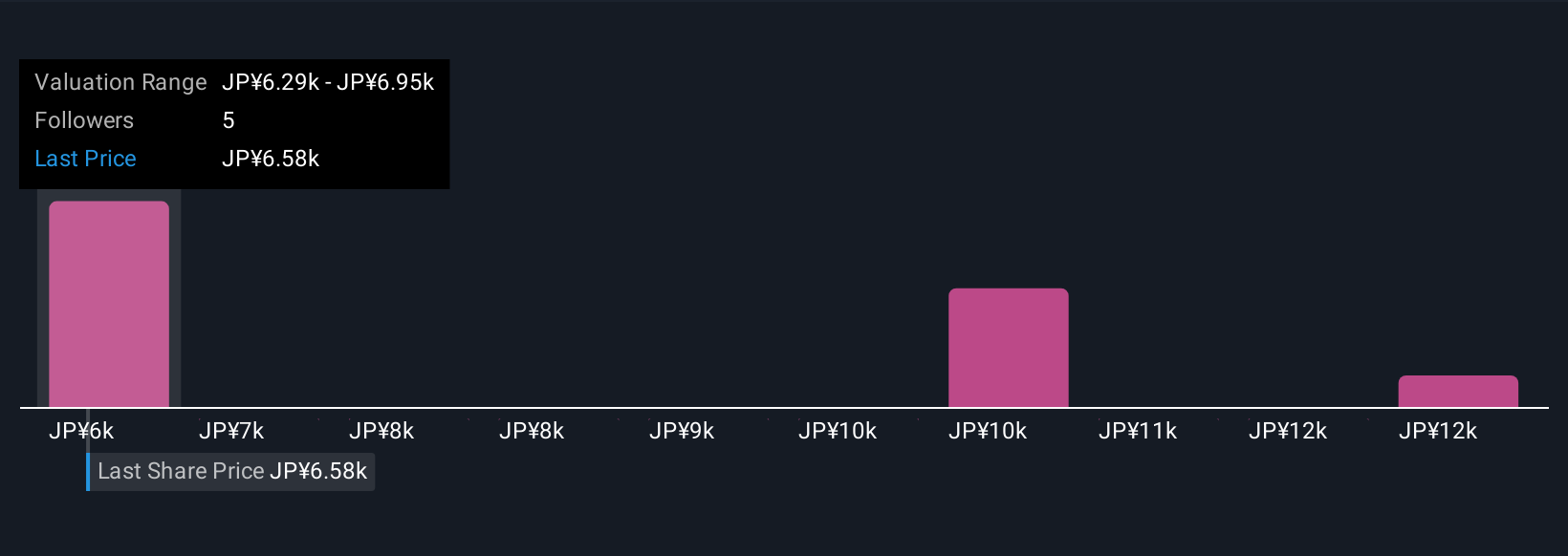

Simply Wall St Community members have published four separate fair value estimates for SBI Holdings, ranging widely from ¥5,950 to ¥12,832.27. With strong profits in recent quarters but sector-wide regulatory shifts underway, your view on risk and opportunity could look quite different from the consensus.

Explore 4 other fair value estimates on SBI Holdings - why the stock might be worth 10% less than the current price!

Build Your Own SBI Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your SBI Holdings research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

- Our free SBI Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate SBI Holdings' overall financial health at a glance.

Looking For Alternative Opportunities?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Rare earth metals are the new gold rush. Find out which 37 stocks are leading the charge.

- Explore 27 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:8473

SBI Holdings

Engages in the online securities and investment businesses in Japan and Saudi Arabia.

Undervalued with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives