- Japan

- /

- Diversified Financial

- /

- TSE:8439

Tokyo Century (TSE:8439): Assessing Valuation After Upgraded Profit and Dividend Forecasts

Reviewed by Simply Wall St

Tokyo Century (TSE:8439) has caught investor attention after revising its earnings guidance upward and announcing increased dividends for both the interim and full fiscal year. These changes reflect the company’s view of stronger financial performance ahead.

See our latest analysis for Tokyo Century.

The upbeat revisions to Tokyo Century’s profit and dividend forecasts have added fuel to a share price already on a strong run, with a year-to-date gain of more than 23%. Taking total shareholder return into account, investors have seen a 35% boost over the past year and an impressive 74% over three years. This suggests momentum is still building as a result of these improvements to the company’s outlook.

If Tokyo Century’s recent upgrade has you thinking about what else is on the move, now is a great time to broaden your search and discover fast growing stocks with high insider ownership

But after such strong momentum and upgraded forecasts, is there still value left for new investors? Do current prices already reflect all the good news in Tokyo Century’s future growth prospects?

Price-to-Earnings of 7x: Is it justified?

With Tokyo Century trading at a price-to-earnings (P/E) ratio of 7, shares currently look notably cheaper than industry peers and the broader market. At the last close of ¥1,937, the market is clearly applying a discount to the company’s earnings profile.

The price-to-earnings ratio helps investors gauge how much they are paying for each unit of earnings a company generates. In capital-intensive industries like diversified financials, a lower multiple can either suggest undervaluation or skepticism about future profitability.

In Tokyo Century’s case, the current P/E of 7 is significantly lower than the industry average of 12.3 and a peer group average of 19.2. When compared to our fair ratio estimate of 13.3, the current valuation leaves significant room for rerating upwards should sentiment or fundamentals improve.

Explore the SWS fair ratio for Tokyo Century

Result: Price-to-Earnings of 7x (UNDERVALUED)

However, sustained net income declines and slower annual revenue growth could challenge Tokyo Century’s undervaluation thesis and support for a higher share price.

Find out about the key risks to this Tokyo Century narrative.

Another View: What Does Our DCF Model Say?

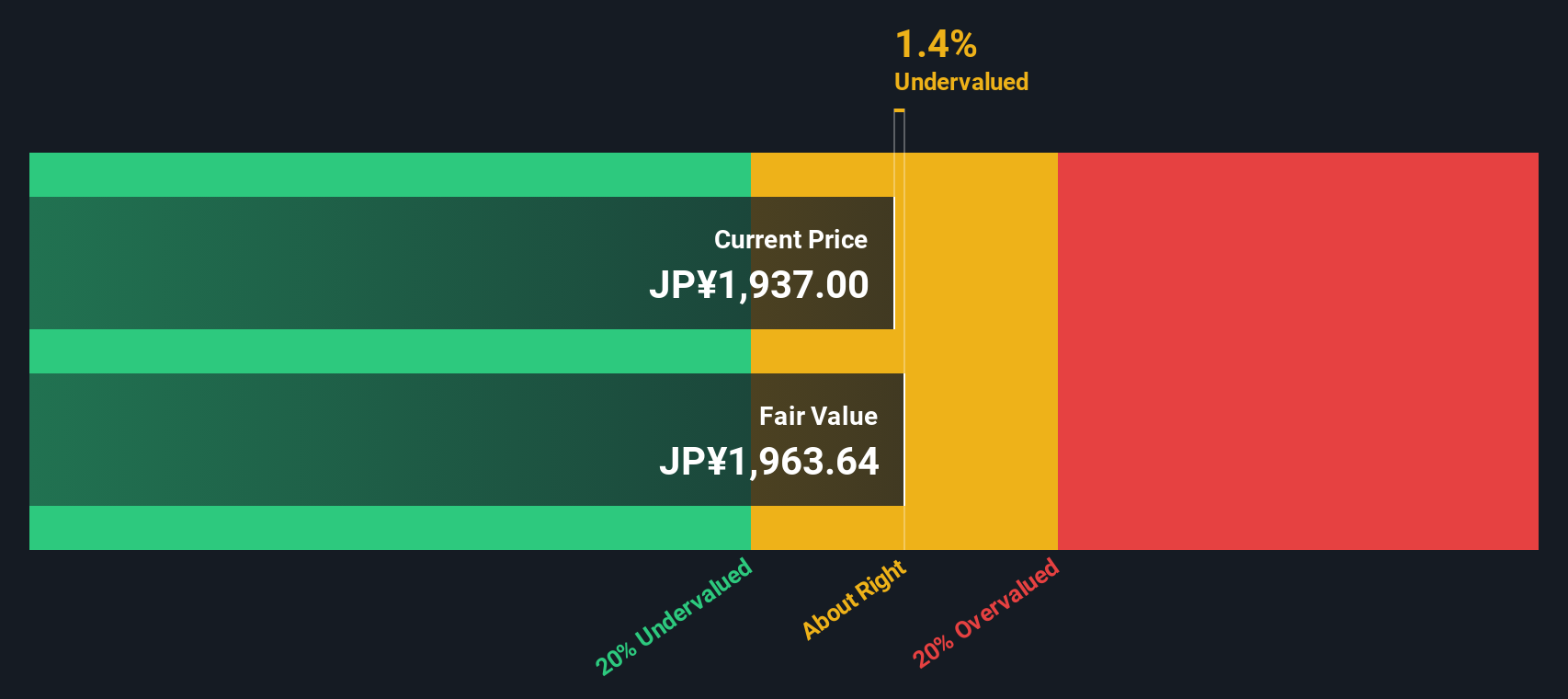

Looking through the lens of our SWS DCF model, Tokyo Century’s shares are trading at roughly 1.4% below our estimated fair value. This suggests that while the current price appears attractive by some measures, the margin of undervaluation is quite narrow. Does this shift the outlook or just confirm the value case?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Tokyo Century for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 916 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Tokyo Century Narrative

If you’re keen to dig deeper or feel your perspective might differ, you can assemble your own Tokyo Century story in just a few minutes. Do it your way

A great starting point for your Tokyo Century research is our analysis highlighting 5 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Don’t let great opportunities pass you by. A world of potential investments is waiting to be uncovered with the Simply Wall Street Screener.

- Capitalize on cutting-edge developments in healthcare by checking out these 30 healthcare AI stocks, which is spearheading breakthroughs in medical AI and technology.

- Collect potential passive income by browsing these 16 dividend stocks with yields > 3%, featuring companies with yields above 3% and strong dividend track records.

- Ride the momentum of technological disruption with these 25 AI penny stocks, which are powering the AI revolution and driving innovation across industries.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Tokyo Century might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:8439

Tokyo Century

Provides equipment leasing, automobility, specialty financing, environmental infrastructure, and international businesses in Japan and internationally.

6 star dividend payer and good value.

Similar Companies

Market Insights

Community Narratives