- Japan

- /

- Diversified Financial

- /

- TSE:8425

Mizuho Leasing (TSE:8425): Assessing Valuation Following Q2 2026 Earnings Call

Reviewed by Simply Wall St

Mizuho Leasing Company (TSE:8425) held its Q2 2026 earnings call on November 13. The event drew investor attention as quarterly results provide a firsthand look at the company’s latest financial performance and strategic direction.

See our latest analysis for Mizuho Leasing Company.

The Q2 earnings call appears to have energized Mizuho Leasing Company’s stock, with a 6.7% 7-day share price return and strong year-to-date momentum building. Total shareholder return sits at an impressive 40.6% over the past year, reflecting rising investor confidence in the business and potential for further upside.

If the latest results have you scanning for other compelling moves in the market, it might be the perfect moment to discover fast growing stocks with high insider ownership

But with shares already delivering standout returns, the real question for investors now is whether Mizuho Leasing Company’s current price offers untapped value or if the market has fully factored in its future growth prospects.

Price-to-Earnings of 8.3x: Is it justified?

With a price-to-earnings ratio (P/E) of 8.3x, Mizuho Leasing Company’s shares look attractively valued compared to both peers and the broader industry, given a last close of ¥1,349. The stock is currently trading at a level that suggests the market is not fully pricing in its profit potential.

The price-to-earnings ratio measures how much investors are willing to pay per yen of earnings. It is a vital gauge of sentiment around a company’s future profits. For diversified financials in Japan, this metric is particularly important because it reflects expected returns relative to sector averages and peers with similar business models.

At 8.3x, Mizuho Leasing’s valuation is not only below the industry average (12.4x) but also below its peer group (12.6x). This discount indicates the market could be overlooking the company’s earnings track record and longer-term growth. If sentiment shifts or the company delivers further earnings strength, the multiple may climb closer to these benchmarks, potentially driving up the share price.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price-to-Earnings of 8.3x (UNDERVALUED)

However, external economic pressures or weaker than expected future earnings could quickly alter the attractive valuation story for Mizuho Leasing Company’s shares.

Find out about the key risks to this Mizuho Leasing Company narrative.

Another View: DCF Model Shows Deeper Undervaluation

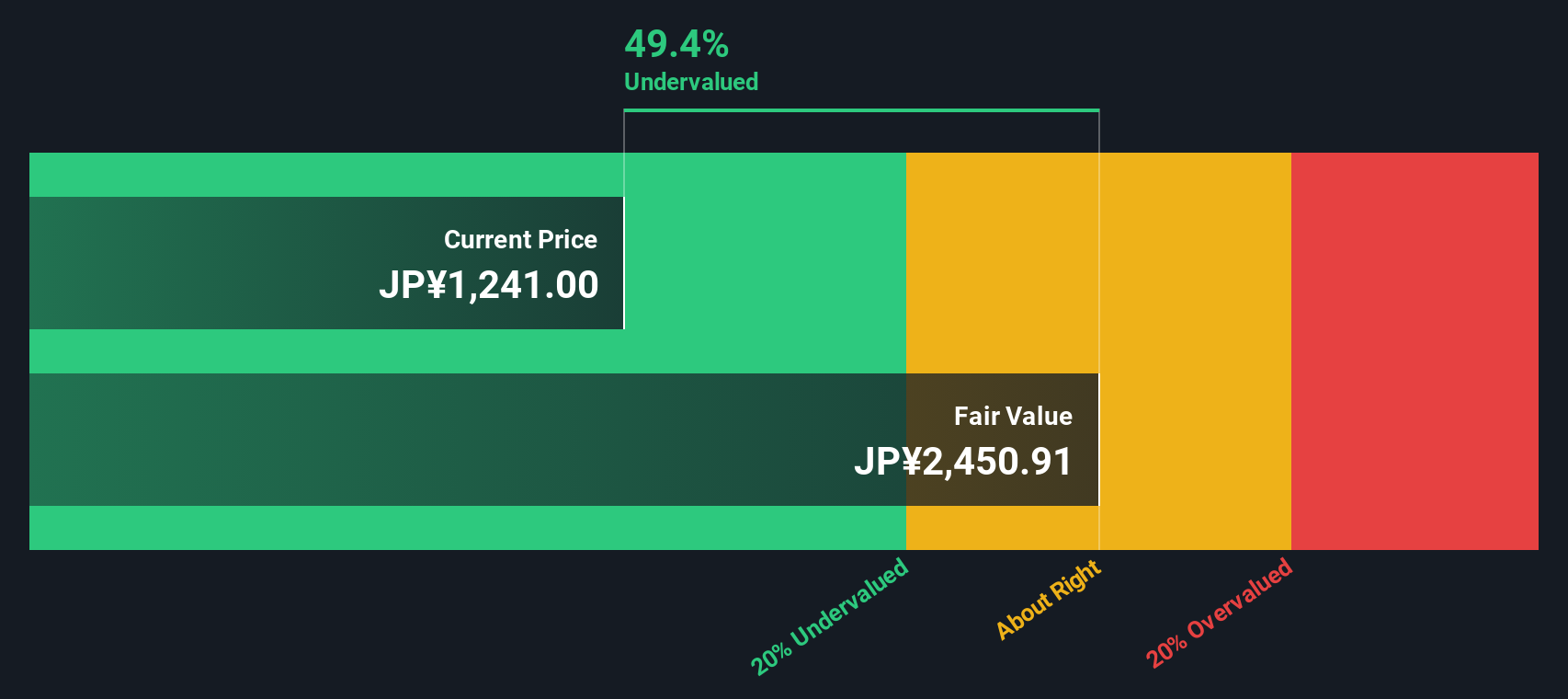

While the price-to-earnings ratio suggests Mizuho Leasing Company is undervalued, our DCF model reveals an even wider gap. The shares are trading at roughly 52% below our estimate of fair value. This challenges the idea that the upside is already factored in. Could the market be missing something bigger?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Mizuho Leasing Company for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 928 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Mizuho Leasing Company Narrative

If you have a different perspective or want to dive deeper into the numbers, you can easily craft your own view of Mizuho Leasing Company’s outlook in just a few minutes. Do it your way

A great starting point for your Mizuho Leasing Company research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Don't let great investment opportunities slip by. Uncover stocks with hidden potential or growth stories you might otherwise miss using these smart screeners:

- Unlock income potential and set your portfolio on a steady path by reviewing these 15 dividend stocks with yields > 3% offering yields above 3%.

- Jump ahead of market trends by finding truly undervalued gems in these 928 undervalued stocks based on cash flows before others catch on.

- Catch the next wave in healthcare innovation by seeking out these 30 healthcare AI stocks transforming medicine with artificial intelligence.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:8425

Mizuho Leasing Company

Engages in the provision of general leasing services in Japan and internationally.

Good value with adequate balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success