- Japan

- /

- Food and Staples Retail

- /

- TSE:2659

Kotobuki Spirits And 2 Other Undiscovered Gems In Japan For Your Portfolio

Reviewed by Simply Wall St

Japan's stock markets have experienced a notable rise recently, with the Nikkei 225 Index gaining 2.45% and the broader TOPIX Index up 0.45%, driven by yen weakness which has provided a favorable backdrop for exporters. In this environment of shifting currency dynamics and cautious economic recovery, identifying potential opportunities in lesser-known stocks can be an effective strategy for investors seeking to diversify their portfolios.

Top 10 Undiscovered Gems With Strong Fundamentals In Japan

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Ohashi Technica | NA | 1.57% | -20.55% | ★★★★★★ |

| Kanda HoldingsLtd | 30.47% | 4.35% | 18.02% | ★★★★★★ |

| AOKI Holdings | 28.27% | 0.91% | 37.15% | ★★★★★★ |

| Toukei Computer | NA | 5.46% | 12.14% | ★★★★★★ |

| Uoriki | NA | 3.90% | 6.15% | ★★★★★★ |

| Innotech | 38.96% | 7.08% | 6.36% | ★★★★★☆ |

| Marusan Securities | 5.33% | 1.01% | 10.00% | ★★★★★☆ |

| MIRARTH HOLDINGSInc | 266.33% | 3.00% | -2.40% | ★★★★☆☆ |

| Toyo Kanetsu K.K | 47.92% | 2.34% | 15.44% | ★★★★☆☆ |

| Hakuto | 56.93% | 8.02% | 27.72% | ★★★★☆☆ |

Underneath we present a selection of stocks filtered out by our screen.

Kotobuki Spirits (TSE:2222)

Simply Wall St Value Rating: ★★★★★★

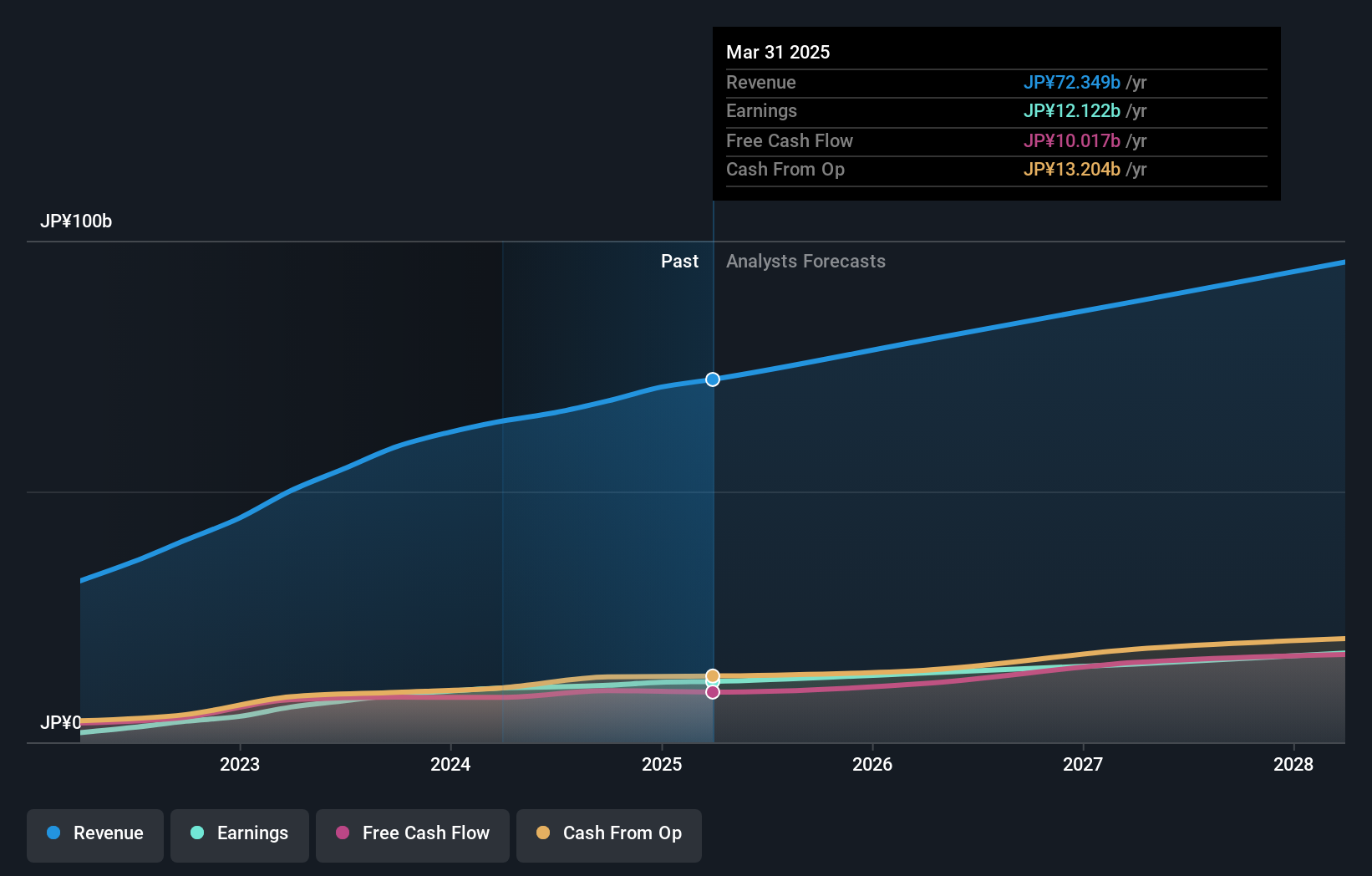

Overview: Kotobuki Spirits Co., Ltd. is a Japanese company that specializes in the production and sale of sweets, with a market capitalization of approximately ¥292.46 billion.

Operations: Kotobuki Spirits generates revenue primarily from its Shukrei and Casey Shii segments, contributing ¥27.03 billion and ¥18.88 billion, respectively. Additional income streams include Kotobuki Confectionery/Tajima Kotobuki at ¥13.19 billion and sales subsidiaries at ¥7.06 billion, while the Kujukushima segment adds ¥6.56 billion to the total revenue mix.

Kotobuki Spirits, a small cap player in Japan's food industry, is trading at 45.3% below its estimated fair value, offering potential upside for investors. The company's earnings grew by 33.7% last year, outpacing the broader food industry's growth of 26.8%. With a debt-to-equity ratio reduced from 2.1 to 0.9 over five years and more cash than total debt, financial health appears robust. Earnings are forecasted to grow at an annual rate of 12.77%, indicating promising future prospects.

- Unlock comprehensive insights into our analysis of Kotobuki Spirits stock in this health report.

Explore historical data to track Kotobuki Spirits' performance over time in our Past section.

SAN-ALTD (TSE:2659)

Simply Wall St Value Rating: ★★★★★★

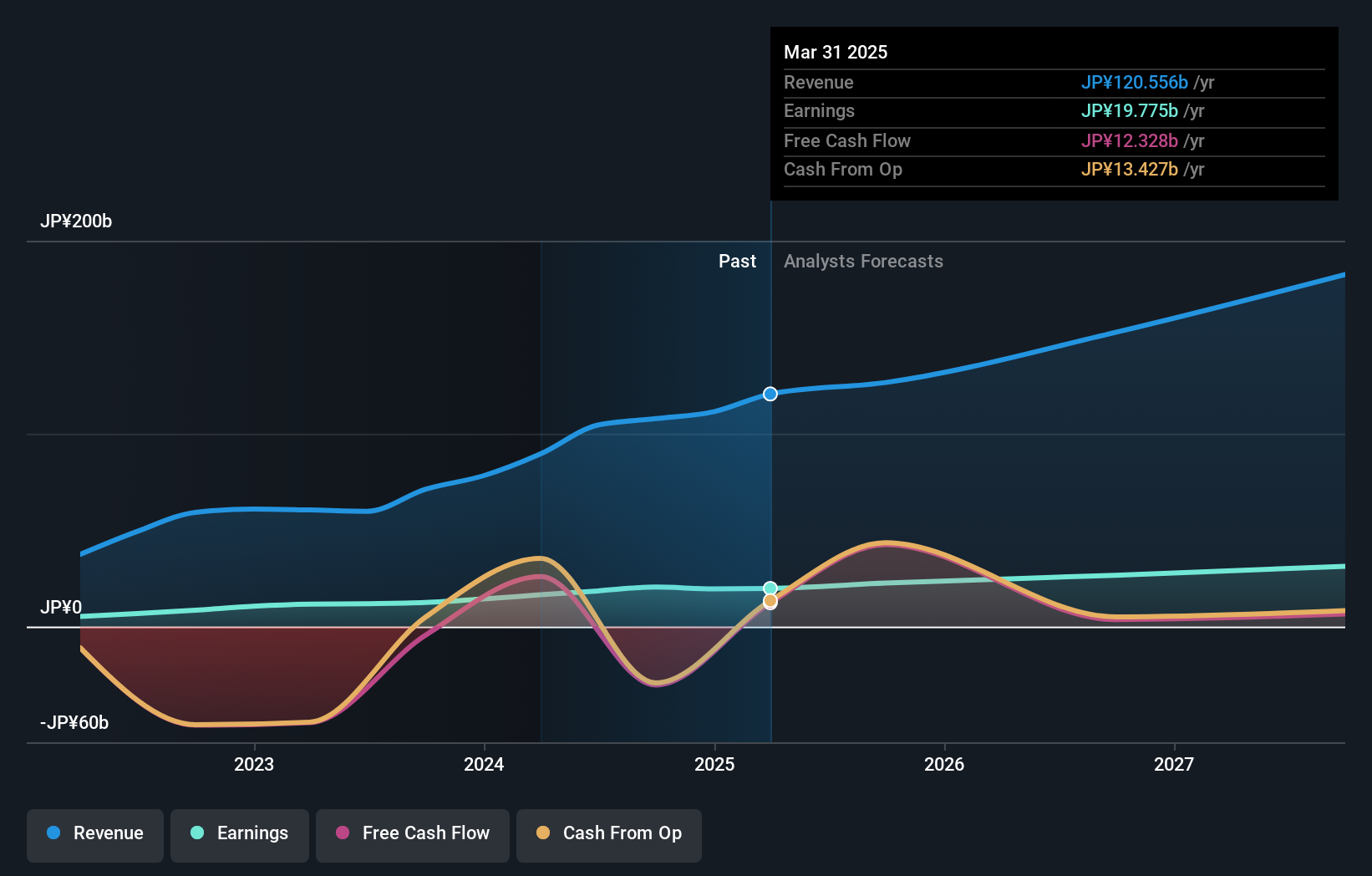

Overview: SAN-A CO., LTD. operates a chain of supermarkets in Okinawa with a market cap of ¥180.53 billion.

Operations: The company generates revenue primarily from its supermarket operations in Okinawa. It has a market capitalization of ¥180.53 billion.

SAN-ALTD boasts high-quality earnings and has been growing profits at 8.7% annually over the last five years, reflecting robust financial health. The company is debt-free, eliminating concerns about interest coverage or debt management. Despite a recent 17.6% earnings growth that lagged behind the Consumer Retailing industry’s 21.4%, it still trades at a significant discount of 40.5% below its estimated fair value, suggesting potential for future appreciation in value for investors eyeing opportunities in Japan's market gems.

- Take a closer look at SAN-ALTD's potential here in our health report.

Review our historical performance report to gain insights into SAN-ALTD's's past performance.

Financial Partners GroupLtd (TSE:7148)

Simply Wall St Value Rating: ★★★★★☆

Overview: Financial Partners Group Co., Ltd., along with its subsidiaries, offers a range of financial products and services in Japan and has a market capitalization of approximately ¥206.11 billion.

Operations: Financial Partners Group Co., Ltd. generates revenue through its diverse financial products and services offered in Japan, contributing to a market capitalization of approximately ¥206.11 billion. The company's financial performance is reflected in its net profit margin, which provides insight into profitability relative to total revenue.

Financial Partners Group, a small financial entity in Japan, has been making strategic moves with impressive earnings growth of 55.9% over the past year, outpacing the industry average of 24.9%. The company’s net debt to equity ratio stands at a high 228.7%, but it benefits from high-quality earnings and an attractive P/E ratio of 11.2x compared to the market's 13.5x. Recently, they repurchased shares worth ¥1,143 million and expanded their sales network with a new office in Imabari City, reflecting ongoing growth initiatives despite volatility in share price over recent months.

Make It Happen

- Access the full spectrum of 730 Japanese Undiscovered Gems With Strong Fundamentals by clicking on this link.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:2659

Flawless balance sheet established dividend payer.