- Japan

- /

- Diversified Financial

- /

- TSE:7148

Evaluating Financial Partners Group (TSE:7148) After Dividend Cut and Updated Earnings Guidance

Reviewed by Simply Wall St

Financial Partners GroupLtd (TSE:7148) just announced it will be lowering its year-end dividend for the past fiscal year, along with guidance pointing to another decrease next year. The updated earnings forecasts also give investors a clearer outlook for the future.

See our latest analysis for Financial Partners GroupLtd.

The recent announcement of lower dividends, along with new earnings guidance, appears to have put further pressure on Financial Partners GroupLtd’s share price. The stock has struggled for momentum this year, reflected in a year-to-date share price return of -22.3%, while the 1-year total shareholder return stands at -13.9%. However, looking further back, long-term investors have still enjoyed a remarkable 430.7% total return over the last five years.

If today’s market moves have you scanning for your next opportunity, now is a great time to broaden your search and discover fast growing stocks with high insider ownership

With sentiment subdued and future dividends expected to fall, is Financial Partners GroupLtd now trading at a discount, or are the company's prospects already fully reflected in the current share price?

Price-to-Earnings of 10.3x: Is it justified?

Financial Partners GroupLtd trades at a price-to-earnings ratio of 10.3x, which makes it appear attractively valued compared to both its industry and peer averages. This is especially notable given its last close of ¥2,229.

The price-to-earnings (P/E) ratio compares a company’s current share price to its per-share earnings, and is widely used to evaluate whether a stock is expensive or cheap relative to its profitability. For diversified financial companies, a lower P/E may suggest that the market is underestimating future earnings potential or is pricing in uncertainties.

Financial Partners GroupLtd’s P/E ratio is lower than the JP Diversified Financial industry average of 11.3x and the peer average of 10.8x. When compared to our estimated fair P/E ratio of 18.5x, the current level may indicate that the market is significantly discounting the company’s future growth prospects or is cautious about sustainability. There could be meaningful upside if sentiment improves toward the sector or if the company meets its strong forecasted earnings growth.

Explore the SWS fair ratio for Financial Partners GroupLtd

Result: Price-to-Earnings of 10.3x (UNDERVALUED)

However, risks remain, including the possibility of slower revenue growth or profit margin pressure. These factors could weigh on sentiment and challenge further upside.

Find out about the key risks to this Financial Partners GroupLtd narrative.

Another View: Discounted Cash Flow Analysis

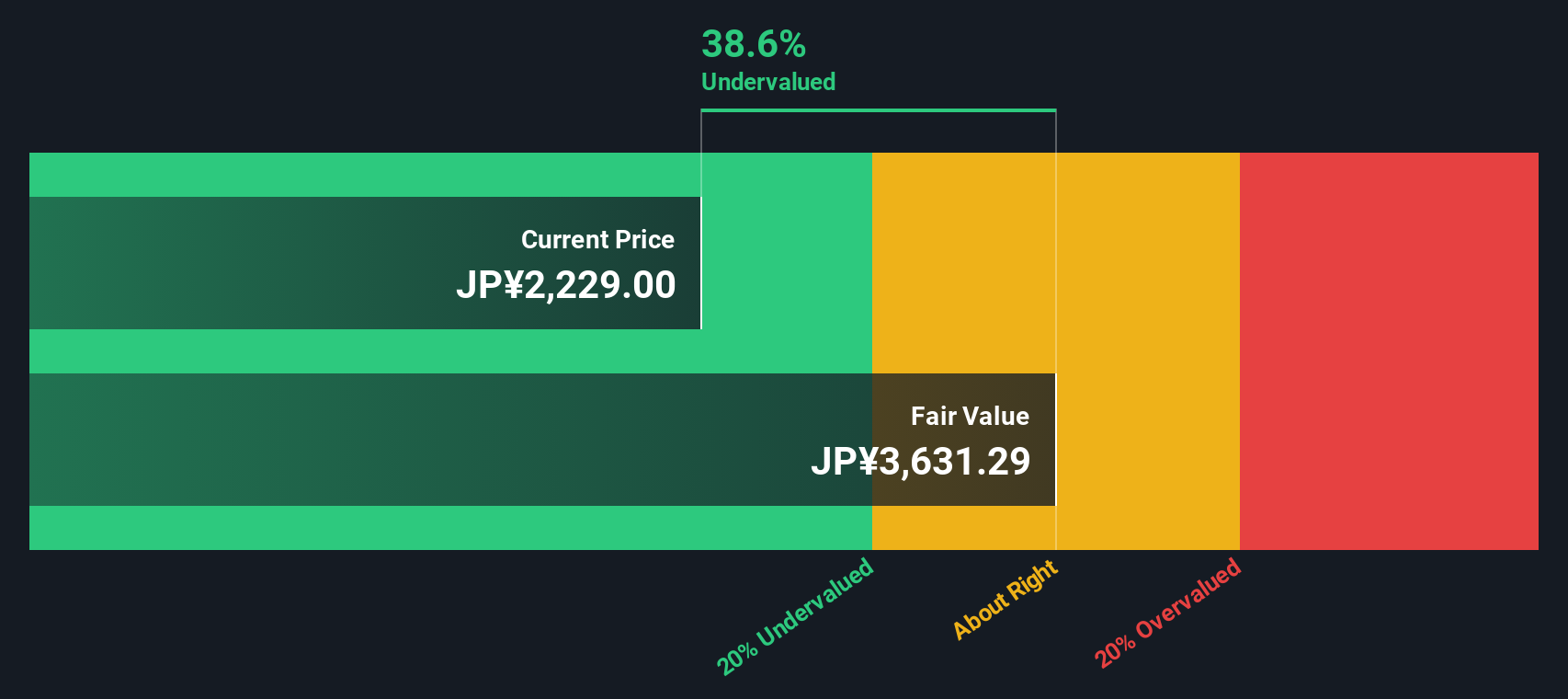

Another lens is the SWS DCF model, which estimates Financial Partners GroupLtd's fair value at ¥3,614.5, much higher than its current price of ¥2,225. This suggests shares could be trading well below what the company's future cash flows might justify. Could the market be missing something about its potential?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Financial Partners GroupLtd for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 843 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Financial Partners GroupLtd Narrative

If you want to dig deeper or form your own conclusions, it's never been easier to explore the numbers and build your own perspective in minutes. Do it your way

A great starting point for your Financial Partners GroupLtd research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Smart investors stay ahead by tracking fresh opportunities tailored to their interests. Don’t let tomorrow’s winners pass you by. Curate your watchlist now.

- Tap into tomorrow’s breakthroughs by searching these 26 AI penny stocks. These companies are fueling innovation in artificial intelligence and transforming whole industries with their growth potential.

- Boost your potential returns by uncovering these 843 undervalued stocks based on cash flows. These selections appear mispriced based on their projected cash flows and fundamentals.

- Pick up steady income ideas by checking out these 18 dividend stocks with yields > 3%. These options offer robust dividend yields that could add stability to your portfolio over time.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:7148

Financial Partners GroupLtd

Provides various financial products and services in Japan.

Undervalued with high growth potential and pays a dividend.

Market Insights

Community Narratives