- Japan

- /

- Hospitality

- /

- TSE:9936

Why Ohsho Food Service (TSE:9936) Is Down 6.7% After Cutting Its Dividend and Updating Guidance

Reviewed by Sasha Jovanovic

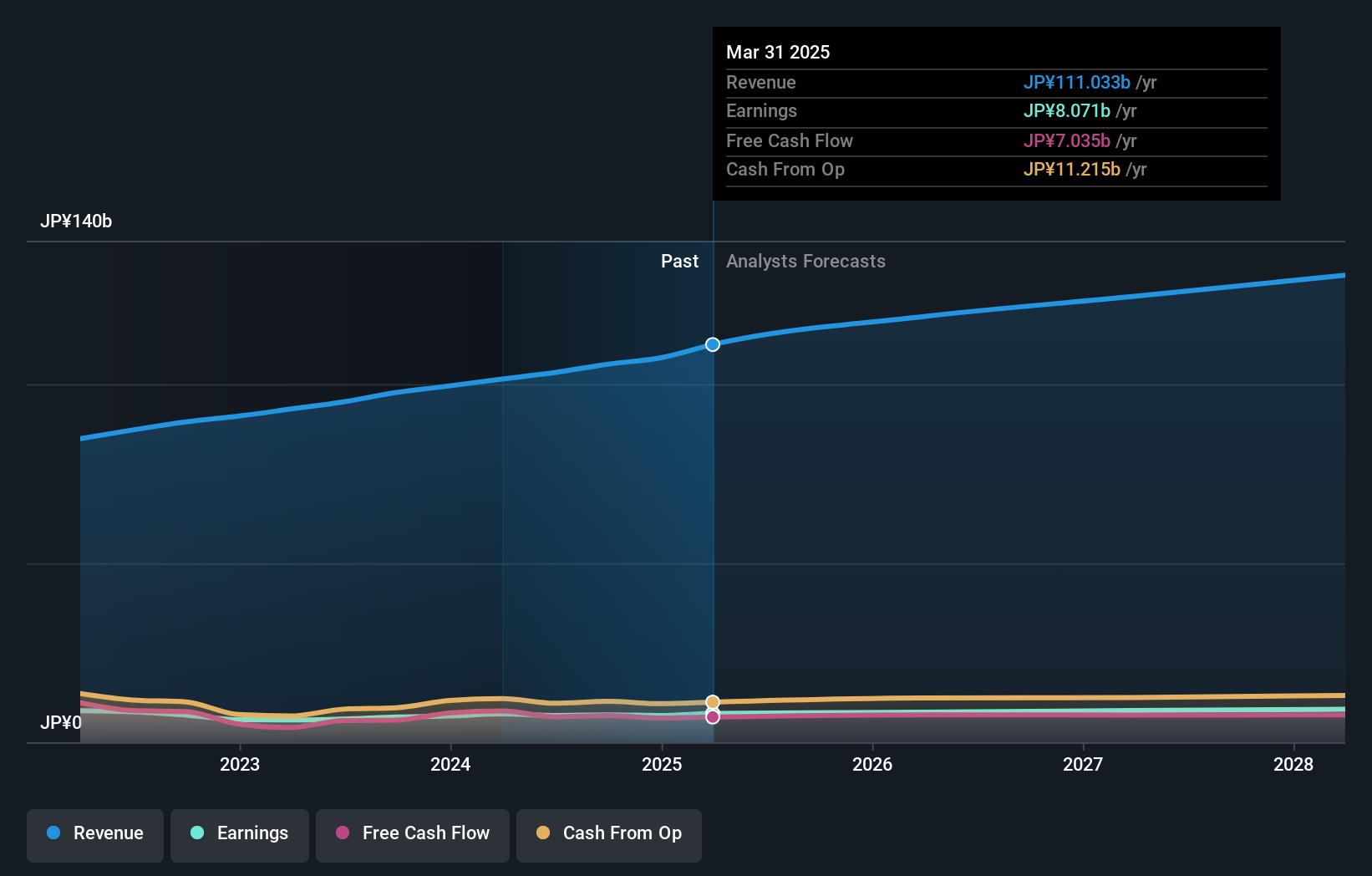

- Ohsho Food Service Corp. recently announced a reduction in its second-quarter dividend to ¥28.00 per share, down from ¥75.00, and released consolidated earnings guidance projecting full-year net sales of ¥119.73 billion and net profit of ¥8.09 billion for the fiscal year ending March 2026.

- Monthly results for October 2025 showed that all company-operated stores achieved year-on-year sales growth, highlighting operational momentum despite the dividend decrease.

- We’ll explore how Ohsho’s ongoing sales growth across company-operated stores shapes the company’s investment narrative following these latest developments.

Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

What Is Ohsho Food Service's Investment Narrative?

To be a shareholder in Ohsho Food Service, you need confidence in the company’s ability to maintain consistent sales growth, even through strategic shifts like the recent dividend cut. The second-quarter dividend reduction to ¥28.00 from ¥75.00 came alongside guidance for both top- and bottom-line growth in the coming fiscal year, but it’s clear that capital allocation priorities may be shifting. Despite the dividend change, all company-operated stores achieved year-on-year sales gains in October, suggesting resilient consumer demand and effective operations. However, the market’s immediate reaction, illustrated by a double-digit share price drop in the last month, shows concerns about whether these internal improvements can offset the lower yield for income-focused investors. The most important short-term catalysts now revolve around whether store-level momentum continues and if profitability targets hold, while risks have increased around management stability and dividend sustainability. The recent developments make these risk factors more pressing than before the announcement. On the flip side, dividend reliability is now a concern investors should be aware of.

Ohsho Food Service's share price has been on the slide but might be dropping deeper into value territory. Find out whether it's a bargain at this price.Exploring Other Perspectives

Explore another fair value estimate on Ohsho Food Service - why the stock might be worth as much as ¥3100!

Build Your Own Ohsho Food Service Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Ohsho Food Service research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Ohsho Food Service research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Ohsho Food Service's overall financial health at a glance.

Seeking Other Investments?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 35 best rare earth metal stocks of the very few that mine this essential strategic resource.

- We've found 16 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:9936

Ohsho Food Service

Operates and franchises a chain of Chinese restaurants under the Gyoza no OHSHO brand name in Japan.

Flawless balance sheet average dividend payer.

Market Insights

Community Narratives