- Japan

- /

- Hospitality

- /

- TSE:9936

Ohsho Food Service (TSE:9936) Valuation in Focus After Strong Q2 Sales and Maintained Dividend Outlook

Reviewed by Simply Wall St

Ohsho Food Service (TSE:9936) just announced an 8.6% rise in net sales for the second quarter, steady profit growth for shareholders, and a maintained dividend forecast. These updates are helping to keep investor interest strong.

See our latest analysis for Ohsho Food Service.

This upbeat sales report seems to have energized Ohsho Food Service’s stock, as reflected in a steady year-to-date share price return of almost 6%. Short-term volatility aside, long-term investors have been well rewarded, with a total shareholder return of nearly 75% over the past five years. This momentum speaks to consistent business execution and market confidence.

If you’re keeping an eye on companies with accelerating growth stories, now’s a perfect moment to broaden your search and discover fast growing stocks with high insider ownership

With shares near record highs after a solid run, the real question for investors now is whether Ohsho Food Service is still trading at a bargain or if the market has already factored in its growth prospects.

Price-to-Earnings of 20.6x: Is it justified?

Ohsho Food Service is currently trading at a price-to-earnings (P/E) ratio of 20.6x, closely in line with the fair P/E ratio estimate of 20.7x and below industry and peer averages. At a last close price of ¥3,185, the stock appears attractively valued relative to fundamentals and sector norms. This suggests the recent rally has not pushed it into overvalued territory.

The price-to-earnings ratio is a measure of how much investors are willing to pay for each yen of the company’s earnings. For service companies like Ohsho, the P/E can reflect both growth expectations and profitability stability within the hospitality industry. If the multiple is justified, it signals the market expects steady, though not necessarily spectacular, future growth.

This P/E ratio is not only below the hospitality industry average (22.8x) but also significantly lower than the peer average of 51.5x. The fair ratio estimate (20.7x) is almost a perfect match for the current P/E, which may signal limited room for rerating, but also very limited evidence of overpricing. The market seems to be pricing Ohsho for dependable, modest expansion rather than rapid growth.

Explore the SWS fair ratio for Ohsho Food Service

Result: Price-to-Earnings of 20.6x (ABOUT RIGHT)

However, rising input costs or unexpected slowdowns in growth could quickly challenge the current valuation and change market sentiment around Ohsho Food Service.

Find out about the key risks to this Ohsho Food Service narrative.

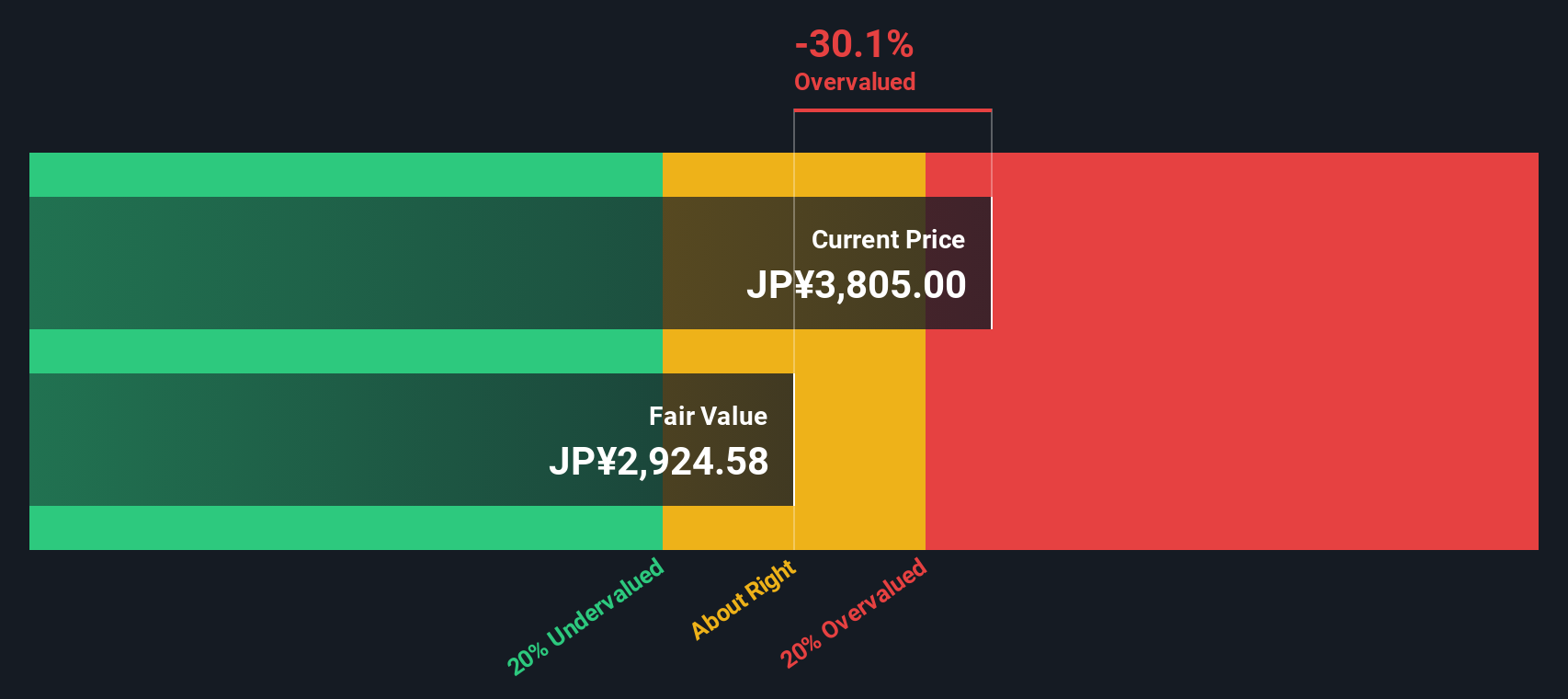

Another View: Discounted Cash Flow Tells a Different Story

Looking through the lens of our SWS DCF model, Ohsho Food Service is trading slightly above its fair value estimate (¥3,185 vs. ¥3,101.73). This suggests the stock may not be as undervalued as the price-to-earnings ratio alone implies. It is possible the market is already pricing in future growth.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Ohsho Food Service for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 918 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Ohsho Food Service Narrative

If you’d rather draw your own conclusions or want to dig deeper into the numbers, it’s quick and easy to build your own view in just a few minutes, so why not Do it your way?

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding Ohsho Food Service.

Looking for more investment ideas?

Smart investors broaden their horizons, and the best opportunities often go beyond what’s in focus today. Your next great investment move could be just a click away with the right tools.

- Uncover outstanding passive income opportunities when you review these 17 dividend stocks with yields > 3% with yields above 3% and consistent payout histories.

- Tap into breakthroughs in digital assets by checking out these 81 cryptocurrency and blockchain stocks and see which companies are driving blockchain innovation and cryptocurrency momentum.

- Spot undervalued gems poised for growth by filtering for these 918 undervalued stocks based on cash flows to ensure you never overlook hidden potential in the market.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:9936

Ohsho Food Service

Operates and franchises a chain of Chinese restaurants under the Gyoza no OHSHO brand name in Japan.

Flawless balance sheet and fair value.

Market Insights

Community Narratives