- Japan

- /

- Food and Staples Retail

- /

- TSE:9948

Discovering January 2025's Undiscovered Gems with Strong Potential

Reviewed by Simply Wall St

As global markets continue to navigate political shifts and economic developments, the S&P 500 has reached record highs, driven by optimism around potential trade deals and AI investments. Amidst this backdrop, investors are increasingly looking toward small-cap stocks that may be undervalued or overlooked in the broader market rally. Identifying such "undiscovered gems" often involves seeking companies with strong fundamentals and growth potential that align well with current economic trends and investor sentiment.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Morris State Bancshares | 10.20% | -0.28% | 6.97% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Natural Food International Holding | NA | 2.49% | 20.35% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Kenturn Nano. Tec | 45.38% | 9.73% | 28.94% | ★★★★★☆ |

| ONEJOON | 9.85% | 24.95% | 4.85% | ★★★★★☆ |

| Giant Heavy Machinery Service | 17.81% | 21.88% | 48.77% | ★★★★★☆ |

| PAN Group | 143.29% | 15.75% | 23.10% | ★★★★☆☆ |

| Petrolimex Insurance | 32.25% | 4.46% | 7.91% | ★★★★☆☆ |

| Bhakti Multi Artha | 45.21% | 32.37% | -16.43% | ★★★★☆☆ |

Let's dive into some prime choices out of from the screener.

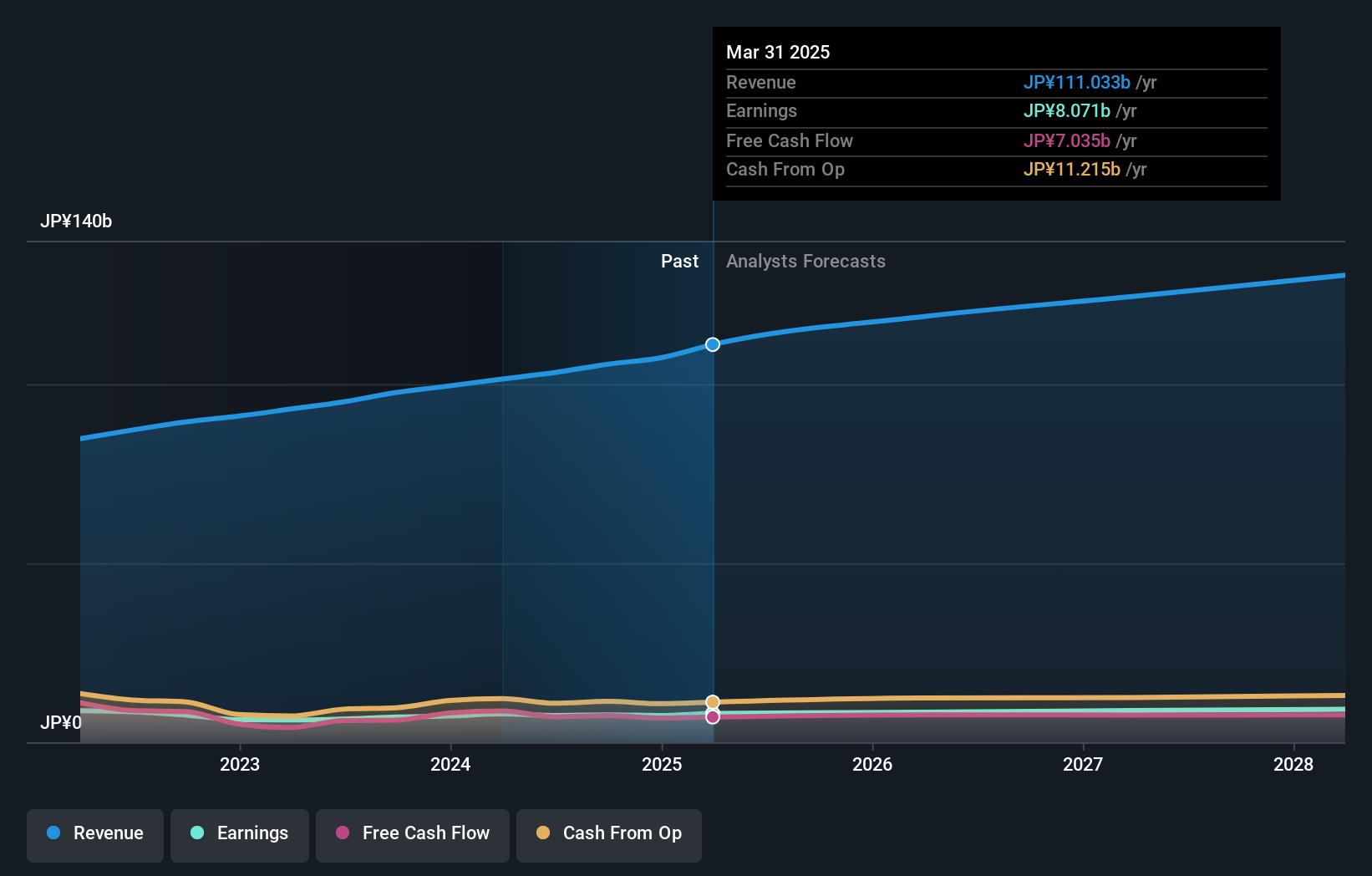

Totetsu Kogyo (TSE:1835)

Simply Wall St Value Rating: ★★★★★★

Overview: Totetsu Kogyo Co., Ltd. operates in Japan, focusing on railway track maintenance, civil engineering, architectural, and environmental services with a market capitalization of ¥109.50 billion.

Operations: The company generates revenue primarily from its Civil Engineering Business, contributing ¥93.02 billion, followed by the Construction Business at ¥46.10 billion.

Totetsu Kogyo, a small player in the construction sector, offers intriguing prospects. Trading at 48.2% below its estimated fair value, it presents a potential bargain for investors. Despite earnings growth of 16.8% over the past year not matching the industry's 20.8%, it remains debt-free with high-quality past earnings and no interest payment concerns due to zero debt levels. The company is profitable with positive free cash flow and forecasts suggest an annual growth rate of 6.85%. These factors likely contribute to its stable financial footing, making it a noteworthy consideration for those exploring under-the-radar opportunities in construction.

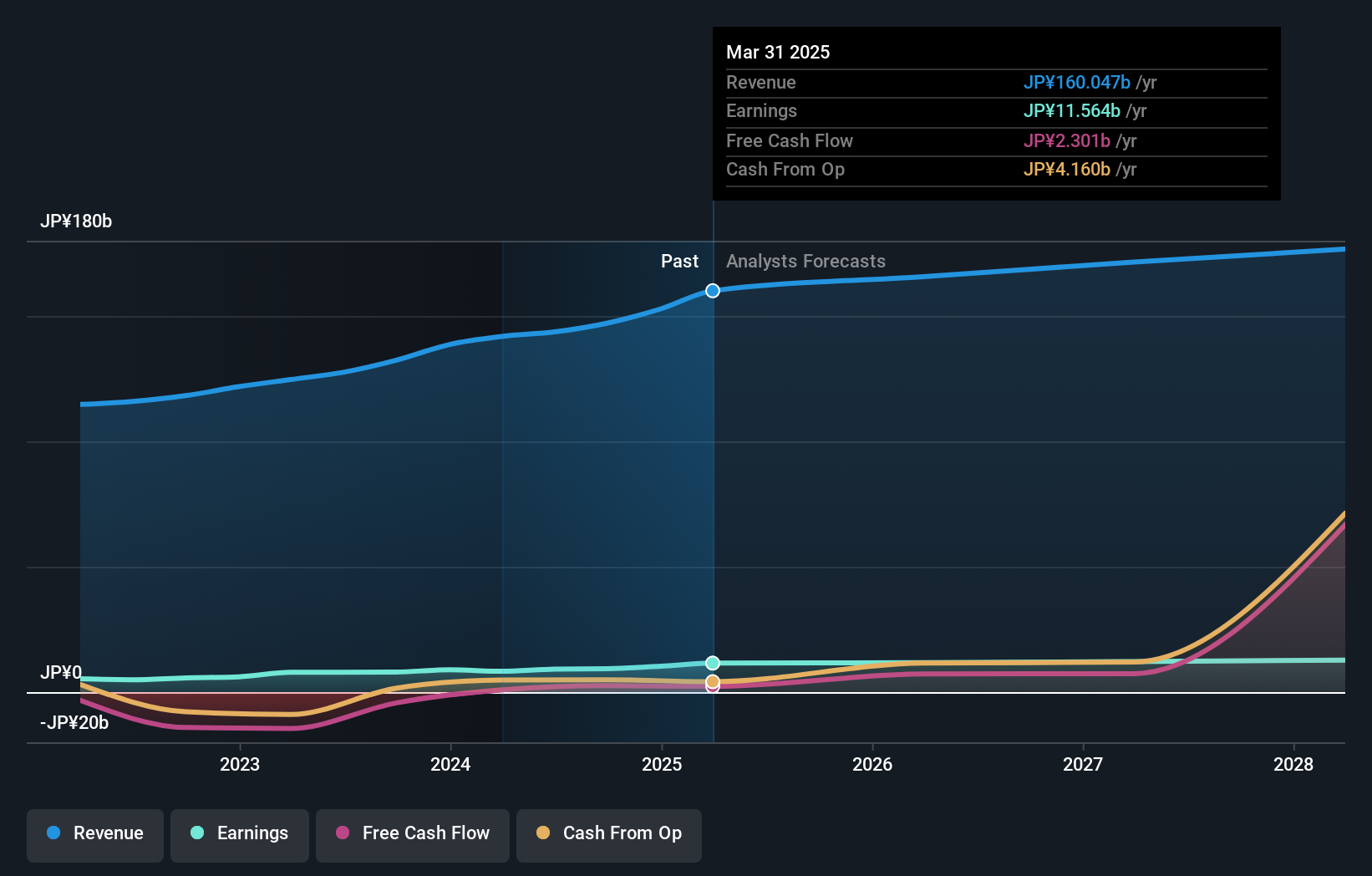

Ohsho Food Service (TSE:9936)

Simply Wall St Value Rating: ★★★★★★

Overview: Ohsho Food Service Corp. operates and franchises a chain of Chinese restaurants under the Gyoza no OHSHO brand name in Japan, with a market cap of ¥169.81 billion.

Operations: The company's primary revenue stream is from its restaurant operations, with a focus on the Gyoza no OHSHO brand. The net profit margin has shown variability, reflecting changes in operational efficiency and cost management.

Ohsho Food Service, a promising player in the hospitality sector, has shown steady growth with earnings increasing by 11.3% annually over the past five years. Despite not outpacing the broader industry last year, its price-to-earnings ratio of 22.3x remains competitive compared to the industry average of 23x. The company's financial health is robust, as it holds more cash than its total debt and has reduced its debt-to-equity ratio from 10% to 8.5% over five years. Recently, Ohsho announced a dividend increase to ¥75 per share for Q2 FY2025, up from ¥70 previously, reflecting confidence in future prospects.

- Navigate through the intricacies of Ohsho Food Service with our comprehensive health report here.

Explore historical data to track Ohsho Food Service's performance over time in our Past section.

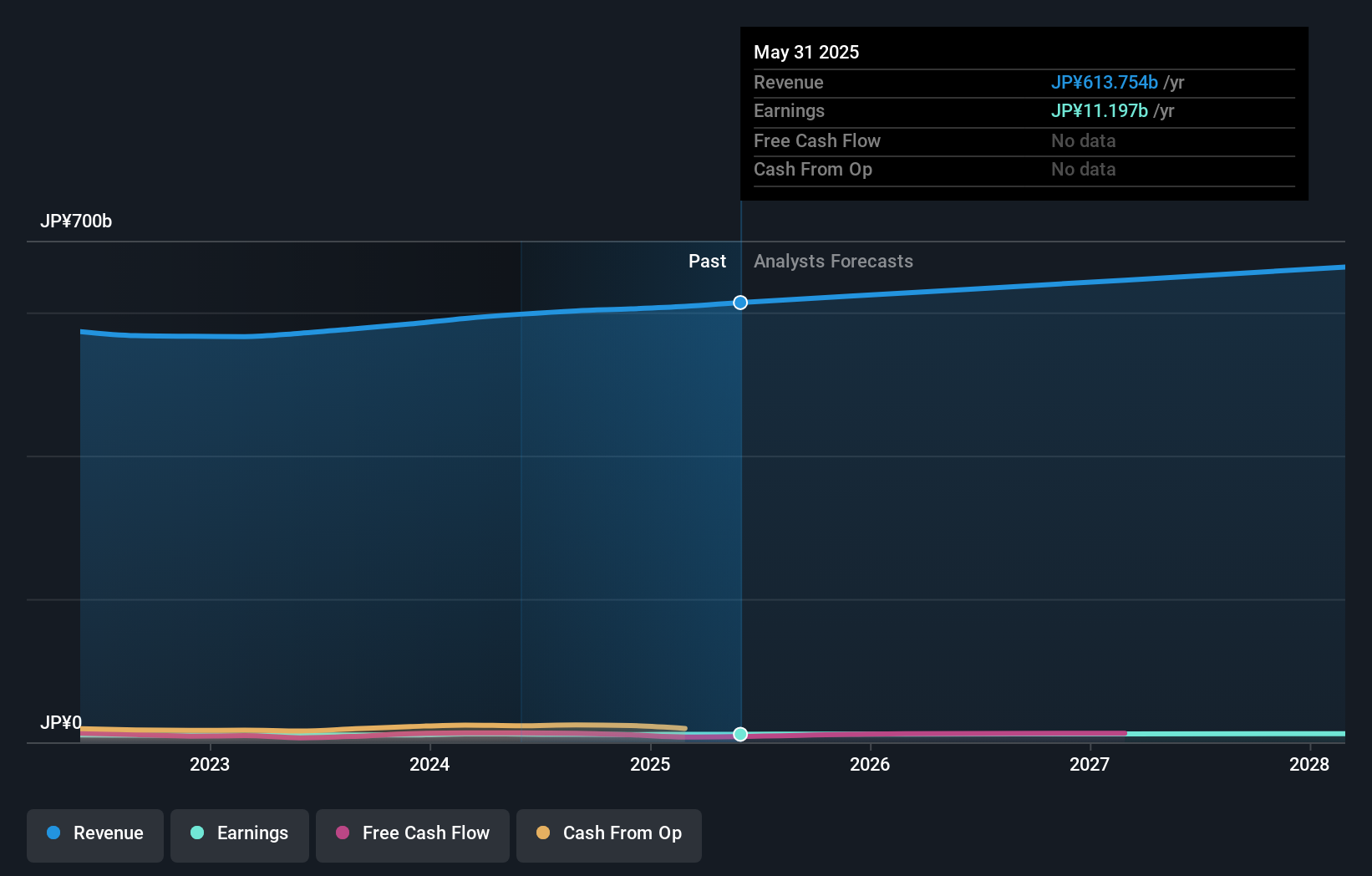

ARCS (TSE:9948)

Simply Wall St Value Rating: ★★★★★★

Overview: ARCS Company Limited operates supermarkets in Japan with a market cap of ¥145.42 billion.

Operations: The primary revenue stream for ARCS comes from its retail business, generating ¥604.78 billion.

ARCS, a smaller player in the market, demonstrates solid financial health with earnings growing 2.8% annually over the past five years. The company is trading at a significant discount of 61.1% below its estimated fair value, which suggests potential undervaluation. Despite not outperforming its industry peers last year with an 8.1% earnings growth compared to the industry's 11.5%, ARCS maintains high-quality earnings and has more cash than total debt, indicating strong liquidity management. Recent dividend guidance shows a slight decrease from ¥39 to ¥38 per share, reflecting cautious fiscal planning amidst ongoing market dynamics.

Taking Advantage

- Embark on your investment journey to our 4664 Undiscovered Gems With Strong Fundamentals selection here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:9948

Excellent balance sheet established dividend payer.

Market Insights

Community Narratives