- Japan

- /

- Consumer Services

- /

- TSE:9760

Does Shingakukai HoldingsLtd (TSE:9760) Have A Healthy Balance Sheet?

Legendary fund manager Li Lu (who Charlie Munger backed) once said, 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.' When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. As with many other companies Shingakukai Holdings Co.,Ltd. (TSE:9760) makes use of debt. But the real question is whether this debt is making the company risky.

What Risk Does Debt Bring?

Debt is a tool to help businesses grow, but if a business is incapable of paying off its lenders, then it exists at their mercy. Part and parcel of capitalism is the process of 'creative destruction' where failed businesses are mercilessly liquidated by their bankers. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. Of course, the upside of debt is that it often represents cheap capital, especially when it replaces dilution in a company with the ability to reinvest at high rates of return. When we think about a company's use of debt, we first look at cash and debt together.

Check out our latest analysis for Shingakukai HoldingsLtd

How Much Debt Does Shingakukai HoldingsLtd Carry?

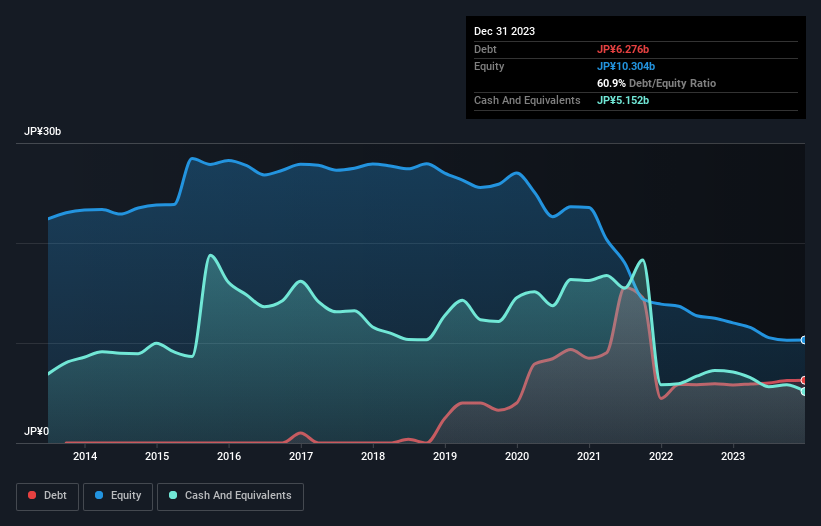

The image below, which you can click on for greater detail, shows that at December 2023 Shingakukai HoldingsLtd had debt of JP¥6.28b, up from JP¥5.81b in one year. However, it also had JP¥5.15b in cash, and so its net debt is JP¥1.12b.

How Healthy Is Shingakukai HoldingsLtd's Balance Sheet?

Zooming in on the latest balance sheet data, we can see that Shingakukai HoldingsLtd had liabilities of JP¥11.6b due within 12 months and liabilities of JP¥286.0m due beyond that. Offsetting this, it had JP¥5.15b in cash and JP¥5.64b in receivables that were due within 12 months. So its liabilities total JP¥1.07b more than the combination of its cash and short-term receivables.

Shingakukai HoldingsLtd has a market capitalization of JP¥4.44b, so it could very likely raise cash to ameliorate its balance sheet, if the need arose. But we definitely want to keep our eyes open to indications that its debt is bringing too much risk. When analysing debt levels, the balance sheet is the obvious place to start. But it is Shingakukai HoldingsLtd's earnings that will influence how the balance sheet holds up in the future. So when considering debt, it's definitely worth looking at the earnings trend. Click here for an interactive snapshot.

Over 12 months, Shingakukai HoldingsLtd made a loss at the EBIT level, and saw its revenue drop to JP¥4.8b, which is a fall of 38%. That makes us nervous, to say the least.

Caveat Emptor

While Shingakukai HoldingsLtd's falling revenue is about as heartwarming as a wet blanket, arguably its earnings before interest and tax (EBIT) loss is even less appealing. Indeed, it lost a very considerable JP¥1.5b at the EBIT level. Considering that alongside the liabilities mentioned above does not give us much confidence that company should be using so much debt. So we think its balance sheet is a little strained, though not beyond repair. Another cause for caution is that is bled JP¥1.0b in negative free cash flow over the last twelve months. So in short it's a really risky stock. There's no doubt that we learn most about debt from the balance sheet. However, not all investment risk resides within the balance sheet - far from it. Be aware that Shingakukai HoldingsLtd is showing 3 warning signs in our investment analysis , and 2 of those are concerning...

When all is said and done, sometimes its easier to focus on companies that don't even need debt. Readers can access a list of growth stocks with zero net debt 100% free, right now.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:9760

Excellent balance sheet and good value.

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026