The recent earnings release from The Royal Hotel, Limited (TSE:9713 ) was disappointing to investors. We think that they may have more to worry about than just soft profit numbers.

View our latest analysis for Royal Hotel

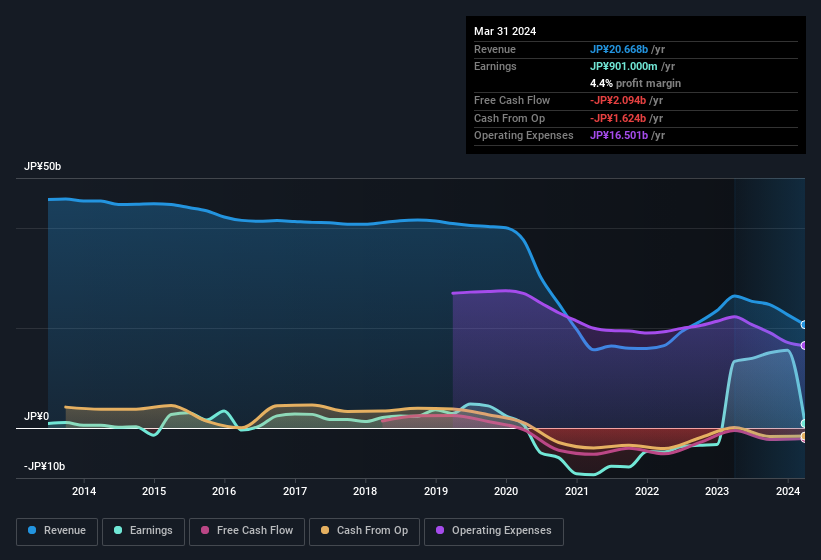

Examining Cashflow Against Royal Hotel's Earnings

One key financial ratio used to measure how well a company converts its profit to free cash flow (FCF) is the accrual ratio. To get the accrual ratio we first subtract FCF from profit for a period, and then divide that number by the average operating assets for the period. The ratio shows us how much a company's profit exceeds its FCF.

Therefore, it's actually considered a good thing when a company has a negative accrual ratio, but a bad thing if its accrual ratio is positive. While it's not a problem to have a positive accrual ratio, indicating a certain level of non-cash profits, a high accrual ratio is arguably a bad thing, because it indicates paper profits are not matched by cash flow. That's because some academic studies have suggested that high accruals ratios tend to lead to lower profit or less profit growth.

Royal Hotel has an accrual ratio of 0.49 for the year to March 2024. Statistically speaking, that's a real negative for future earnings. And indeed, during the period the company didn't produce any free cash flow whatsoever. Even though it reported a profit of JP¥901.0m, a look at free cash flow indicates it actually burnt through JP¥2.1b in the last year. Coming off the back of negative free cash flow last year, we imagine some shareholders might wonder if its cash burn of JP¥2.1b, this year, indicates high risk. However, as we will discuss below, we can see that the company's accrual ratio has been impacted by its tax situation. This would certainly have contributed to the weak cash conversion.

Note: we always recommend investors check balance sheet strength. Click here to be taken to our balance sheet analysis of Royal Hotel.

An Unusual Tax Situation

In addition to the notable accrual ratio, we can see that Royal Hotel received a tax benefit of JP¥346m. This is meaningful because companies usually pay tax rather than receive tax benefits. Of course, prima facie it's great to receive a tax benefit. However, our data indicates that tax benefits can temporarily boost statutory profit in the year it is booked, but subsequently profit may fall back. In the likely event the tax benefit is not repeated, we'd expect to see its statutory profit levels drop, at least in the absence of strong growth. So while we think it's great to receive a tax benefit, it does tend to imply an increased risk that the statutory profit overstates the sustainable earnings power of the business.

Our Take On Royal Hotel's Profit Performance

This year, Royal Hotel couldn't match its profit with cashflow. On top of that, the unsustainable nature of tax benefits mean that there's a chance profit may be lower next year, certainly in the absence of strong growth. Considering all this we'd argue Royal Hotel's profits probably give an overly generous impression of its sustainable level of profitability. With this in mind, we wouldn't consider investing in a stock unless we had a thorough understanding of the risks. Be aware that Royal Hotel is showing 2 warning signs in our investment analysis and 1 of those is a bit unpleasant...

Our examination of Royal Hotel has focussed on certain factors that can make its earnings look better than they are. And, on that basis, we are somewhat skeptical. But there is always more to discover if you are capable of focussing your mind on minutiae. Some people consider a high return on equity to be a good sign of a quality business. So you may wish to see this free collection of companies boasting high return on equity, or this list of stocks with high insider ownership.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:9713

Flawless balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives