- Japan

- /

- Hospitality

- /

- TSE:9616

Kyoritsu Maintenance (TSE:9616) Valuation Insights Following Upbeat Guidance and a Higher Interim Dividend

Reviewed by Simply Wall St

Kyoritsu Maintenance (TSE:9616) just released its earnings guidance for the fiscal year ending March 2026, along with news of a substantial jump in its interim dividend compared to last year. Both updates are grabbing investor attention this week.

See our latest analysis for Kyoritsu Maintenance.

Kyoritsu Maintenance’s upbeat earnings outlook and higher interim dividend have sparked renewed attention, especially after a challenging stretch. While momentum has cooled, with a 1-year total shareholder return of 4.45% and the share price down nearly 9% over the past month, the long-term picture is healthier. The stock boasts a 54.96% total return over five years, showing it can reward patient investors when the company delivers positive surprises.

If these recent moves have you curious about what else is working in the market, now’s a perfect time to broaden your search and discover fast growing stocks with high insider ownership

With forecasts pointing upward and the stock still trading well below analyst targets, investors are left wondering if Kyoritsu Maintenance is trading at a bargain right now, or if the market has already priced in its growth prospects.

Price-to-Earnings of 15.3x: Is it justified?

Kyoritsu Maintenance is currently trading at a price-to-earnings ratio of 15.3x, which sits well below both peer averages and industry norms. At a last close of ¥2,768.5, this suggests the stock may be undervalued by the market compared to similar companies.

The price-to-earnings (P/E) ratio compares a company’s share price to its earnings per share and is a classic measure of how much investors are willing to pay for a unit of current profits. For a service-oriented company like Kyoritsu Maintenance, operating in the hospitality sector, the P/E ratio is widely used to gauge whether shares are priced attractively relative to ongoing profit generation.

This multiple looks especially appealing when compared with the peer average of 23.3x and the Japanese hospitality industry average of 22.8x. The ratio is not only below peers, but also beneath the estimated fair price-to-earnings ratio of 25x, a level that may attract market attention depending on future growth forecasts.

Explore the SWS fair ratio for Kyoritsu Maintenance

Result: Price-to-Earnings of 15.3x (UNDERVALUED)

However, it is important to note that any slowdown in revenue growth or weaker net income trends could quickly challenge this undervaluation thesis.

Find out about the key risks to this Kyoritsu Maintenance narrative.

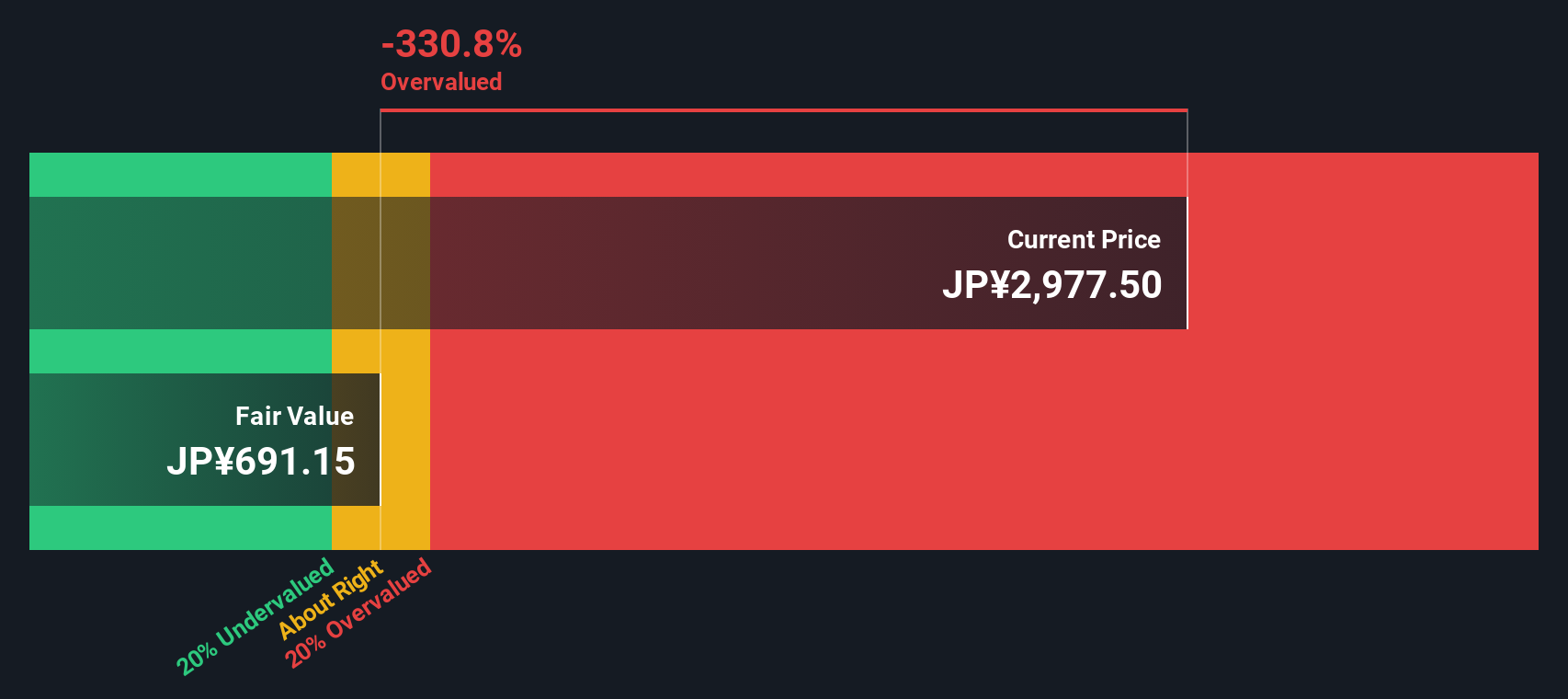

Another View: DCF Model Shows Overvaluation

While Kyoritsu Maintenance looks undervalued based on earnings multiples, our DCF model tells a different story. According to this method, the current share price is well above its estimated fair value. This suggests the stock may actually be overvalued by this measure. Could the market be pricing in more optimism than fundamentals support?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Kyoritsu Maintenance for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 919 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Kyoritsu Maintenance Narrative

If you feel differently or want to dig deeper, you can quickly build your own view and uncover your own story in just minutes. Do it your way

A great starting point for your Kyoritsu Maintenance research is our analysis highlighting 5 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Don’t wait for opportunities to pass by when you could be seizing the advantage right now. The next portfolio star might be just a click away. Expand your horizons today with these hand-picked strategies:

- Grow your passive income stream by checking out these 16 dividend stocks with yields > 3% that consistently deliver attractive yields above 3%.

- Ride the momentum in artificial intelligence by tapping into these 25 AI penny stocks gaining traction with breakthrough innovations in machine learning and automation.

- Capitalize on tomorrow’s financial disruptors by getting ahead of the curve with these 81 cryptocurrency and blockchain stocks making waves in blockchain technology and digital assets.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kyoritsu Maintenance might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:9616

Good value with moderate growth potential.

Market Insights

Community Narratives