- Japan

- /

- Consumer Services

- /

- TSE:7037

Investors Still Aren't Entirely Convinced By teno. Holdings Company Limited's (TSE:7037) Revenues Despite 36% Price Jump

teno. Holdings Company Limited (TSE:7037) shares have had a really impressive month, gaining 36% after a shaky period beforehand. Not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 25% in the last twelve months.

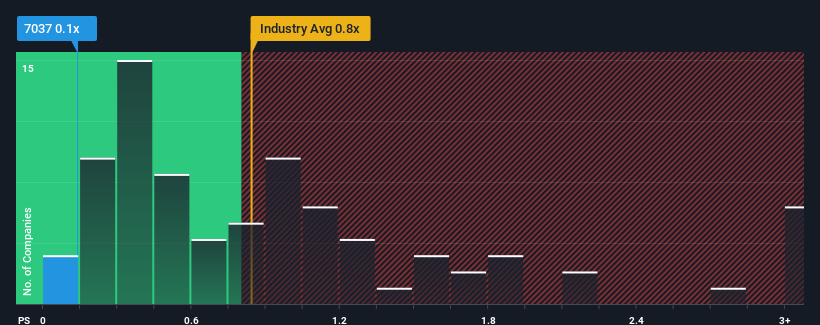

In spite of the firm bounce in price, considering around half the companies operating in Japan's Consumer Services industry have price-to-sales ratios (or "P/S") above 0.8x, you may still consider teno. Holdings as an solid investment opportunity with its 0.1x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

See our latest analysis for teno. Holdings

How Has teno. Holdings Performed Recently?

The revenue growth achieved at teno. Holdings over the last year would be more than acceptable for most companies. One possibility is that the P/S is low because investors think this respectable revenue growth might actually underperform the broader industry in the near future. If that doesn't eventuate, then existing shareholders have reason to be optimistic about the future direction of the share price.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on teno. Holdings will help you shine a light on its historical performance.Is There Any Revenue Growth Forecasted For teno. Holdings?

There's an inherent assumption that a company should underperform the industry for P/S ratios like teno. Holdings' to be considered reasonable.

Retrospectively, the last year delivered an exceptional 15% gain to the company's top line. The strong recent performance means it was also able to grow revenue by 37% in total over the last three years. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

It's interesting to note that the rest of the industry is similarly expected to grow by 9.8% over the next year, which is fairly even with the company's recent medium-term annualised growth rates.

With this in consideration, we find it intriguing that teno. Holdings' P/S falls short of its industry peers. Apparently some shareholders are more bearish than recent times would indicate and have been accepting lower selling prices.

The Bottom Line On teno. Holdings' P/S

The latest share price surge wasn't enough to lift teno. Holdings' P/S close to the industry median. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

The fact that teno. Holdings currently trades at a low P/S relative to the industry is unexpected considering its recent three-year growth is in line with the wider industry forecast. There could be some unobserved threats to revenue preventing the P/S ratio from matching the company's performance. medium-term

There are also other vital risk factors to consider and we've discovered 4 warning signs for teno. Holdings (2 can't be ignored!) that you should be aware of before investing here.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:7037

Good value slight.

Market Insights

Community Narratives