- Japan

- /

- Hospitality

- /

- TSE:6547

Greens Co.,Ltd. (TSE:6547) Stock Catapults 26% Though Its Price And Business Still Lag The Market

Greens Co.,Ltd. (TSE:6547) shares have had a really impressive month, gaining 26% after a shaky period beforehand. Looking back a bit further, it's encouraging to see the stock is up 63% in the last year.

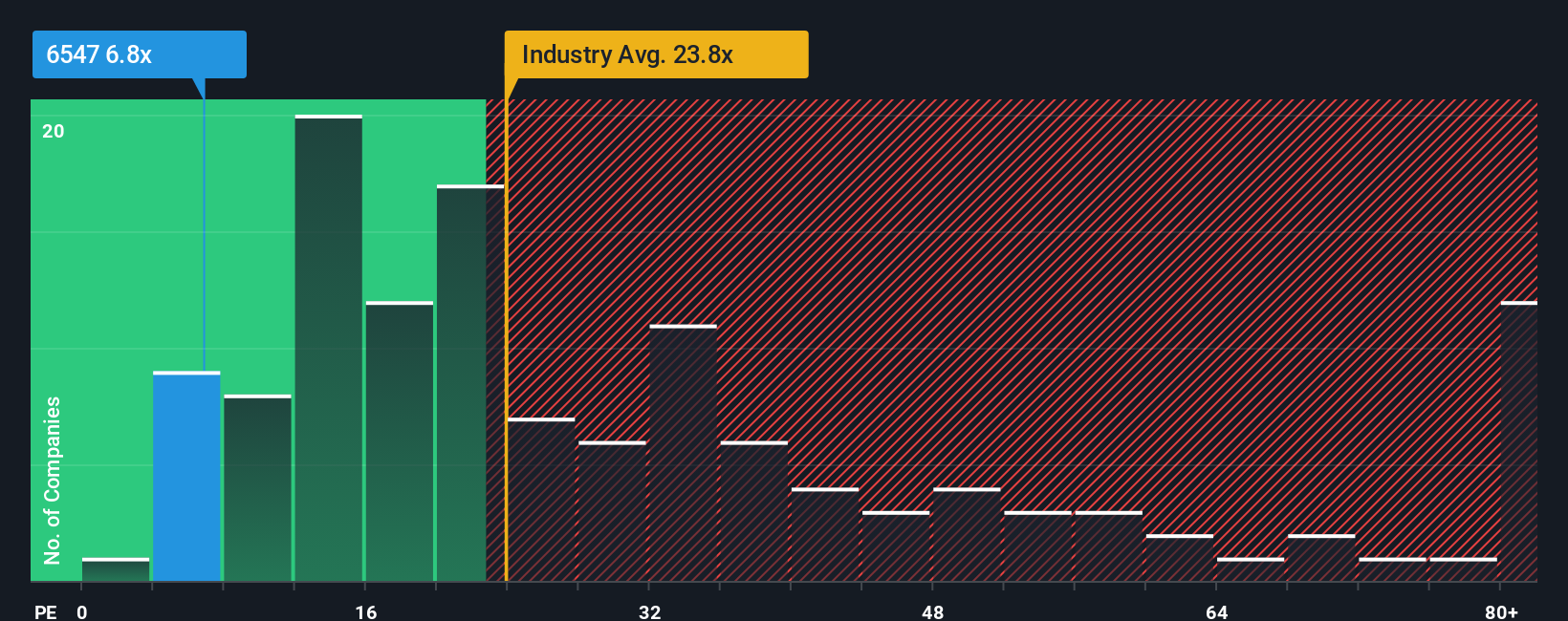

Even after such a large jump in price, GreensLtd may still be sending very bullish signals at the moment with its price-to-earnings (or "P/E") ratio of 6.8x, since almost half of all companies in Japan have P/E ratios greater than 15x and even P/E's higher than 23x are not unusual. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly reduced P/E.

Recent earnings growth for GreensLtd has been in line with the market. One possibility is that the P/E is low because investors think this modest earnings performance may begin to slide. If not, then existing shareholders have reason to be optimistic about the future direction of the share price.

Check out our latest analysis for GreensLtd

Is There Any Growth For GreensLtd?

In order to justify its P/E ratio, GreensLtd would need to produce anemic growth that's substantially trailing the market.

Taking a look back first, we see that the company managed to grow earnings per share by a handy 9.2% last year. Still, EPS has barely risen at all in aggregate from three years ago, which is not ideal. Therefore, it's fair to say that earnings growth has been inconsistent recently for the company.

Shifting to the future, estimates from the two analysts covering the company suggest earnings growth is heading into negative territory, declining 0.4% per year over the next three years. Meanwhile, the broader market is forecast to expand by 9.6% per annum, which paints a poor picture.

With this information, we are not surprised that GreensLtd is trading at a P/E lower than the market. However, shrinking earnings are unlikely to lead to a stable P/E over the longer term. There's potential for the P/E to fall to even lower levels if the company doesn't improve its profitability.

The Key Takeaway

GreensLtd's recent share price jump still sees its P/E sitting firmly flat on the ground. Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

We've established that GreensLtd maintains its low P/E on the weakness of its forecast for sliding earnings, as expected. Right now shareholders are accepting the low P/E as they concede future earnings probably won't provide any pleasant surprises. Unless these conditions improve, they will continue to form a barrier for the share price around these levels.

A lot of potential risks can sit within a company's balance sheet. You can assess many of the main risks through our free balance sheet analysis for GreensLtd with six simple checks.

You might be able to find a better investment than GreensLtd. If you want a selection of possible candidates, check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:6547

Flawless balance sheet and undervalued.

Market Insights

Community Narratives