- Japan

- /

- Hospitality

- /

- TSE:4661

How Do Oriental Land’s (TSE:4661) Steady Dividend and Guidance Reflect Its Long-Term Strategy?

Reviewed by Sasha Jovanovic

- Oriental Land announced its second quarter 2026 results and maintained an interim dividend of ¥7 per share, consistent with the previous year, with payment scheduled for December 10, 2025.

- Alongside the earnings disclosure, the company provided new full-year guidance for the fiscal year ending March 31, 2026, projecting net sales of ¥693.35 billion and earnings per share of ¥69.16.

- We'll assess how Oriental Land's latest earnings guidance shapes expectations for future revenue and profit growth in its investment narrative.

We've found 16 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Oriental Land Investment Narrative Recap

To have confidence in Oriental Land as a shareholder, you need to believe in the enduring appeal and revenue-driving power of attractions like Fantasy Springs, new entertainment offerings, and the robust guest experience that underpin the company’s theme park and hotel business. The recent earnings guidance and stable dividend do not significantly alter the most important short-term catalyst, the continued boost in attendance and guest spending following new park expansions, or the main risk, which is pressure on operating margins from rising costs. The market will likely remain focused on how new attractions support earnings resilience, even as cost pressures and unpredictable weather add uncertainty.

Of the recent announcements, the updated full-year forecast stands out, with Oriental Land projecting net sales of ¥693.35 billion and earnings per share of ¥69.16. This directly addresses short-term expectations around revenue growth and the ability of newly opened facilities to deliver on profit goals, especially as investors watch for signs of decelerating “revenge spending” that could weigh on attendance and margins.

In contrast, the unpredictability of weather-related attendance shortfalls is a risk investors should keep in mind as it could...

Read the full narrative on Oriental Land (it's free!)

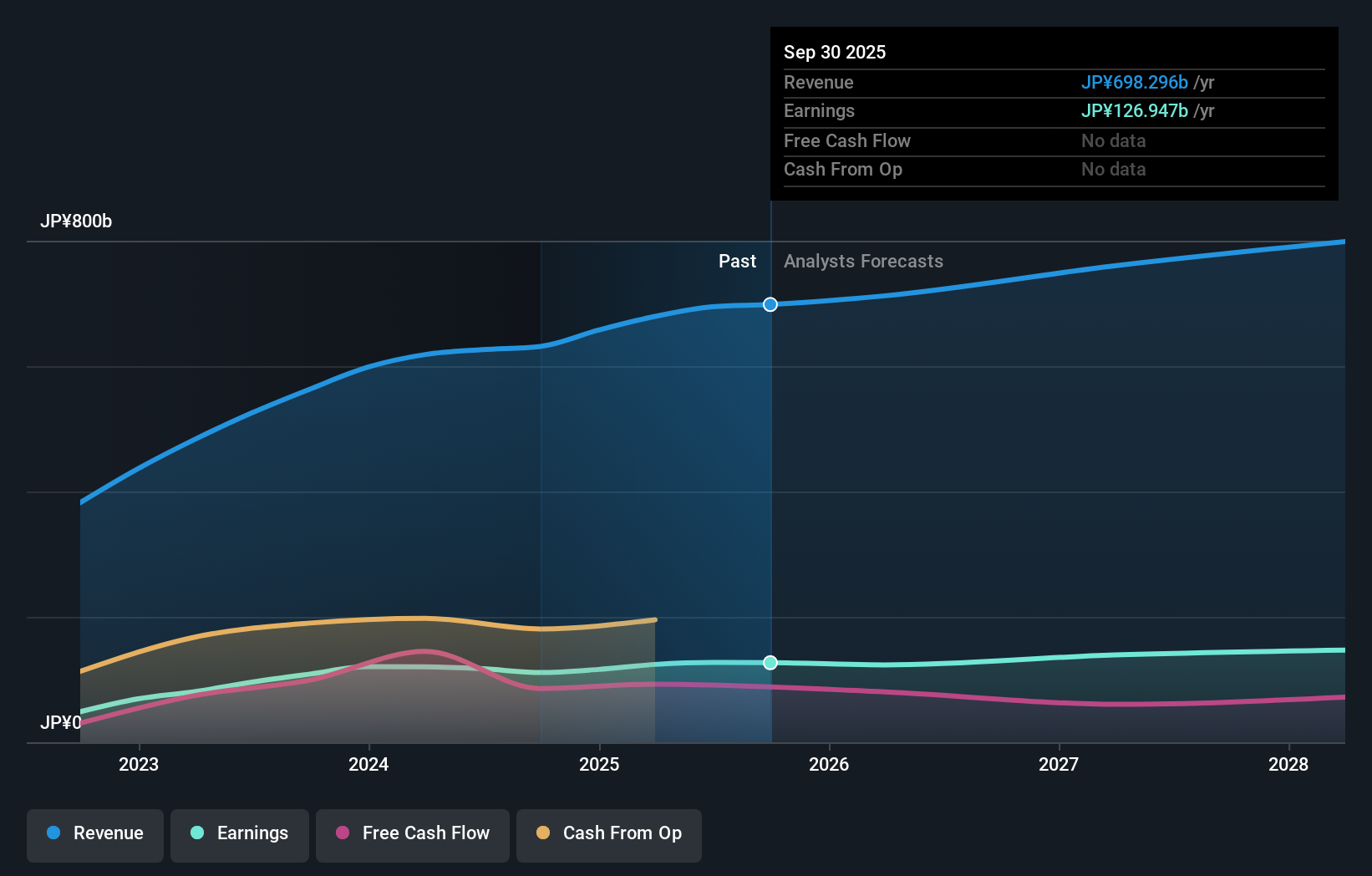

Oriental Land's narrative projects ¥810.3 billion revenue and ¥147.3 billion earnings by 2028. This requires 5.3% yearly revenue growth and a ¥20.1 billion earnings increase from ¥127.2 billion today.

Uncover how Oriental Land's forecasts yield a ¥3965 fair value, a 27% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members provided just two fair value estimates, ranging from ¥2,198 to ¥3,964 per share. With rising operating costs as a key risk, your own expectations for earnings growth may paint a different picture of value.

Explore 2 other fair value estimates on Oriental Land - why the stock might be worth 29% less than the current price!

Build Your Own Oriental Land Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Oriental Land research is our analysis highlighting 2 key rewards that could impact your investment decision.

- Our free Oriental Land research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Oriental Land's overall financial health at a glance.

Curious About Other Options?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- Explore 27 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:4661

Flawless balance sheet with proven track record.

Market Insights

Community Narratives