- South Korea

- /

- Electronic Equipment and Components

- /

- KOSE:A353200

Asian Value Stocks Estimated Below Intrinsic Worth In June 2025

Reviewed by Simply Wall St

As global markets navigate escalating geopolitical tensions and trade uncertainties, Asian stock markets have shown resilience with mixed performances across key indices. In this environment, identifying undervalued stocks can provide opportunities for investors who seek to capitalize on discrepancies between market prices and intrinsic values.

Top 10 Undervalued Stocks Based On Cash Flows In Asia

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Wanguo Gold Group (SEHK:3939) | HK$31.50 | HK$62.31 | 49.4% |

| Taiwan Union Technology (TPEX:6274) | NT$214.50 | NT$422.60 | 49.2% |

| Range Intelligent Computing Technology Group (SZSE:300442) | CN¥43.39 | CN¥85.77 | 49.4% |

| PixArt Imaging (TPEX:3227) | NT$218.50 | NT$435.75 | 49.9% |

| Nanya New Material TechnologyLtd (SHSE:688519) | CN¥39.16 | CN¥77.06 | 49.2% |

| M&A Research Institute Holdings (TSE:9552) | ¥1292.00 | ¥2554.92 | 49.4% |

| Livero (TSE:9245) | ¥1704.00 | ¥3371.90 | 49.5% |

| Global Tax Free (KOSDAQ:A204620) | ₩6940.00 | ₩13841.09 | 49.9% |

| Ficont Industry (Beijing) (SHSE:605305) | CN¥26.49 | CN¥52.29 | 49.3% |

| Dive (TSE:151A) | ¥926.00 | ¥1834.46 | 49.5% |

Let's take a closer look at a couple of our picks from the screened companies.

DAEDUCK ELECTRONICS (KOSE:A353200)

Overview: Daeduck Electronics Co., Ltd. is a company that supplies a range of printed circuit boards (PCB) both domestically in South Korea and internationally, with a market cap of approximately ₩859.49 billion.

Operations: The company's revenue is primarily derived from the manufacture and sale of printed circuit boards, amounting to approximately ₩892.75 million.

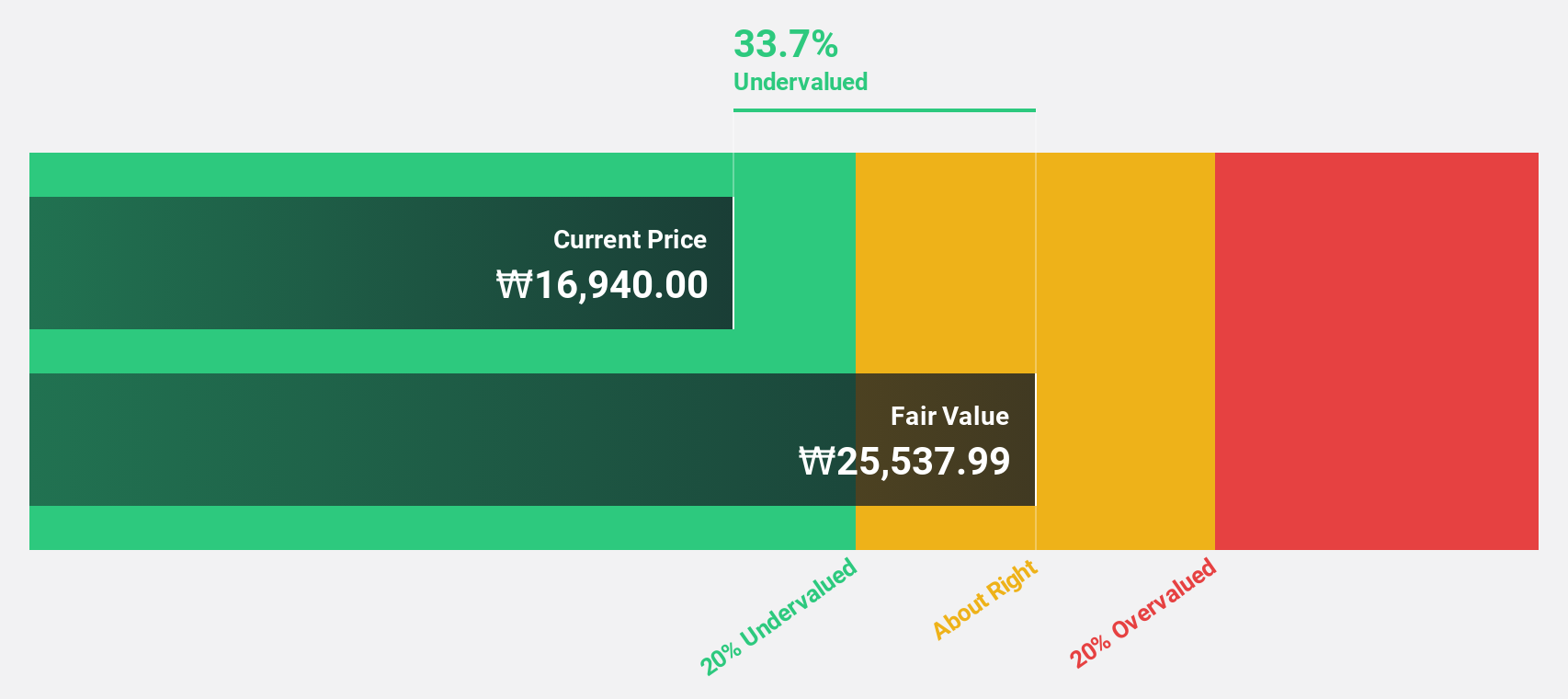

Estimated Discount To Fair Value: 33.3%

DAEDUCK ELECTRONICS is trading 33.3% below its estimated fair value of ₩25,543.87, with a current price of ₩17,050. Despite reporting a net loss in Q1 2025, earnings are forecast to grow significantly at 58.6% annually over the next three years, outpacing the Korean market's growth rate of 20.9%. However, it has an unstable dividend track record and a forecasted low return on equity of 8.4% in three years.

- The growth report we've compiled suggests that DAEDUCK ELECTRONICS' future prospects could be on the up.

- Click here to discover the nuances of DAEDUCK ELECTRONICS with our detailed financial health report.

Venustech Group (SZSE:002439)

Overview: Venustech Group Inc. offers network security products, trusted security management platforms, and specialized security services globally, with a market cap of CN¥18.44 billion.

Operations: The company generates revenue from its Information Network Security segment, which amounts to CN¥3.01 billion.

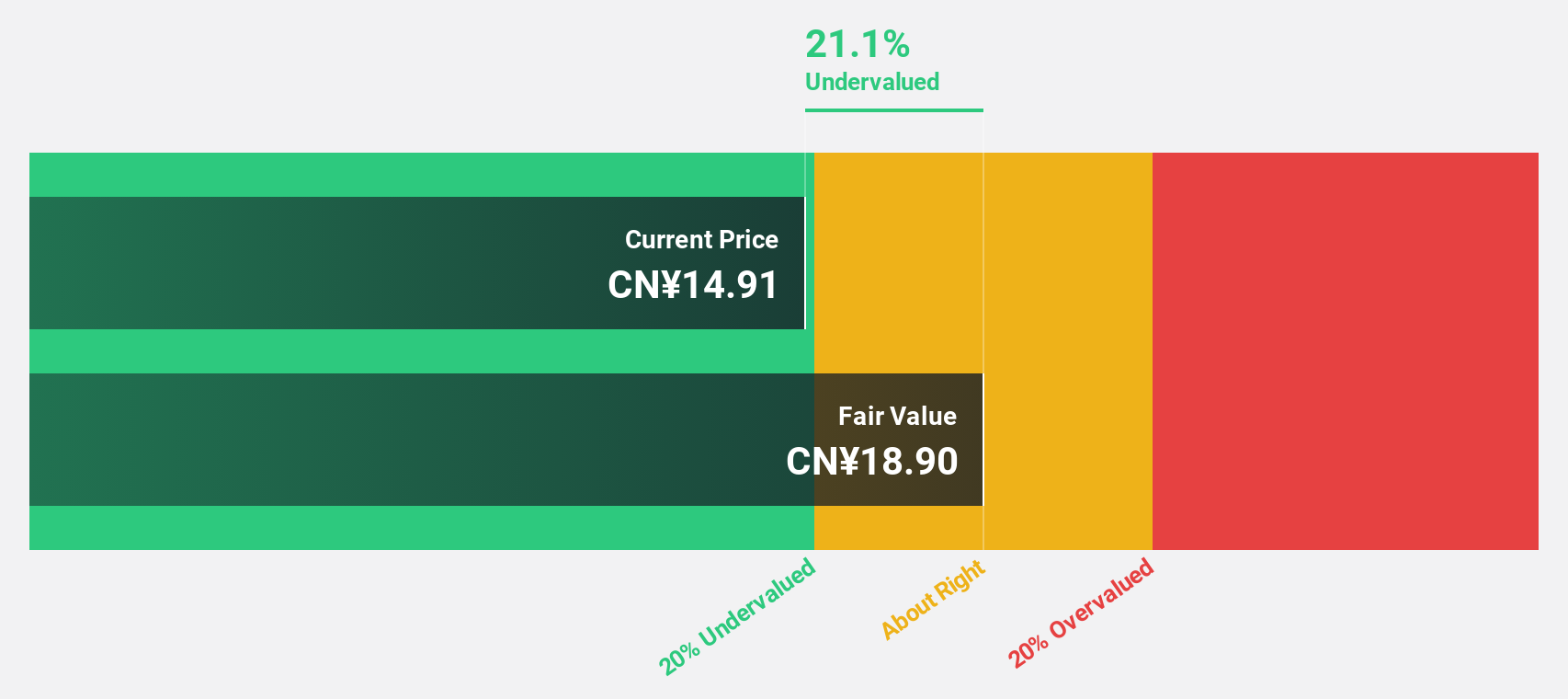

Estimated Discount To Fair Value: 18.9%

Venustech Group is trading at CN¥15.32, which is 18.9% below its estimated fair value of CN¥18.9, indicating potential undervaluation based on cash flows. Despite a challenging year with decreased revenue and a net loss in 2024, the company turned profitable in Q1 2025 with CN¥1.6 million net income compared to a significant loss previously. Earnings are forecast to grow annually at 42.17%, surpassing market averages, though return on equity remains low at 3.7%.

- Upon reviewing our latest growth report, Venustech Group's projected financial performance appears quite optimistic.

- Delve into the full analysis health report here for a deeper understanding of Venustech Group.

AEON FantasyLTD (TSE:4343)

Overview: AEON Fantasy Co., LTD. operates amusement facilities in Japan and has a market cap of ¥54.27 billion.

Operations: The company's revenue is derived from its operations in Japan (¥69.47 billion), ASEAN countries (¥13.18 billion), and China (¥4.83 billion).

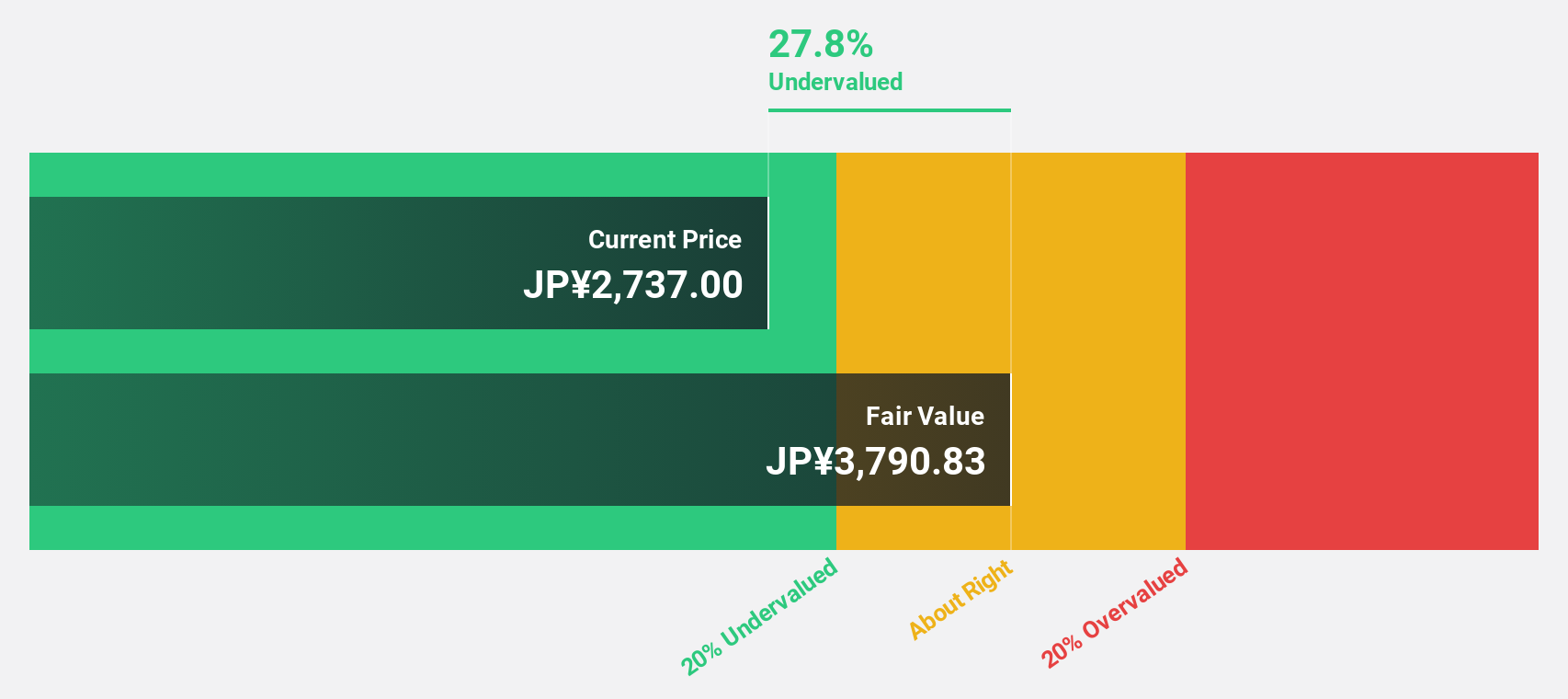

Estimated Discount To Fair Value: 27.7%

AEON Fantasy Co., LTD. is trading at ¥2,744, significantly below its estimated fair value of ¥3,792.99, suggesting potential undervaluation based on cash flows. The company reported strong sales growth with April's operating revenue in Japan reaching ¥5.49 billion, up 10.2% year-on-year. Despite not paying a dividend last year, it plans to pay ¥15 per share this fiscal year. Earnings are projected to grow 59.29% annually and achieve profitability within three years.

- Our growth report here indicates AEON FantasyLTD may be poised for an improving outlook.

- Unlock comprehensive insights into our analysis of AEON FantasyLTD stock in this financial health report.

Make It Happen

- Delve into our full catalog of 288 Undervalued Asian Stocks Based On Cash Flows here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSE:A353200

DAEDUCK ELECTRONICS

Daeduck Electronics Co., Ltd. provides various printed circuit boards (PCB) in South Korea and internationally.

Excellent balance sheet with reasonable growth potential.

Market Insights

Community Narratives