- Japan

- /

- Hospitality

- /

- TSE:3397

Shareholders Should Be Pleased With TORIDOLL Holdings Corporation's (TSE:3397) Price

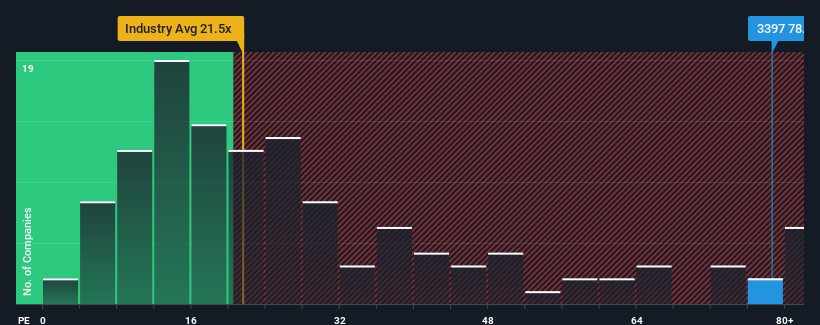

With a price-to-earnings (or "P/E") ratio of 78.6x TORIDOLL Holdings Corporation (TSE:3397) may be sending very bearish signals at the moment, given that almost half of all companies in Japan have P/E ratios under 13x and even P/E's lower than 9x are not unusual. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/E.

Recent times have been advantageous for TORIDOLL Holdings as its earnings have been rising faster than most other companies. The P/E is probably high because investors think this strong earnings performance will continue. If not, then existing shareholders might be a little nervous about the viability of the share price.

Check out our latest analysis for TORIDOLL Holdings

How Is TORIDOLL Holdings' Growth Trending?

There's an inherent assumption that a company should far outperform the market for P/E ratios like TORIDOLL Holdings' to be considered reasonable.

If we review the last year of earnings growth, the company posted a terrific increase of 68%. However, the latest three year period hasn't been as great in aggregate as it didn't manage to provide any growth at all. So it appears to us that the company has had a mixed result in terms of growing earnings over that time.

Turning to the outlook, the next three years should generate growth of 41% each year as estimated by the four analysts watching the company. Meanwhile, the rest of the market is forecast to only expand by 9.5% per annum, which is noticeably less attractive.

With this information, we can see why TORIDOLL Holdings is trading at such a high P/E compared to the market. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

The Bottom Line On TORIDOLL Holdings' P/E

Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

As we suspected, our examination of TORIDOLL Holdings' analyst forecasts revealed that its superior earnings outlook is contributing to its high P/E. At this stage investors feel the potential for a deterioration in earnings isn't great enough to justify a lower P/E ratio. Unless these conditions change, they will continue to provide strong support to the share price.

You should always think about risks. Case in point, we've spotted 1 warning sign for TORIDOLL Holdings you should be aware of.

It's important to make sure you look for a great company, not just the first idea you come across. So take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Valuation is complex, but we're here to simplify it.

Discover if TORIDOLL Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:3397

TORIDOLL Holdings

Through its subsidiaries, operates and manages restaurants in Japan and internationally.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives