- Japan

- /

- Hospitality

- /

- TSE:3350

Metaplanet (TSE:3350): Rethinking Valuation as Bitcoin Treasury Strategy Reshapes This Hotel Operator

Reviewed by Simply Wall St

Metaplanet (TSE:3350) has been quietly reshaping its profile, balancing its core hotel operations with a growing Bitcoin treasury and Web3 bets, which is leaving investors to reassess how to value this hybrid exposure.

See our latest analysis for Metaplanet.

That mix of hotel cash flows and Bitcoin exposure has kept sentiment volatile, with the latest share price at ¥406 and a 30 day share price return of 20.12 percent suggesting momentum is rebuilding despite a 90 day share price pullback, while the three year total shareholder return of 745.83 percent shows how powerful the story has been for early investors.

If Metaplanet has you rethinking how growth and risk can combine, it is worth exploring fast growing stocks with high insider ownership for more out of the box opportunities with serious skin in the game.

With Metaplanet’s share price still far below consensus targets but backed by rapid revenue growth and a volatile Bitcoin treasury, the key question now is simple: is this a mispriced opportunity or is the market already discounting future upside?

Price-to-Earnings of 22.9x: Is it justified?

Metaplanet currently trades on a price-to-earnings ratio of 22.9 times, which leaves it looking slightly cheap compared with the hospitality industry but expensive against its closest peers.

The price-to-earnings multiple compares the company’s share price with its per share earnings. It is a direct snapshot of how much investors are willing to pay for today’s profits.

For Metaplanet, the 22.9 times multiple sits just below the broader Japan hospitality average of 23.1 times. This suggests that the market is not assigning a premium despite forecasts for earnings to grow strongly and its hybrid profile that mixes hotel cash flows with a Bitcoin treasury.

However, the same 22.9 times ratio appears expensive relative to the peer group average of 18.2 times. This means investors are already paying a higher price tag than for similar names even though the stock has been volatile and the company has recently diluted shareholders.

At the same time, when measured against the estimated fair price-to-earnings ratio of 45.1 times, the current multiple implies considerable potential for re-rating if the company can deliver on its high quality earnings and aggressive growth expectations.

Explore the SWS fair ratio for Metaplanet

Result: Price-to-Earnings of 22.9x (ABOUT RIGHT)

However, lingering share issuance concerns and sharp Bitcoin swings could quickly reverse optimism if hotel cash flows or treasury management stumble.

Find out about the key risks to this Metaplanet narrative.

Another View: What Does Our DCF Say?

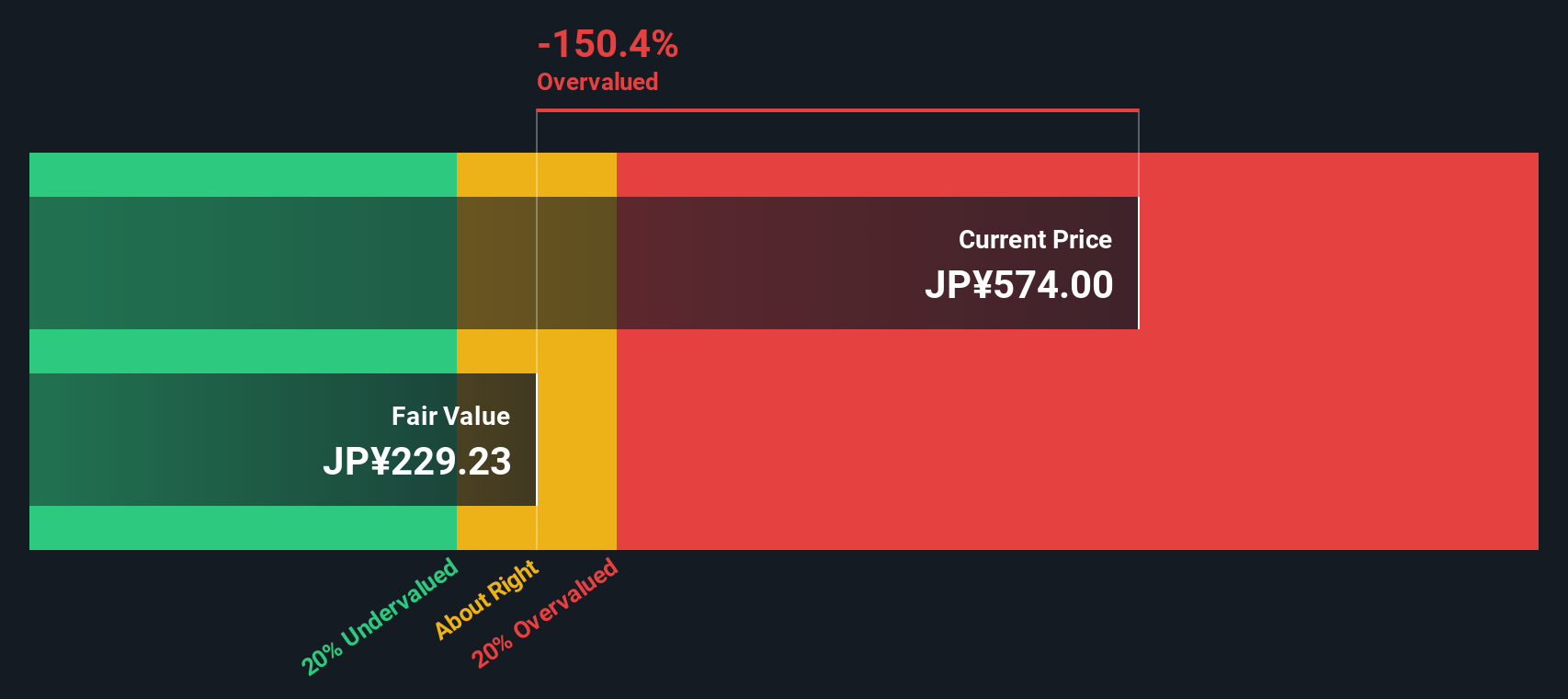

While earnings based ratios hint at room for a re rating, our DCF model paints a far harsher picture, suggesting fair value closer to ¥35.4 per share. That implies Metaplanet could be trading at more than ten times its modeled worth, so are investors leaning too hard into the story?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Metaplanet for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 917 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Metaplanet Narrative

If you see things differently or want to dig into the numbers yourself, you can shape a personalised view in just minutes: Do it your way.

A great starting point for your Metaplanet research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Ready for your next investment move?

Do not stop at one compelling story. Put Simply Wall Street’s powerful screener to work and uncover fresh ideas that could sharpen your edge before others react.

- Target reliable income streams by reviewing these 13 dividend stocks with yields > 3% that can help anchor your portfolio through shifting markets.

- Position ahead of the next tech wave by assessing these 24 AI penny stocks poised to benefit from accelerating AI adoption.

- Lock in potential bargains by scanning these 917 undervalued stocks based on cash flows that the market may be mispricing today.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:3350

Metaplanet

Engages in hotel management operation and development in Japan.

Flawless balance sheet with high growth potential.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion