- Japan

- /

- Hospitality

- /

- TSE:3350

How Metaplanet’s ¥21.28 Billion Capital Raise and New Institutional Backers Have Changed Its Investment Story (TSE:3350)

Reviewed by Sasha Jovanovic

- On November 20, 2025, Metaplanet Inc. approved a private placement to issue 23.61 million Class B shares and new stock acquisition rights to several institutional investors, raising over ¥21.28 billion, alongside proposed changes to its Articles of Incorporation.

- This significant fundraising move brought in new institutional backers and included plans to restructure capital and corporate governance arrangements.

- We’ll explore how Metaplanet’s large-scale capital raise and the entry of new institutional investors impact its broader investment narrative.

These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

What Is Metaplanet's Investment Narrative?

To be a shareholder in Metaplanet, I think you have to believe in the potential for its Bitcoin-focused expansion and the company's efforts to reshape corporate governance and access large-scale funding. The recent ¥21.29 billion private placement brings influential institutional investors, adding both capital and credibility, but materially shifts the short-term outlook. With this influx, Metaplanet has a runway to pursue ambitious initiatives, potentially smoothing previous financing concerns. However, this sizeable equity raise increases dilution for existing shareholders and may intensify scrutiny on management’s ability to translate new resources into sustainable growth, especially given the relatively short tenure of both team and board. The capital raise may temporarily stabilize finances, but attention will likely shift to execution and returns from the Bitcoin business, as well as sensitivity to cryptocurrency prices. Market volatility and rapid share price swings remain key risks following this fundamental shift.

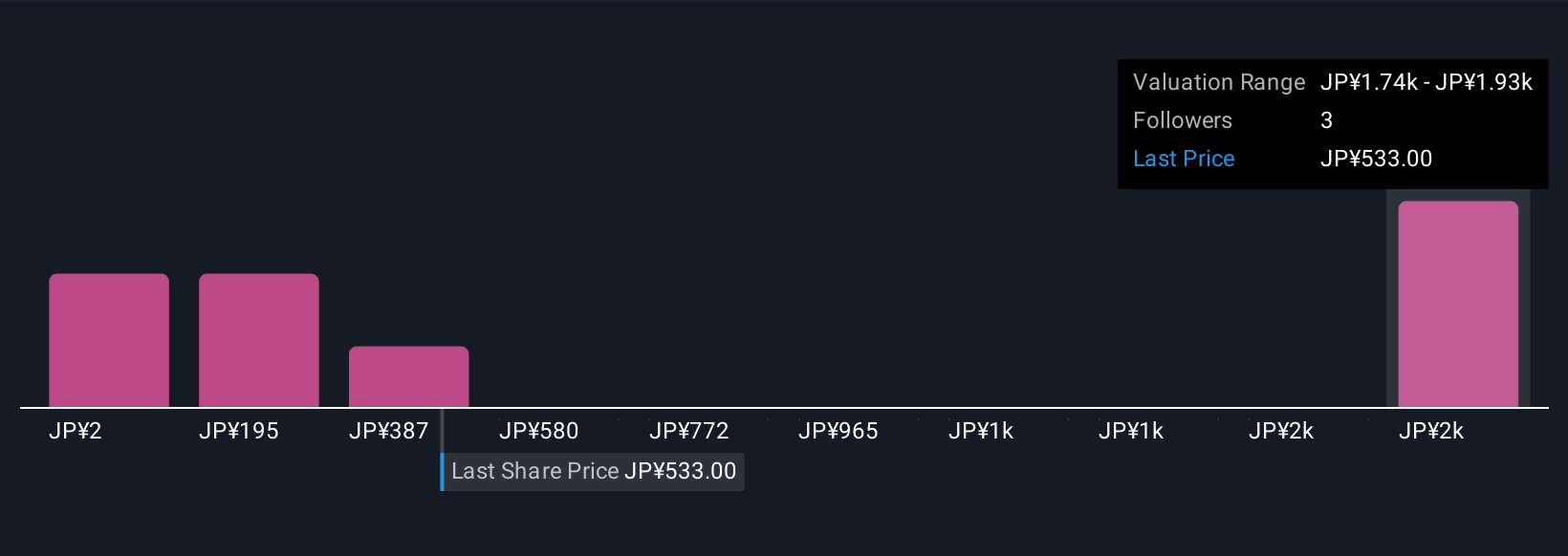

Yet, with this renewed capital, the risk of further dilution is an important point for investors to keep in mind. Metaplanet's shares are on the way up, but could they be overextended? Uncover how much higher they are than fair value.Exploring Other Perspectives

Explore 6 other fair value estimates on Metaplanet - why the stock might be worth over 4x more than the current price!

Build Your Own Metaplanet Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Metaplanet research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Metaplanet research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Metaplanet's overall financial health at a glance.

Seeking Other Investments?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- The latest GPUs need a type of rare earth metal called Terbium and there are only 35 companies in the world exploring or producing it. Find the list for free.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:3350

Metaplanet

Engages in hotel management operation and development in Japan.

Flawless balance sheet with high growth potential.

Market Insights

Community Narratives

Recently Updated Narratives

Q3 Outlook modestly optimistic

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success