- Japan

- /

- Hospitality

- /

- TSE:3350

A Look at Metaplanet (TSE:3350) Valuation Following Board-Approved Share Buyback and Bitcoin Strategy Shift

Reviewed by Simply Wall St

Metaplanet (TSE:3350) just unveiled a large-scale share buyback program, with board approval to repurchase up to 150 million shares, or roughly 13% of its outstanding shares. This move is closely tied to efforts to enhance capital flexibility and leverage Bitcoin assets for future initiatives.

See our latest analysis for Metaplanet.

After a strong start to the year, Metaplanet’s share price has surged nearly 40% year-to-date. However, momentum cooled in recent months following a steep 90-day share price return of -58%. The 12-month total shareholder return stands at 262%, highlighting just how dramatically sentiment has shifted compared to last year. The recent buyback announcement follows board-level decisions and a broader strategic shift toward leveraging Bitcoin assets. Both of these developments indicate that the company is actively remodeling itself for greater flexibility and growth.

If you’re curious which other companies are attracting attention with bold moves or rapid growth, it’s the perfect moment to broaden your search and discover fast growing stocks with high insider ownership

With the buyback set to reduce the float and a dramatic surge in shareholder returns over the last year, the question now is whether Metaplanet’s current price reflects untapped value or if the market has already moved to price in future growth.

Price-to-Earnings of 53.3x: Is it justified?

Metaplanet’s shares currently trade at a price-to-earnings (P/E) ratio of 53.3x, compared to both its sector and peer averages. At ¥499 per share, this level suggests the market is attaching a premium to future growth or strategic moves already underway.

The price-to-earnings multiple reflects what investors are willing to pay today for a unit of current earnings. In sectors experiencing rapid change or transformation, such as Metaplanet's recent pivot and Bitcoin-related strategy, a higher P/E can indicate optimism about earnings acceleration or structural change.

This premium, however, looks steep not just relative to the industry (the Japan Hospitality sector averages 23.6x) but also compared to Metaplanet’s own "fair" price-to-earnings ratio of 70.5x, which regression analysis suggests the market could eventually converge to. While the P/E implies the market has high expectations, it also points to raised sensitivity if growth targets are not met.

Explore the SWS fair ratio for Metaplanet

Result: Price-to-Earnings of 53.3x (OVERVALUED)

However, rapid revenue growth could slow, or market sentiment may sour, if Bitcoin’s volatility impacts Metaplanet’s financials more than expected.

Find out about the key risks to this Metaplanet narrative.

Another View: What Does Our DCF Say?

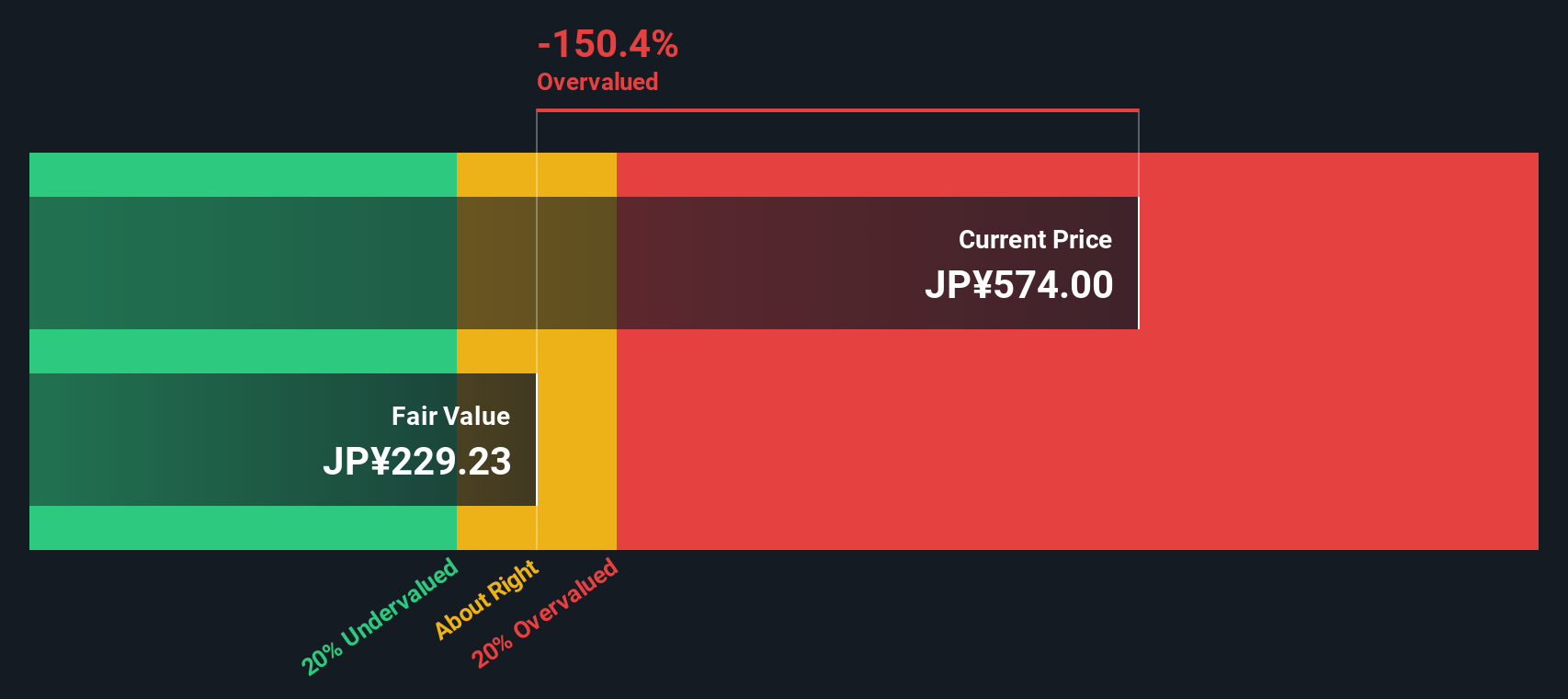

While the price-to-earnings ratio suggests Metaplanet is trading at a premium, the SWS DCF model paints an even starker picture. According to our DCF, shares are currently well above fair value. This flags potential downside risk if market optimism fades. How much weight should you give to each approach?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Metaplanet for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Metaplanet Narrative

If you’ve got your own perspective or want to dig into the numbers, why not try building a custom narrative in just a few minutes? Do it your way

A great starting point for your Metaplanet research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Take the next step toward smarter investing and scan the market for fresh opportunities that others might overlook. Here are three powerful ways to expand your watchlist today:

- Tap into reliable, long-term cash flow by checking out these 21 dividend stocks with yields > 3% that consistently deliver strong yields above 3%.

- Jump ahead of industry trends and catch disruptive potential in the sector with these 34 healthcare AI stocks promising to transform medicine and patient care through artificial intelligence.

- Ride the momentum of digital innovation as you target growth stories among these 81 cryptocurrency and blockchain stocks pioneering blockchain advancements and crypto technologies.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:3350

High growth potential with adequate balance sheet.

Market Insights

Community Narratives