- Japan

- /

- Hospitality

- /

- TSE:2157

October 2024's Top Growth Companies With Strong Insider Ownership

Reviewed by Simply Wall St

As global markets navigate the impact of rising U.S. Treasury yields, with growth stocks showing resilience despite a broader market pullback, investors are keenly observing insider ownership as a potential indicator of confidence and alignment in growth companies. In this environment, strong insider ownership can be seen as a positive signal, suggesting that those closest to the business have faith in its long-term prospects and are committed to weathering economic uncertainties alongside other shareholders.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| Lavvi Empreendimentos Imobiliários (BOVESPA:LAVV3) | 11.9% | 21.1% |

| Kirloskar Pneumatic (BSE:505283) | 30.3% | 26.3% |

| People & Technology (KOSDAQ:A137400) | 16.4% | 35.6% |

| Arctech Solar Holding (SHSE:688408) | 37.8% | 29.8% |

| Laopu Gold (SEHK:6181) | 36.4% | 33.2% |

| Credo Technology Group Holding (NasdaqGS:CRDO) | 13.9% | 95% |

| Adveritas (ASX:AV1) | 21.2% | 144.2% |

| Plenti Group (ASX:PLT) | 12.8% | 107.6% |

| EHang Holdings (NasdaqGM:EH) | 32.8% | 81.4% |

| UTI (KOSDAQ:A179900) | 33.1% | 134.6% |

We're going to check out a few of the best picks from our screener tool.

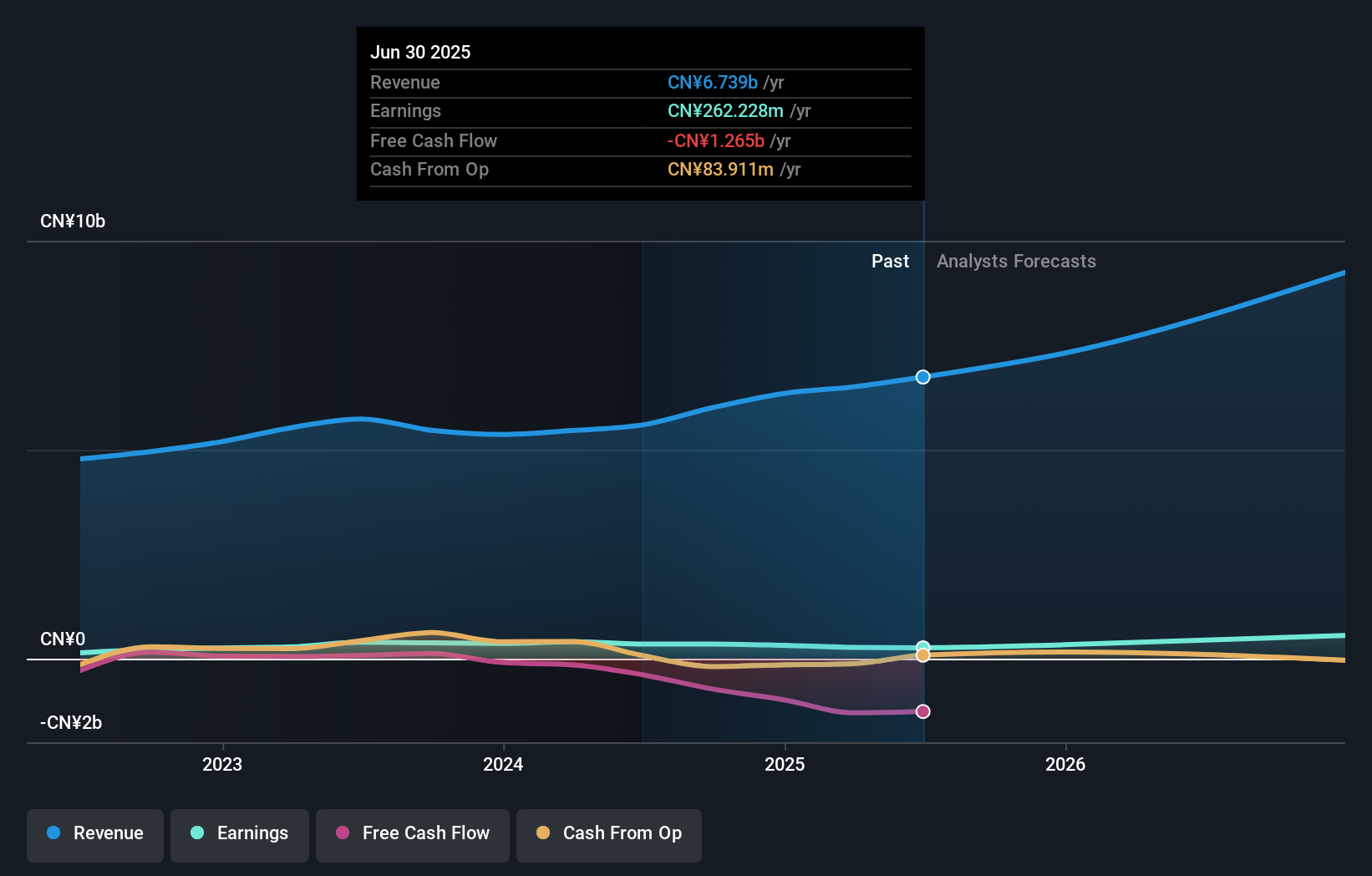

Hebei Huatong Wires and Cables Group (SHSE:605196)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Hebei Huatong Wires and Cables Group Co., Ltd. operates in the manufacturing sector, specializing in the production of wires and cables, with a market capitalization of approximately CN¥4.48 billion.

Operations: Hebei Huatong Wires and Cables Group Co., Ltd. generates its revenue primarily through the manufacturing and sale of wires and cables.

Insider Ownership: 38%

Earnings Growth Forecast: 24.4% p.a.

Hebei Huatong Wires and Cables Group shows potential as a growth company with its earnings forecasted to grow significantly at 24.36% annually, outpacing the Chinese market average. The company's recent half-year revenue increased to CNY 3.03 billion, despite a slight decline in net income. Trading at a price-to-earnings ratio of 12.8x, it is considered good value compared to peers and the broader CN market's 34.1x ratio.

- Get an in-depth perspective on Hebei Huatong Wires and Cables Group's performance by reading our analyst estimates report here.

- Our valuation report here indicates Hebei Huatong Wires and Cables Group may be undervalued.

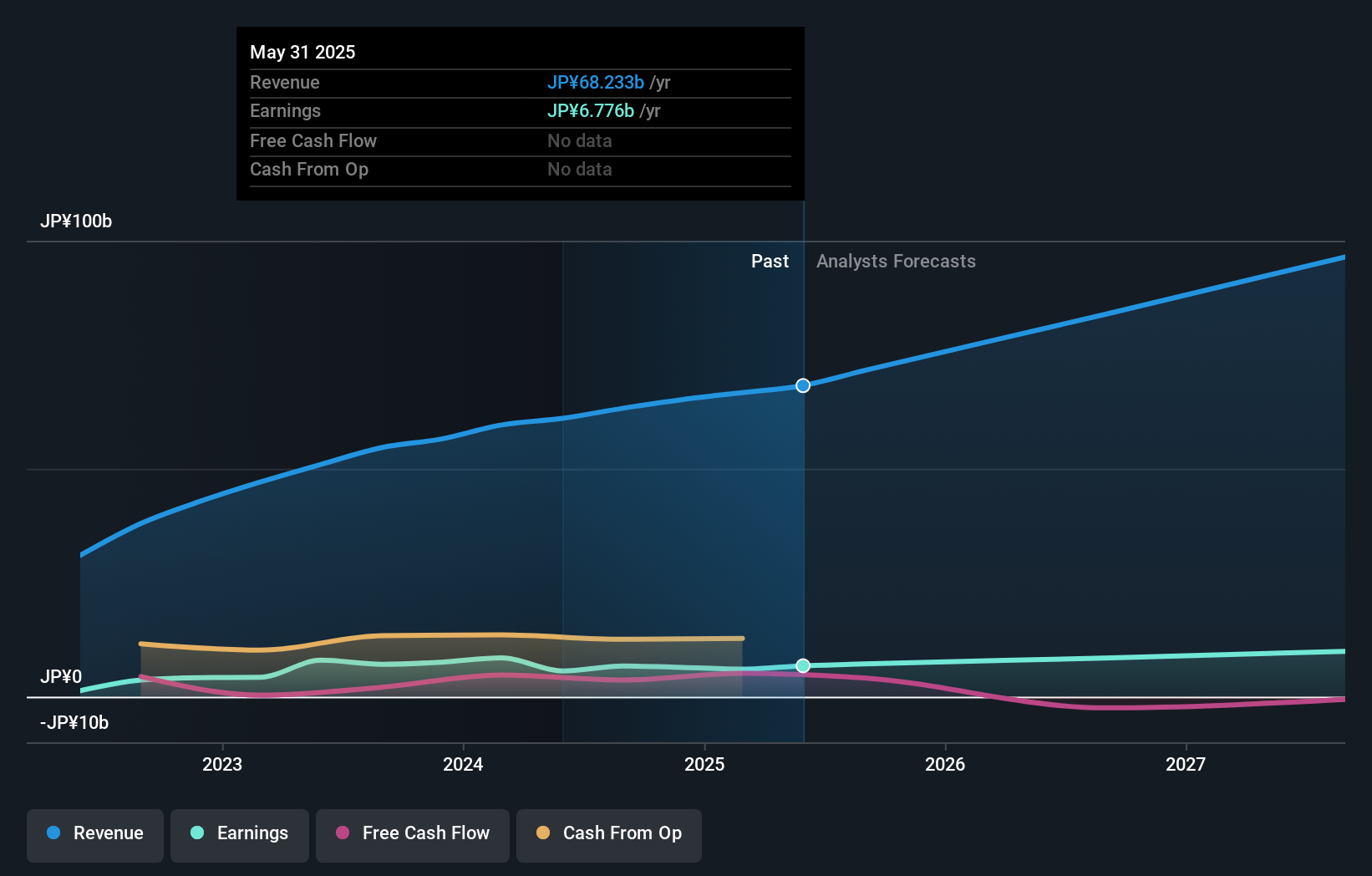

Koshidaka Holdings (TSE:2157)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Koshidaka Holdings Co., Ltd. operates a karaoke and bath house business both in Japan and internationally, with a market cap of ¥96.81 billion.

Operations: The company generates revenue primarily from its karaoke business, which accounts for ¥61.25 billion, and also earns ¥1.59 billion from real estate management.

Insider Ownership: 12%

Earnings Growth Forecast: 13.9% p.a.

Koshidaka Holdings demonstrates growth potential with its earnings projected to increase by 13.9% annually, surpassing the Japanese market average of 8.7%. The company forecasts net sales of ¥71.06 billion for the fiscal year ending August 31, 2025, alongside a significant dividend increase from ¥7 to ¥12 per share for the second quarter. Trading at a price-to-earnings ratio of 14.4x, it offers good value compared to the hospitality industry average of 21.3x.

- Dive into the specifics of Koshidaka Holdings here with our thorough growth forecast report.

- The valuation report we've compiled suggests that Koshidaka Holdings' current price could be quite moderate.

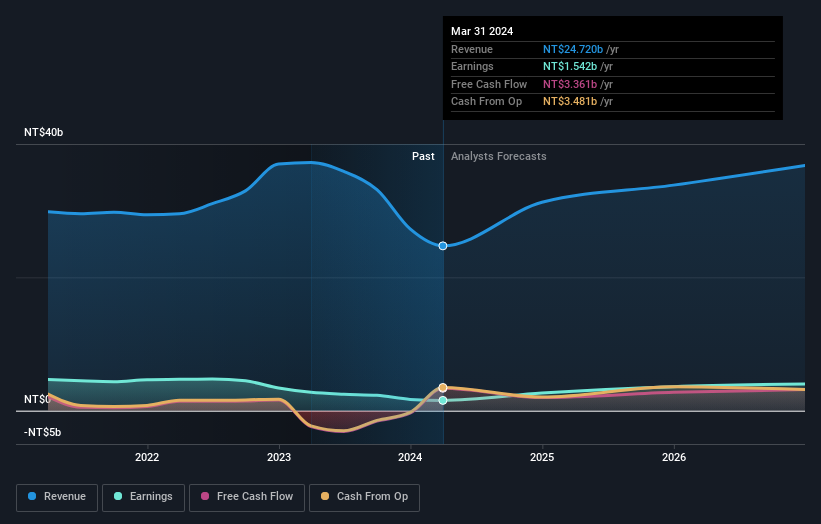

Merida Industry (TWSE:9914)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Merida Industry Co., Ltd. manufactures and sells bicycles and components across Taiwan, China, Hong Kong, Japan, and Europe with a market cap of NT$55.16 billion.

Operations: The company's revenue from the manufacturing and sales of bicycles and its parts amounts to NT$26.58 billion.

Insider Ownership: 26.8%

Earnings Growth Forecast: 34.4% p.a.

Merida Industry's earnings are forecast to grow significantly at 34.4% annually, outpacing the TW market's 19.1%. However, revenue growth is slower at 12.9% per year. Recent financials show mixed results with Q2 sales rising to TWD 9.32 billion from TWD 7.46 billion, but net income slightly decreased to TWD 655.55 million from TWD 671.77 million year-over-year, indicating challenges in maintaining profitability amidst growth aspirations.

- Click to explore a detailed breakdown of our findings in Merida Industry's earnings growth report.

- The analysis detailed in our Merida Industry valuation report hints at an inflated share price compared to its estimated value.

Where To Now?

- Unlock more gems! Our Fast Growing Companies With High Insider Ownership screener has unearthed 1510 more companies for you to explore.Click here to unveil our expertly curated list of 1513 Fast Growing Companies With High Insider Ownership.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if Koshidaka Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:2157

Koshidaka Holdings

Operates a karaoke business and a bath house business in Japan and internationally.

Reasonable growth potential with adequate balance sheet and pays a dividend.